【Anode Material】Shanghai Shanshan Continues to Lead in Artificial Anode Material in H1 2024

【Anode Material】Shanghai Shanshan Continues to Lead in Artificial Anode Material in H1 2024

of 2024, Chinese domestic new energy vehicle (NEV) market continued to perform well, with production and sales reaching 4.929 million and 4.944 million units, respectively, representing year-on-year increases of 30.1% and 32%. The market share reached 35.2%. The energy storage market also saw significant growth, driven by increased demand, with mainstream battery manufacturers showing notable production increases. Graphitized carburant material for the production of negative electrode materials is widely used in steel making, casting, smelting and other industries

Key Data and Statistics:

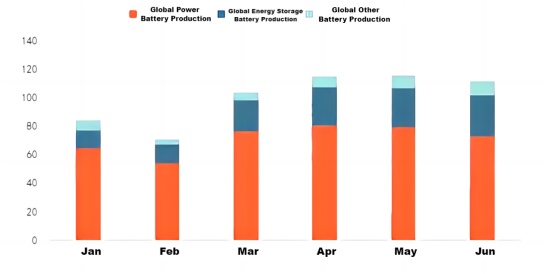

Global lithium battery production in H1 2024 was 608 GWh, a year-on-year increase of about 20%.

Global production of lithium battery anode materials was 967,000 tons, with China accounting for 952,000 tons.

Chart: Global Monthly Lithium Battery Production in H1 2024 (GWh)

Data Source: ICCSINO

Early Peak Season for Domestic Anode Materials in H1 2024:

Compared to previous years, the peak season for the anode materials market arrived early in March 2024. Due to the long Spring Festival holiday and low demand in February, production decreased by nearly 10% year-on-year. However, after the holiday, the NEV market quickly rebounded, driven by new popular models, boosting consumer demand.

Not only did the power battery market gain momentum early, but the energy storage market also saw significant growth starting in March, driven by both demand and restocking. Data indicates that from March to May, anode material production increased by more than 40% month-on-month. This surge supported a low-level rebound in anode prices in the first half of the year.

Chart: Anode Material Production from January to June 2024

Data Source: ICCSINO

Market Share and Leading Companies in Artificial Anode Materials:

The market share of artificial anode materials increased by 2 percentage points to 86%.

Both silicon-based anode materials and hard carbon saw varying degrees of growth, though below expectations.

Natural anode material production grew slightly, but its market share decreased.

Shanghai Shanshan retained its leading position in the artificial anode materials market, followed by BTR. Sunstone Technology and Zhongke Xingcheng also saw their market shares increase. The standout performer in the first half of the year was Yunnan Zhongsheng, which significantly increased its market share.

Chart: Market Share of Artificial Anode Material Production in H1 2024

Data Source: ICCSINO

Market Outlook:

Overall, prices in the lithium battery anode materials industry have stabilized, but the excess production capacity on the supply side still needs time to be absorbed. The industry structure remains open to adjustments. In the short term, the anode materials market is expected to experience a seasonal slowdown in the third quarter, with demand appearing weak. However, competition among enterprises is likely to intensify.

Feel free to contact us anytime for more information about the anode materials market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies