【Petroleum Coke】 Significant Increase in Supply, Low Capacity Utilization Rate Rebounds

【Petroleum Coke】Significant Increase in Supply, Low Capacity Utilization Rate Rebounds

The increase in Chinese domestic production has resulted in a still ample supply of petroleum coke.

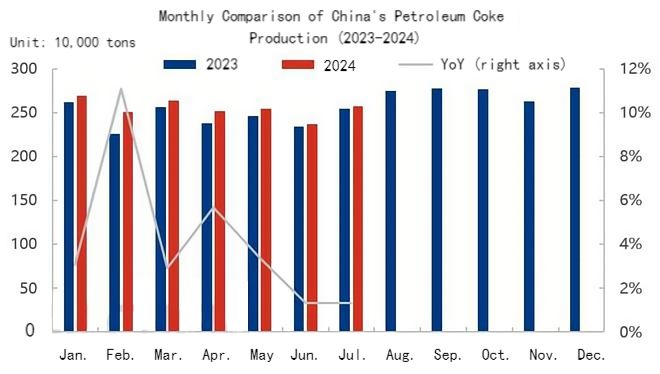

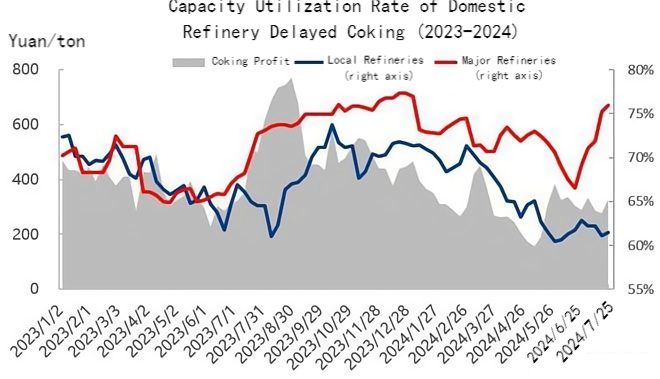

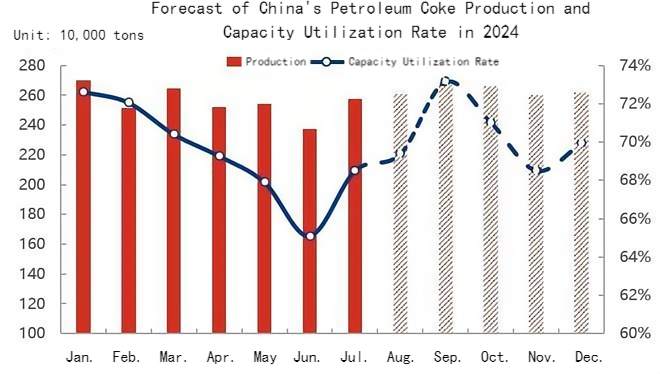

In July, the total production of petroleum coke was 2.5775 million tons, an increase of 8.48% month-on-month and 1.32% year-on-year. With the resumption of delayed coking capacity of 5.6 million tons/year in July 2024, some refineries adjusted their production, leading to a significant increase in petroleum coke output. Capacity utilization rates also showed a gradual recovery. Local refineries' capacity utilization rate reached 61.74%, up 0.13 percentage points month-on-month; major refineries' capacity utilization rate was 73.52%, up 5.39 percentage points month-on-month.The weakening profit from delayed coking, with theoretical profit at 307 yuan/ton in July, a decrease of 2.23% month-on-month, is a primary reason for the slow recovery of capacity utilization in local refineries.

Data Source: Oilchem

Supply-Demand Gap Slightly Narrows in July, Supply Remains Excessive

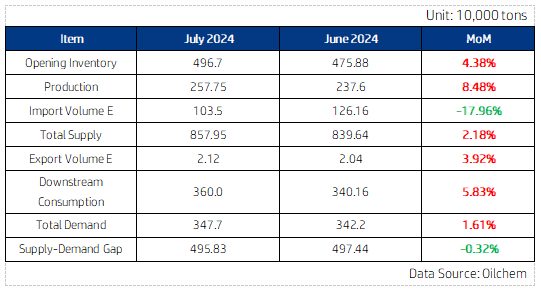

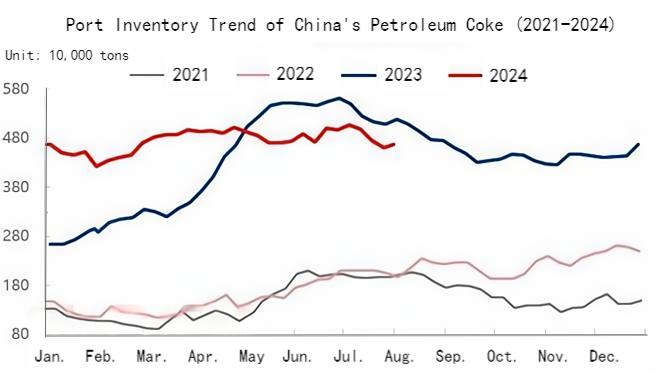

Data shows that the domestic supply of petroleum coke in July remained ample, with total supply increasing by 2.18% month-on-month, while demand increased by 5.83%. The overall supply-demand gap narrowed by 0.32%, but the oversupply situation persists. Domestic port inventories slowly declined from high levels, reaching 4.668 million tons at the end of July, a decrease of 6.02% month-on-month from the end of June.

August Production May Continue to Rise, Demand Increase Below Expectations

Regarding domestic petroleum coke, in August 2024, three new delayed coking units with a total capacity of 3.4 million tons/year will undergo maintenance, while four units with a total capacity of 4.7 million tons/year are expected to resume production, leading to potential growth in overall production. The capacity utilization rate of domestic delayed coking units is expected to rise to 69.37%, with production potentially increasing by 4.8% month-on-month.

On the import side, August is expected to see a continued decline, possibly falling below 1 million tons, a decrease of 8.2%.

From the supply perspective, production and import volumes are expected to reach 3.56 million tons, overall possibly decreasing by about 1.45%.

From the demand perspective, the operating load of terminal electrolytic aluminum remains high and fluctuates, potentially rising to around 96%, which is a favorable factor for the medium-high sulfur calcined petroleum coke market. In the anode material sector, the operating load may decline slightly to 64% due to inventory and order volume, adversely affecting the low-sulfur market to some extent. The market for steel carbon products is running stably but weakly, while silicon enterprises may see a slight increase in operating rates.

Considering these factors, the expected consumption of petroleum coke in August may still show a slight increase, but the increase may be around 1%. Given the current high inventory pressure, petroleum coke prices are unlikely to see a significant rebound.

Data Source: Oilchem

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies