【Calcined Petroleum Coke】 Price Increase! The Market Shows Slight Improvement

【Calcined Petroleum Coke】 Price Increase! The Market Shows Slight Improvement

Market Summary

On September 6, the average price of calcined petroleum coke (CPC) was RMB 2,148/ton, remaining stable compared to the previous working day. Currently, the overall CPC market is running steadily. The low-sulfur CPC market has seen slight improvement in sales due to cost advantages, with some companies raising their prices in response to rising raw material costs. However, downstream demand has not significantly improved. The medium-high sulfur CPC market has seen decent trading activity, with most September orders for premium-grade products sold out. Prices remain stable, with sales fulfilling contracts. In contrast, the general-grade CPC market is also stable, although some companies, due to a lack of orders for general-grade products, have switched to producing premium-grade CPC.

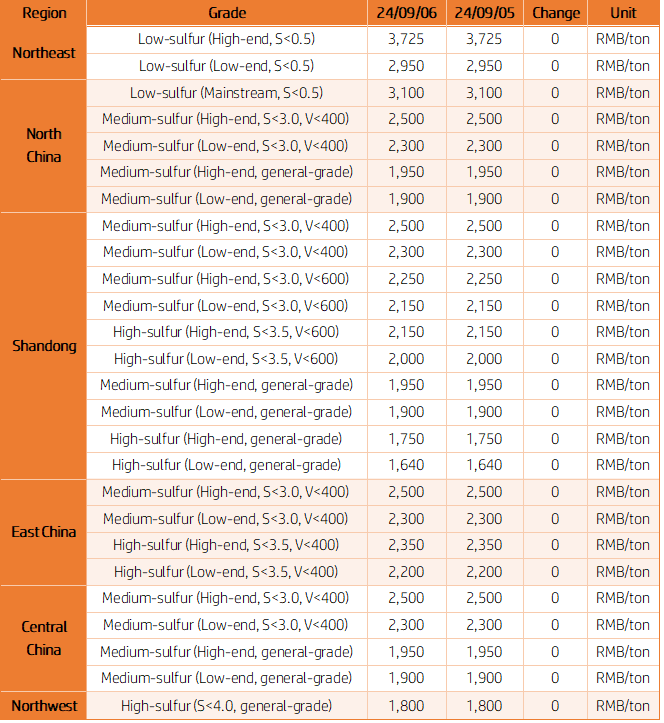

Major Regional Market Transaction Prices

Current Prices

Low-sulfur CPC (raw material from Jinxi, Jinzhou): RMB 3,000-3,200/ton.

Low-sulfur CPC (raw material from Fushun): RMB 3,400-3,725/ton.

Low-sulfur CPC (raw material from Liaohe, Binzhou CNOOC): RMB 2,850-2,950/ton.

Medium-high sulfur CPC (S<3.0%, no requirements for trace elements): Previous mainstream price: RMB 1,950/ton, current price: RMB 1,900-1,950/ton.

Medium-high sulfur CPC (S<3.5%, no requirements for trace elements): RMB 1,680-1,750/ton.

Medium-high sulfur CPC (S<3.0%, V<400): Previous price: RMB 2,400/ton, current price: RMB 2,400/ton.

Supply

The current daily supply of commercial CPC is 26,574 tons, with an operating rate of 62.44%. The market supply remains stable compared to the previous working day.

Upstream Market

Petroleum Coke: Sinopec refineries have seen stable trading; medium-sulfur petroleum coke in the Yangtze River region is selling as needed. Some refineries, like Anqing Petrochemical, have temporarily stopped for maintenance. In South China, high-sulfur petroleum coke is stable, with Maoming Petrochemical's entire output for internal use. Northern China and Shandong regions are stable, with downstream buyers purchasing on demand. In Northeast China, low-sulfur coke sales are decent, and Daqing Petrochemical maintains stable pricing. In the Southwest, Yunnan Petrochemical primarily produces high-sulfur coke, while CNOOC refineries are maintaining steady shipments.

Downstream Market

Graphite Electrodes: Due to weak downstream demand, negotiations on graphite electrode prices are difficult, with some companies offering lower prices to gain market share. Transactions fluctuate, but the market remains weak.

Electrolytic Aluminum: After three consecutive price drops, market sentiment in East and South China remains sluggish, and aluminum ingot sales have underperformed expectations, dragging down spot aluminum prices.

Anode Materials: China's lithium battery anode materials market remains stable, with upstream low-sulfur petroleum coke and medium-temperature pitch prices rising. Needle coke and coated pitch prices remain stable. While these factors provide price support for anode materials, downstream cost reduction pressures persist, keeping actual transaction prices low amid excess production capacity.

Market Outlook

It is expected that all grades of calcined petroleum coke will maintain stable prices tomorrow.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies