【Graphite Electrode】 Forecast for China's UHP Graphite Electrode Market in November

【Graphite Electrode】 Forecast for China's UHP Graphite Electrode Market in November

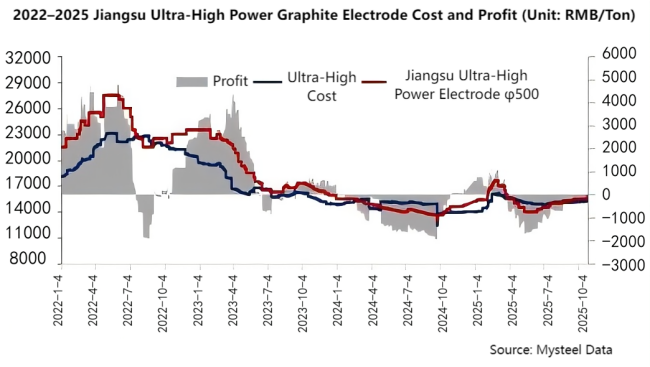

In October, China's ultra-high power (UHP) graphite electrode market first remained stable and then showed a slight increase. Steel mill bidding prices rose modestly. Due to pre-holiday stockpiling, adjustments in steelmaking processes, and declining finished steel profits, transaction volumes in October decreased, and overall market activity was moderate. The contradiction between rising petroleum coke prices and shrinking demand has become increasingly apparent. How will the UHP graphite electrode market perform in November?

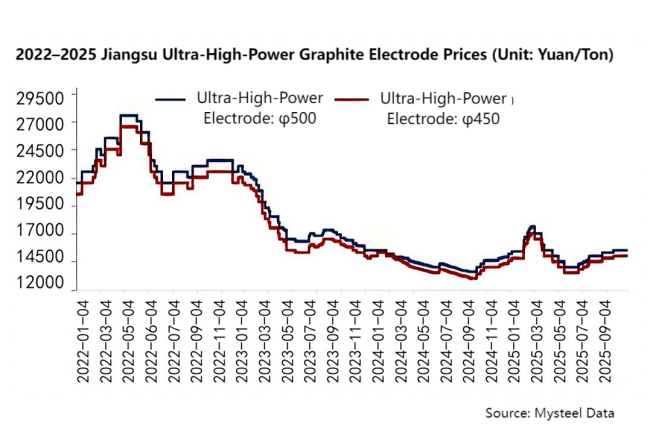

1. Review of UHP Graphite Electrode Prices

In October, the UHP graphite electrode market generally remained stable. The current quotations are:

φ450 UHP graphite electrode: 15,300 RMB/ton

φ500 UHP graphite electrode: 15,800 RMB/ton

φ550 UHP graphite electrode: 16,300 RMB/ton

From the perspective of steel mill bidding, prices in October showed a slight increase on top of the rise achieved at the end of September.

2. Rising Raw Material Prices Push Up Electrode Costs

In terms of electrode raw materials, petroleum coke prices rose for two consecutive months in October, with the monthly average price increasing by 84 RMB/ton, up 2.06% month-on-month. Although coal tar pitch prices fell slightly, its share in total electrode costs is relatively limited. Overall, electrode costs continued to move upward. It is also understood that petroleum coke prices are still expected to rise in November, and suppliers' intentions to raise prices are strengthening.

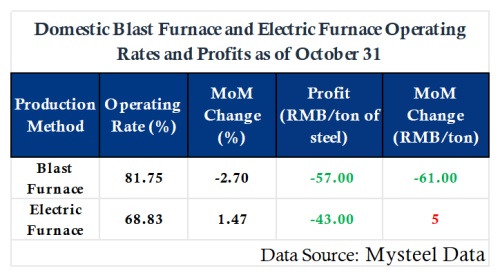

3. Poor Finished Steel Profits May Lead to Lower Electrode Demand

Based on theoretical calculations, both long- and short-process steelmaking routes are experiencing varying degrees of losses, weakening production enthusiasm among enterprises. In addition, production schedules have slowed due to environmental control measures in some regions, and output is expected to decline.

From another perspective, differences in the refining processes of various steel grades, coupled with cost-reduction needs, have led to short-term adjustments in refining time and refining ratios, which have also affected the procurement rhythm of graphite electrodes. Therefore, demand for UHP graphite electrodes is likely to decline.

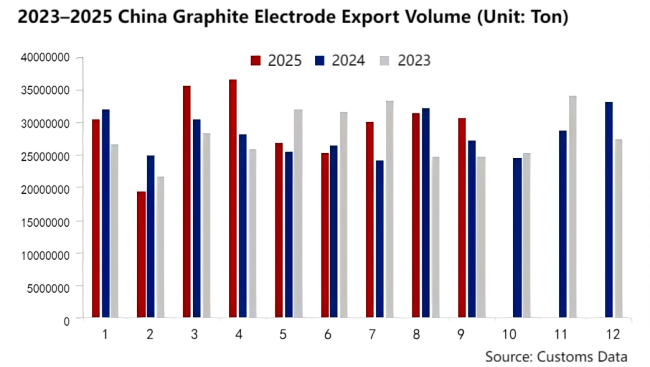

4. Falling Export Prices May Drag Down Export Volume

From the export perspective, about 30,600 tons of furnace electrodes were exported in September 2025, up 12.29% year-on-year. Cumulative exports from January to September reached 266,800 tons, up 6.13% year-on-year.

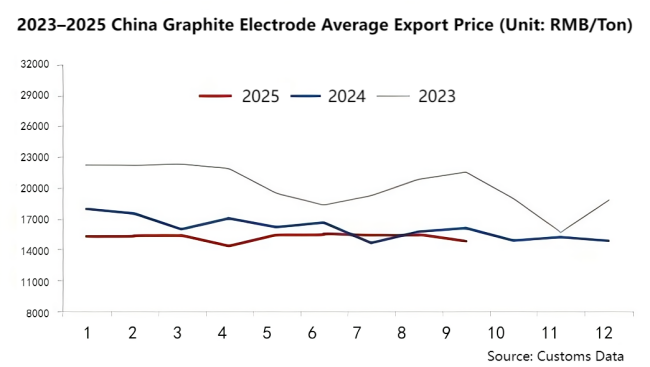

In terms of export prices, the average export price of graphite electrodes in 2025 was lower than in 2024. While domestic graphite electrode prices rose from September to October, the average export price in September fell 4.33% compared with August. According to cost calculations, taking the φ500 UHP graphite electrode as an example, graphite electrodes are hovering around the breakeven point. Export prices are lower than domestic market prices, which may limit the signing of export orders and hinder export volume growth to some extent.

5. Summary and Outlook

At the end of October, graphite electrode prices rose. Some steel enterprises had already completed procurement before the price increase, and from the results, the price rise did not fully meet expectations. The strengthening trend of petroleum coke prices has pushed electrode costs higher, narrowing the loss margin of graphite electrode producers, but profitability has not yet been achieved. Supplier sentiment toward price hikes remains strong. It is expected that in November, China's UHP graphite electrode market will still have upward price potential, but close attention should be paid to steel mills' production dynamics.

(Source: Mysteel.com)

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies