【Petroleum Coke】Downstream Increased Purchasing Enthusiasm! PetCoke Prices May See a Slight Uptick?

【Petroleum Coke】Downstream Buyers Show Increased Purchasing Enthusiasm! Petroleum Coke Prices May See a Slight Uptick?

Market Overview

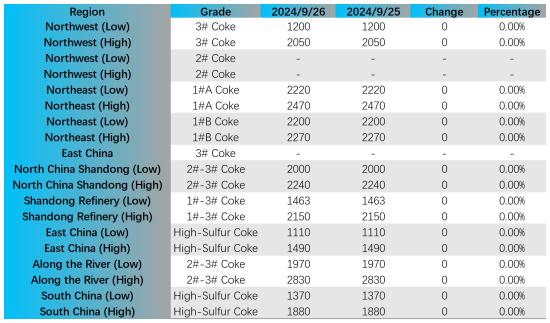

As of September 26, the average market price of petroleum coke stood at 1,684 yuan/ton, stable compared to the previous business day. To learn more about calcined petroleum coke market prices... Currently, trading in major refineries remains steady, with prices in local refineries fluctuating within a narrow range of 5-50 yuan/ton.

Key Regional Market Prices

Petroleum coke from Sinopec's refineries remains mostly stable, with slight price increases in certain areas. In Shandong, the price of 5# coke from Qingdao Refining rose by 20 yuan/ton, with a vanadium content of around 520 ppm. Jinan Refinery is shipping low-discharge coke as usual, and Qilu Petrochemical is shipping at stable prices. In East China, 4B coke is the main product being shipped, while Jinling Petrochemical mainly produces 3A and 4B grades. PetroChina's petroleum coke remains stable, with steady demand for low-sulfur coke in the northeast, though purchases from graphite electrode and anode material companies remain low. In North China, Dagang Petrochemical is delivering based on orders, while in the northwest, Lanzhou Petrochemical plans to resume production on September 28, Yumen Petrochemical is shipping aluminum-grade coke, and Xinjiang refineries are maintaining stable shipments with low inventory levels. CNOOC refineries are also shipping at stable prices.

In local refineries, the petroleum coke market is stabilizing, with refinery prices adjusting by 10-50 yuan/ton. Refinery inventories remain low, but as prices stabilize, downstream carbon companies are beginning to stock up, and refineries are signing orders for the National Day period. Currently, Wantuo Petrochemical has reduced its sulfur content to around 3.2%, with prices up by 40 yuan/ton. Panjin Haoye’s Phase II petroleum coke sulfur content has risen to 4.5%, with the latest price at 1,226 yuan/ton.

Imported Coke

Downstream demand for imported high-sulfur sponge coke remains weak, putting pressure on shipments. However, demand for low-sulfur sponge coke is decent, with slight price increases in Indonesian coke.

Supply

As of September 26, 13 coking units in China are undergoing regular maintenance. The country's daily petroleum coke output is 86,195 tons, with a coking unit operating rate of 67.97%, down 0.12% from the previous day.

Demand

Downstream aluminum carbon companies maintain a just-in-time purchasing strategy for petroleum coke. The anode material market lacks strong drivers, leading to a cautious approach in production and weaker demand for petroleum coke. The graphite electrode market has underperformed expectations, with mostly just-in-time transactions, limiting petroleum coke purchases. The silicon carbide industry and southern fuel companies are purchasing high-sulfur shot coke as needed.

Market Outlook

With previous price declines, downstream purchasing enthusiasm has slightly increased compared to earlier. In the short term, petroleum coke prices are expected to remain stable, with potential slight upticks of around 50 yuan/ton in certain areas.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies