【Petroleum Coke】Price Increases, Market Actively Pushes Up, Supported by Strong Aluminum Demand

【Petroleum Coke】Price Increases, Market Actively Pushes Up, Supported by Strong Aluminum Demand

Market Overview

As of October 9, the average price of petroleum coke in the market was 1,703 yuan/ton, up 7 yuan/ton from the previous working day, representing an increase of 0.41%.Supported by strong aluminum demand, petroleum coke shipments were satisfactory, leading to an active push for price hikes. Additionally, with low inventories at some refineries, prices were generally adjusted upward. The prices at major refineries increased by 10-50 yuan/ton, while independent refineries pushed prices up by 5-100 yuan/ton.

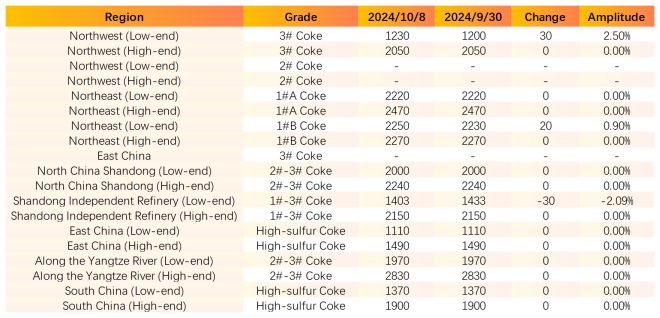

Transaction Prices in Key Regional Markets

PetroChina's and Sinopec's petroleum coke prices remained mostly stable, with a few price adjustments. In Shandong, Qingdao Refining's 5# coke price increased by 20 yuan/ton, with vanadium content around 520 ppm. Jinan Refinery continued normal shipments of low-emission coke, and Qilu Petrochemical maintained stable prices. In East China, 4B coke was the main product being shipped, while Jinling Petrochemical focused on producing 3A and 4B coke. PetroChina's petroleum coke shipments remained stable. In Northeast China, low-sulfur coke demand was steady, with limited stocking activity from graphite electrode and anode material companies. In North China, Dagang Petrochemical shipped according to orders. In Northwest China, Lanzhou Petrochemical planned to resume production on September 28, Yumen Petrochemical shipped aluminum-use coke, and refineries in Xinjiang maintained stable shipments with low inventories. Refineries under China National Offshore Oil Corporation (CNOOC) continued to ship at stable prices.

Regarding independent refineries, the petroleum coke market showed stable trading operations, with some price adjustments ranging from 10 to 50 yuan/ton. Ahead of the National Day holiday, inventories at independent refineries remained low, but as prices stabilized, carbon companies began procuring stock for post-holiday operations. Refineries signed orders for the holiday period, with Wantong Petrochemical lowering sulfur content to around 3.2% and increasing prices by 40 yuan/ton. Panjin Haoye's second-phase coke sulfur content increased to 4.5%, with the latest price at 1,226 yuan/ton.

Imported Coke

The willingness of downstream buyers to purchase imported high-sulfur sponge coke was low, putting pressure on sales. However, demand for low-sulfur sponge coke remained stable, with slight price increases for Indonesian coke.

Supply

As of September 26, there were 13 regular maintenance activities at coking units across China. The national daily production of petroleum coke was 86,195 tons, with a coking unit operating rate of 67.97%, down 0.12% from the previous working day.

Demand

Downstream aluminum carbon companies actively purchased petroleum coke, with overall demand remaining strong. Battery manufacturers slightly increased production schedules, driving short-term procurement demand from anode material companies. Supported by recovering profits in steel mills, major graphite electrode companies planned to raise prices, with mainstream market prices showing signs of upward movement and petroleum coke being purchased as needed. The silicon carbide industry and the southern fuel market still had demand for high-sulfur shot coke.

Market Outlook

The overall trade in the petroleum coke market remains satisfactory, with refinery inventories generally staying at low levels. Post-holiday restocking by carbon companies is expected to continue supporting the market. Therefore, it predicts that petroleum coke prices will likely remain stable in short term, with some upward adjustments in the range of 10-50 yuan/ton. Prices for shot coke are expected to remain stable in the near term.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies