Graphitization 37 Questions II

Natural graphite, graphite electrode and process improvement

21. Possible measures for enterprises under the shortage of graphitization?

There are several solutions:

1) Pre-graphitization has been used in the first three quarters of this year to increase the furnace loading of the existing capacity;

2) Switching to negative electrode processing through graphite electrode or other spare capacity, but the overall is still relatively limited;

3) Battery factory adopts natural + artificial composite materials.

22. Doping proportion and application scenario of natural graphite?

Domestic head negative enterprises have natural production capacity, part of the product using natural and artificial combination. After buying raw materials, battery manufacturers may also make composites by themselves. This phenomenon has always existed, just the problem of proportion. At present, the ratio of artificial doping to natural doping is 9:1 or 7:3. If there is no better solution next year, the ratio of natural doping may be higher, possibly to 6:4 or even 5:5. In terms of use scenarios, composite negative electrodes are generally used in special vehicles and energy storage, and passenger cars mainly use artificial graphite. Natural graphite is still poor in cycle performance, rate performance and compatibility with electrolyte. If battery enterprises want to use pure natural graphite for production process requirements will be higher.

23. Why is natural graphite used more overseas?

There are many cylindrical batteries used overseas, and the cylinder has a high tolerance for the expansion of natural graphite. Natural graphite will basically be used in 1865 and 2170 batteries of Panasonic, LG and Samsung. In addition, the overall process level of overseas batteries is relatively high.

24. Proportion of man-made and natural products?

The sharp increase in the price of products at one end will increase the proportion of use at the other end. In the future, the proportion of natural and man-made may not be as extreme as it is now. The proportion of natural may increase, but the proportion of man-made will remain above 60%. China is rich in natural graphite resources.

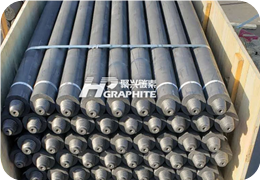

25. What is the capacity scale of graphitization of graphite electrode to negative electrode?

The profit of graphite electrode this year is also considerable. From 2017 to 2018, there has been a tide of production expansion. At present, some OEM enterprises in the market have idle production capacity. Stimulated by the high profits of negative electrode graphitization, some production capacity may be transferred, with the limit order of about 200000-300000 tons. The graphitization of graphite electrode mainly adopts crucible and inner string. Crucible is mainly used to produce high-power graphite electrode. Corresponding to negative electrode, it is some high-end products. The inner string process of graphite electrode is generally changed into negative chamber furnace. If the production capacity is not very large, it can be improved in 2-3 months.

26. Progress of continuous graphitization?

It has not been used on a large scale in the industry, and the optimal state is still being explored. The existing methods are still Acheson and Box type graphitization furnaces. Continuous batch application may take two years, and a large number of applications may not be seen before 2022. The charging capacity of continuous graphitization single furnace is relatively low. If it comes out, it may still grab the share of the box type first. The application of crucible in high-end products is unlikely to be replaced in the short term.

Negative electrode

27. Number and pattern of enterprises in the negative electrode industry?

The number of negative electrode enterprises has been increasing year by year in recent. According to statistics last year, there were about 40 enterprises, and this year there will be more. Next year, the survival pressure of small factories will be very great, and small and medium-sized enterprises may become OEM factories of large enterprises.

28. What is the competitiveness of overseas negative electrode plants and graphitization manufacturers?

The ratio of Negative electrode companies in Japan is declining year by year. Pohang is the main company in South Korea at present, and the products are mainly natural. There will be artificial graphite planning later. There will be no artificial production capacity this year, and some quantity may be produced successively next year. Overseas graphitization is mainly in Japan, and their graphitization processing price is generally over 30,000 yuan, so the disadvantage of negative electrode cost is obvious. In the future, in terms of product quality and customer structure, it will be difficult for overseas enterprises to squeeze the market of Chinese enterprises.

29. Silicon doped proportion of silicon carbon negative electrode?

5%-10%, no more than 20%.

Enterprise Perspective

30. Situation of a graphitization enterprise

The production capacity is tens of thousands of tons. The agent processing enterprises are mainly Beitrui, Zichen and Shanshan. In the past two months, they have successively received sporadic orders from Kaijin and Cheung Fenghua. Because of the Olympic Games, the list in the later stage stopped without signing, waiting for the implementation of the policy. The electricity price is 30 cents at the beginning of the year. It rose once in July to 43 cents, and is expected to rise to 55 cents from November to December. Other industries such as battery and silicon enterprises have risen to more than 60 cents. On the quotation side, the box furnace is reported as 21000-22000, and 12000 at the beginning of the year; Crucible reported 24000-25000 and 13000 at the beginning of the year. Small factories offer 25000-26000, but the company's own capacity is not enough, and the high price orders from small factories are also relatively limited, mainly from large factories. For the expansion of production, it is planned to focus on the box type furnace in the new phase, which is 1-2k cheaper than the crucible. In the future, it may be planned to build another two workshops with a capacity of 50000 tons. In terms of power rationing, 30% in September, 40% now, and maybe 60% - 70% during the Winter Olympics. It may return to normal from March to April next year.

31. Development history of graphitization industry?

The negative electrode appeared later than the carbon industry, and the graphitization of the negative electrode was first transferred from the graphite electrode. In the range of 2500-3000 degrees, carbon materials undergo graphitization conversion process. From the perspective of process, the earliest one is Acheson furnace. On the basis of Acheson, in order to reduce energy consumption and increase output, box furnace is developed. At present, the third generation is to develop continuous graphitization furnace, and the energy consumption is much lower than the first two. The technology of graphitization furnace in Japan and Germany is more advanced, and many of their carbon enterprises are using continuous graphitization furnace; The domestic equipment has not yet broken through.

32. What is the order difference of each graphite chemical industry?

The technical difference is small, but the production management of each family is a human factor, which is relatively large. The cost of Shangtai is relatively low, the yield can be 92% - 95%, and the cost is 1-2K cheaper than other companies.

33. How do you feel about the graphitization industry from the enterprise level?

From the enterprise itself inquiry and volume is tight. Especially after the second half of the year, many small negative electrode material factories want to find graphitization enterprises for generation processing, but they can't cooperate with them due to production capacity.

34. Is there any difference between different needle coke processed in the same graphitization plant?

The product gap is not big. The yield and recovery rate of the negative electrode material precursors processed by large factories are similar.

35. Price negotiation strategy between enterprises and customers?

A one-year long-term agreement is countersigned with large manufacturers. Small manufacturers basically sign it once a month. Small manufacturers pay 100% in advance and large manufacturers pay 5% in advance (precursor body into the factory before processing). After processing, we will call the remaining payment and we will deliver the goods. In 2-3 months, some price adjustments can be made according to the electricity price, and the quantity is locked but the price is not locked. At present, the rise in electricity charges can be completely transferred to the negative electrode through price rise. Some small factories may hang a price higher than the market in the form of bidding. They also did not say that they would maintain long-term close cooperation with negative electrode customers and pay more attention to such short-term interests.

36. Graphitization cost and profitability per ton?

The cost of the box furnace rose from 1W to 1w2 at the beginning of the year, and the crucible rose from 1w2 to 1w3. If the price rises to 3W, the profit per ton can be 1.5-1.6w.

37. What is the future development model of graphitization enterprises? What are the barriers to being negative?

Will consider to do the whole industry chain, including negative electrode, crushing, shaping, coating and granulation. In the next 3-5 years, the graphitization of large negative electrode plants may be self-sufficient. The processing enterprises are either transforming to integration or becoming graphitization subsidiaries of large negative electrode plants. Hengke and Hengsheng are gradually cutting into negative electrode materials. Turning negative, the expansion on the customer's side could be an obstacle. View more technical news from us.

No related results found

0 Replies