【Monthly Review】October Price Adjustments for Petroleum Coke—What to Expect in the Future?

【Monthly Review】October Price Adjustments for Petroleum Coke in Shandong—What to Expect in the Future?

In October, petroleum coke prices in the Shandong region primarily experienced upward adjustments, as refineries actively sold off stock to reduce inventories. Low-sulfur coke prices rose steadily, with an increase of 350 CNY/ton, while the overall sales pace for medium to high-sulfur coke was satisfactory, with price adjustments ranging from 40 to 140 CNY/ton.

1. Predominantly Price Increases in Shandong's Petroleum Coke Market

As of October 17, the average prices for petroleum coke in Shandong for October are as follows: 2A at 2228 CNY/ton, 2B at 2105 CNY/ton, 3A at 2026 CNY/ton, 3B at 1755 CNY/ton, 3C at 1541 CNY/ton, 4A at 1119 CNY/ton, and 4B at 950 CNY/ton. Calcined petroleum coke (cpc) is used as a pre-baked anode and cathode for aluminum electrolysis, as well as a carbon enhancer for metallurgical and steel industries, graphite electrodes, industrial silicon, and carbon electrodes for ferroalloys. Low-sulfur coke prices saw a wide increase of 16.28%, primarily due to increased procurement from leading companies in the anode sector, coupled with a slight uptick in the operating rate of end-use electric arc furnaces, benefiting the low-sulfur coke market. Prices for medium to high-sulfur coke generally increased, with adjustments between 1.59% and 10.05%. In the aluminum carbon sector, trading was good, with prices for benchmark goods remaining firm; some refineries adjusted prices based on indicator changes and inventory levels.

Domestic refinery supply in October is expected to see a stable increase. Refineries resuming production include Cangzhou Petrochemical, Jilin Petrochemical, Karamay, Lanzhou Petrochemical, and Huajin Petrochemical, while Jinzhou Petrochemical plans to increase production in October. Qicheng Petrochemical is expected to come online at the end of October. Due to logistics disruptions during the holiday period, domestic refinery inventories may have slightly increased compared to pre-holiday levels.

Data Source: Oilchem

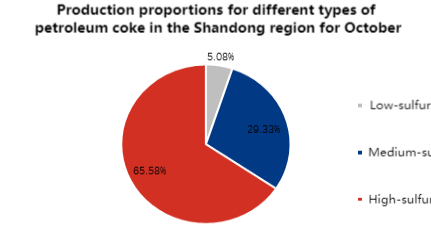

Compared to other regions, Shandong's refineries frequently adjust their production indicators, with a higher proportion of high-sulfur coke produced in the area. As of October 17, low-sulfur coke accounted for 5.08% of production, medium-sulfur coke for 29.33%, and high-sulfur coke for 65.58%. Given the high proportion of medium to high-sulfur coke and continuous adjustments to production indicators, prices tend to fluctuate, resulting in a generally volatile price trend in Shandong.

2. Stable Production and Reasonable Sales Pace in Shandong

Overall production in Shandong remained stable in October. Three refineries in the region are involved in resuming and halting operations, including Qicheng Petrochemical, which plans to launch its 1.6 million ton/year delayed coking unit. Consequently, the main refineries maintained stable production, with local refineries potentially seeing slight increases. The weekly production from October 9 to October 16 was 23.6 thousand tons, which was stable compared to the beginning of the month.

Data Source: Oilchem

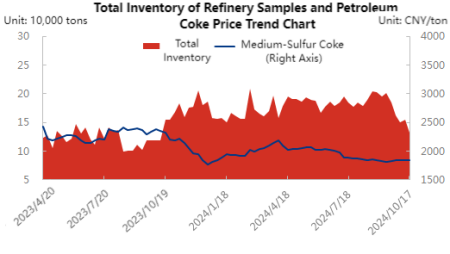

Despite stable production, refinery inventory is effectively reducing. As of October 17, inventories in Shandong decreased by 4.45% compared to the beginning of the month, with an overall reasonable sales pace among refineries. Coupled with reduced port inventories, prices primarily showed stable upward adjustments. As of October 17, the price of 3B petroleum coke in Shandong was 1767 CNY/ton, reflecting an increase of 0.57% since the beginning of the month.

3. Downstream Demand-Driven Purchasing—Future Price Outlook for Shandong Petroleum Coke Mixed

Data Source: Oilchem

Looking ahead, as of the end of October, Qicheng Petrochemical's new production facility will come online, and some refineries may slightly adjust production levels, leading to a minor increase in overall supply and a gradual reduction in inventories. It is expected that inventory levels will increase by approximately 0.1 to 0.3 thousand tons by the end of the month, with a general upward trend in inventories.

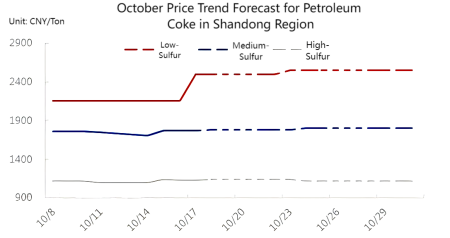

Driven by the purchasing enthusiasm of leading companies in the anode sector, demand for low-sulfur coke remains robust. Prices for low-sulfur coke from major refineries are expected to rise, with price ranges likely between 2400 and 2600 CNY/ton. For medium to high-sulfur coke, price stability is anticipated under basic demand support, with benchmark goods maintaining firm prices; medium-sulfur coke prices are projected in the range of 1600 to 2030 CNY/ton, while high-sulfur coke prices may range from 1000 to 1200 CNY/ton.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies