【Petroleum Coke】Low-Sulfur Coke Prices Continue to Rise, Market Support Remains Strong

【Petroleum Coke】Low-Sulfur Coke Prices Continue to Rise, Market Support Remains Strong

Introduction:

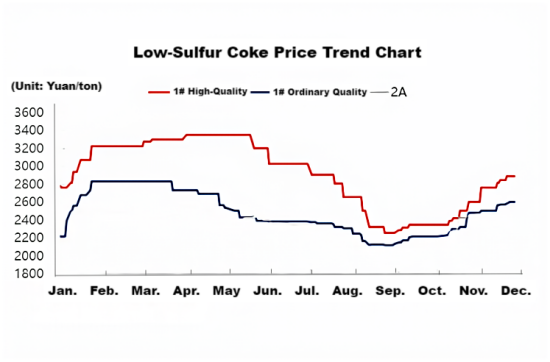

Since bottoming out in September, low-sulfur coke prices have risen continuously for three months. As of November 25, high-end 1# coke reached 2,895 yuan/ton, an increase of 610 yuan/ton (27%) from September. Ordinary 1# coke rose by 453 yuan/ton (21%), while 2A coke increased to 2,560 yuan/ton, up by 472 yuan/ton (23%). The price of low-sulfur coke has surged significantly, with a strong upward momentum.

Data Source:Oilchem

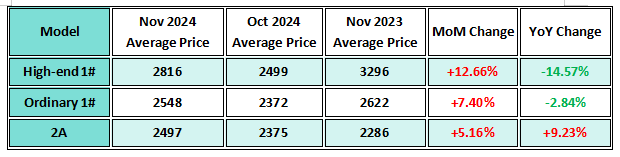

1. November Low-Sulfur Coke Prices Increase Month-on-Month

Data Source:Oilchem

As shown in the table above, low-sulfur coke prices continued to rise in November. Despite varying growth rates across different models, all showed month-on-month increases. Notably, 2A coke surpassed last year's price, increasing by 9.23% year-on-year.

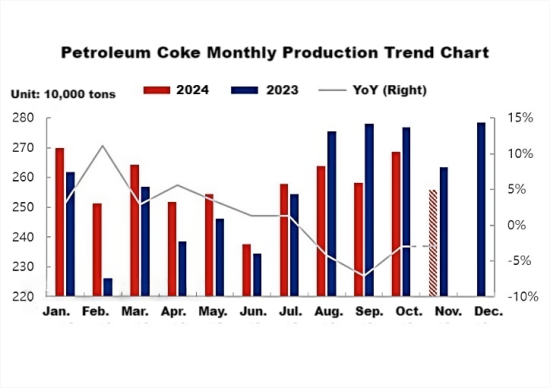

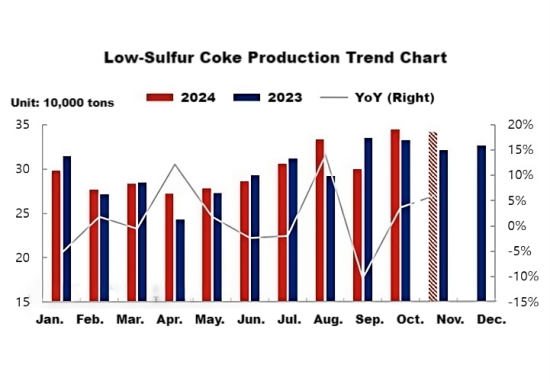

2. Domestic Low-Sulfur Coke Supply Increased by 6.32% Year-on-Year, Stable Month-on-Month

Data Source:Oilchem

Due to maintenance shutdowns at refineries like Zhejiang Petrochemical and Sinochem, China's petroleum coke supply showed a downward trend both month-on-month and year-on-year. However, low-sulfur coke production remained unaffected, and even increased due to production arrangements. In the fourth quarter, monthly production of low-sulfur coke exceeded 340,000 tons, up from 320,000 tons in the same period last year. Despite the increase in production, low-sulfur coke prices continued to rise, reinforcing the upward trend in prices.

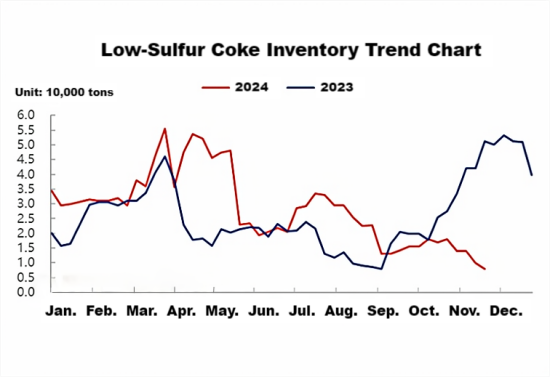

3. Domestic Low-Sulfur Coke Inventory Continues to Decline, Mills Maintain Low Inventory Levels

Data Source:Oilchem

As shown in the chart, low-sulfur coke inventories have been steadily declining since September, with current stock levels around 10,000 tons. Refineries have very little inventory, and some external storage at PetroChina refineries has been largely consumed. Therefore, despite an increase in monthly production of 20,000 tons, mills face no inventory pressure, providing strong support for rising low-sulfur coke prices.

4. Increased Downstream Demand Strengthens Market Support for Low-Sulfur Coke

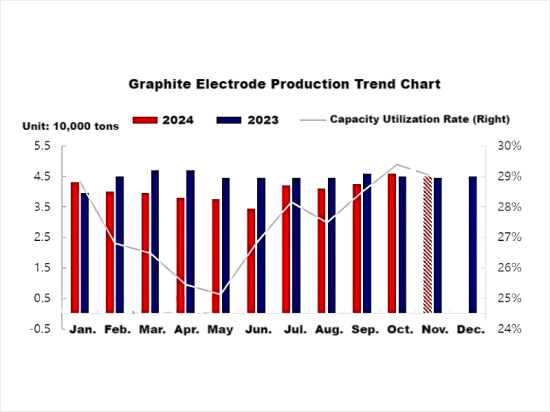

Data Source:Oilchem

As a traditional downstream consumer of low-sulfur coke, the production of graphite electrodes has not increased significantly in the fourth quarter. However, due to a steady operating rate of around 70% for electric arc furnaces, the consumption of graphite electrode inventories has increased. This has led to reduced inventory and greater production enthusiasm among graphite electrode manufacturers, increasing their acceptance of price hikes for low-sulfur coke.

In another key downstream sector, graphite cathodes, the high price of electrolytic aluminum (over 20,000 yuan/ton) has boosted profits, encouraging enterprises to replace graphite cathodes with those having a lifespan of over 5 years. This has led to an increase in the production of graphite cathodes, driving higher demand for low-sulfur coke and calcined coke.

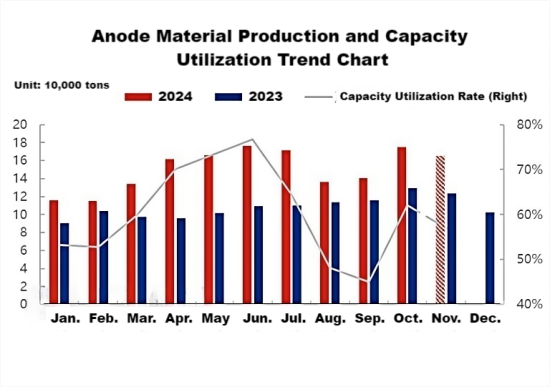

In the anode material sector, monthly production has reached over 170,000 tons in the fourth quarter, approaching the highest levels of the year. This has further increased demand for low-sulfur coke, as some anode material companies are using low-sulfur calcined coke directly, rather than merely blending it.

Conclusion:

In summary, low-sulfur coke prices have been on a continuous upward trend for the past three months. With stable supply and no significant changes in demand, coupled with factors like winter stockpiling, low-sulfur coke prices are expected to continue rising. High-end 1# coke is expected to reach 2,950 yuan/ton, ordinary 1# coke 2,700 yuan/ton, and 2A coke 2,600 yuan/ton.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies