【Steel Market】September Observation: Manufacturing Supports, Construction Weak,...

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel Market】September Observation: Manufacturing Supports, Construction Weak, High Molten Iron Inventory Pressure

In August 2025, the steel market exhibited several significant characteristics: profit-driven steel mills maintained high blast furnace molten iron output, total inventories of the five major steel products continued to accumulate, and supply-side pressure kept rising. Terminal demand showed a clear structural divergence of "strong manufacturing, weak construction." The core contradiction in the steel market remains a "high supply–weak demand" mismatch, and slow inventory destocking limits the room for price rebound. As the market enters the traditional "Golden September, Silver October" window, key points of attention include: the actual enforcement and sustainability of northern production cut policies; whether delayed seasonal demand can be released as expected and effectively absorb supply pressure; the impact of potential Federal Reserve monetary policy shifts; and how cost support and raw material price divergence will evolve. These core variables will jointly shape the steel market trajectory in September. This article aims to outline the market's core contradictions, analyze key driving factors, and provide a reference for understanding and forecasting September steel market trends.

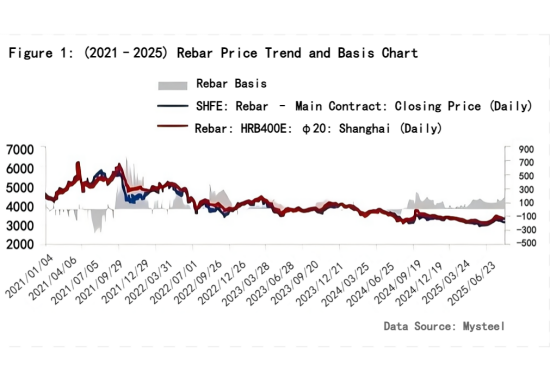

I. Rebar Futures–Spot Basis Hits Yearly High, Basis May Narrow in September

Taking Shanghai rebar prices as an example, the 2025 rebar futures–spot basis shows significant volatility, overall exhibiting a fall-then-rise pattern. At the beginning of the year, on January 27, the basis turned negative (spot discount), but it strengthened continuously mid-year and reached a yearly high in August. As of August 25, 2025, HRB400E φ20 rebar was priced at 3,310 RMB/ton, the SHFE main rebar contract closed at 3,138 RMB/ton, and the rebar basis stood at 172 RMB/ton, month-on-month widening by 98 RMB/ton, and year-on-year changing from a premium of -14 RMB/ton to a discount of 172 RMB/ton.

The basis level is influenced by supply-demand dynamics, market expectations, delivery pressures, and policy factors. Basis expansion is mainly driven by increased delivery resources, spot supply pressure, and futures market sentiment, showing that the spot remains relatively strong compared with futures. Based on historical data and current market dynamics, the normal rebar futures–spot basis ranges from 0 to 200 RMB/ton, with typical values around 100–150 RMB/ton (basis rate 1%–5%), reflecting relative supply-demand balance. At the end of August, influenced by production cut policies, the short-term basis may stay high; in early to mid-September, as delivery resources continue to release or construction demand further weakens, the basis may narrow.

II. High Molten Iron Output, Continuous Increase in Steel Inventories

1. Profit-driven mills maintain high molten iron output, with insufficient willingness to cut production

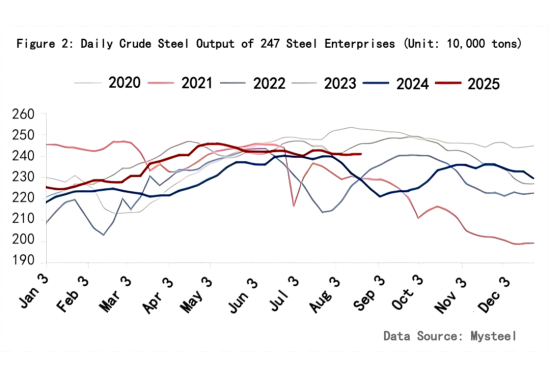

As of August 22, 2025, the daily average molten iron output of 247 sampled steel mills in August was 2.4061 million tons/day, month-on-month down 0.072 million tons/day, year-on-year up 0.643 million tons/day. Blast furnace operating rate was 83.36%, down 0.23% week-on-week, up 5.89% year-on-year. Steel mill profitability was 64.94%, down 0.86% week-on-week, up 63.64% year-on-year. Over the past five years, daily molten iron output is currently at a mid-to-high level. Since the beginning of the year, daily output has remained above the same period last year.

Since mid-July, northern production cut news has been circulating. In early to mid-August, cut policies were loose, and no large-scale new maintenance plans emerged. Although some blast furnaces were temporarily affected by routine maintenance, more furnaces resumed production. Unlike previous years, high profitability directly drives steel mill production enthusiasm. In August, daily molten iron output increased year-on-year significantly. Driven by relative high profits, mills have insufficient motivation to actively reduce output. Even with weak off-season demand, only local furnace rotation adjustments were used, rather than large-scale shutdowns. Research shows that Tangshan, Hebei steel mills were notified to prepare for 40% production cuts from August 31 to September 3, with an estimated daily molten iron impact of about 41,800 tons; the cut strength was below expectations. Currently, daily molten iron output remains at a mid-to-high level over the past five years. Under weak demand, mills must flexibly adjust production to maintain supply-demand balance.

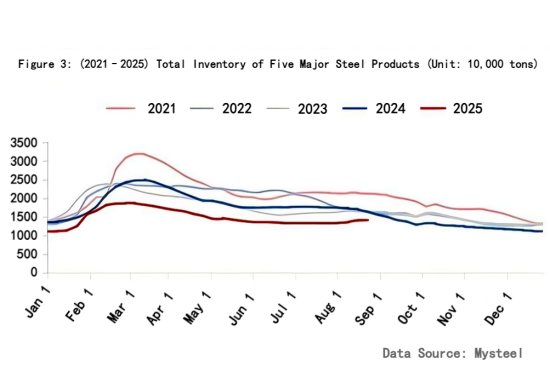

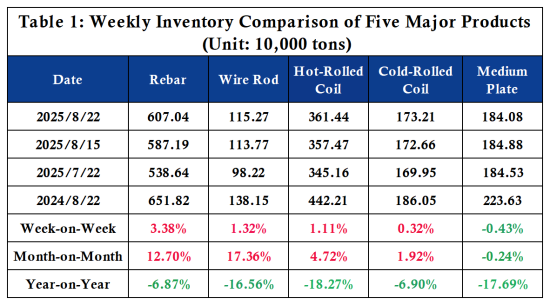

2. Supply-demand mismatch leads to continuous inventory accumulation, factory stock pressure transfers to social inventory

Supply-wise, as of August 22, 2025, the five major steel products supplied 8.7806 million tons, week-on-week up 0.0643 million tons (+0.7%), year-on-year up 12.72%. This week, long products and flat products showed opposite trends, with rebar production declining more. Total inventory of the five major steel products was 14.4104 million tons, week-on-week up 0.2507 million tons (+1.8%), year-on-year down 12.23%. Total inventory continued to accumulate, with structural differences: factory inventory slightly declined while social inventory started to rise, shifting pressure from production to circulation.

The main driver of rising inventory is the combined effect of high steady supply and seasonal demand decline. On one hand, rapid price increases in July preempted some demand release in August. High temperatures in August also suppressed construction activity, reducing steel consumption. On the other hand, driven by profits, production of the five major steel products increased for five consecutive weeks since mid-July, accumulating supply-side pressure. Recently, rising raw material costs reduced production profits, slightly dampening steel mill production enthusiasm. Future attention should focus on mill maintenance plans and the recovery of "Golden September, Silver October" demand. If supply does not shrink significantly, inventory pressure at production and circulation ends may persist.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies