【Graphite Electrode】September Domestic Ultra-High Power GE Market Outlook

【Graphite Electrode】September Domestic Ultra-High Power Graphite Electrode Market Outlook

In August, the graphite electrode market presented a "driven-type increase," with ultra-high power products leading the rise (monthly increase of 2–3%), while high power and regular power products showed limited follow-up growth. Entering September, high costs and peak-season demand may support prices to remain steady to slightly strong. The short-term supply-demand imbalance caused by the concentrated release of exports may heighten suppliers' reluctance to sell, but insufficient recovery momentum in the steel end-use sector will limit the upside space. How will the ultra-high power graphite electrode market develop in September?

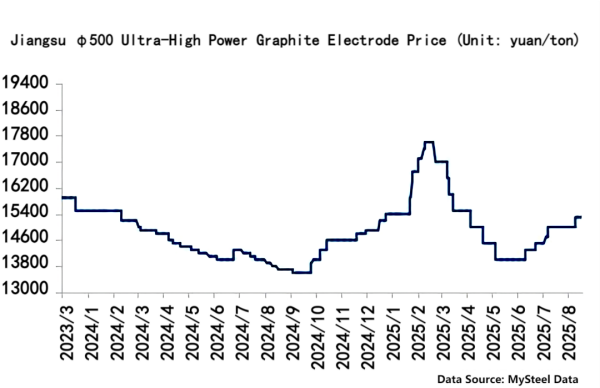

I. Review of Ultra-High Power Graphite Electrode Prices

In August, the graphite electrode market showed a "driven-type upward trend." Ultra-high power electrode prices overall rose by 100–300 yuan/ton. Taking the Jiangsu φ500 ultra-high power graphite electrode as an example, the current price is 10.87% higher than the same period last year, with strong cost support.

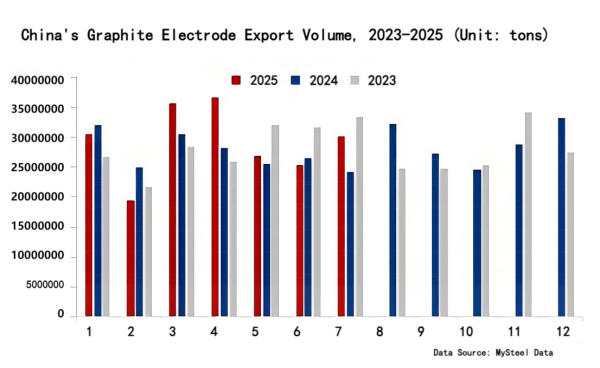

II. Export Concentration Causes Supply-Demand Imbalance, Recovery Still Requires Time

According to customs data, driven by the continuous rise in graphite electrode prices, export volumes surged in July. China's graphite electrode export volume in July reached 30,200 tons, a month-on-month increase of 1929% and a year-on-year increase of 24.77%. After the release of export demand, a short-term supply-demand imbalance emerged. Supply of φ500 and above ultra-high power graphite electrodes became tight, with suppliers holding firm quotations. Additionally, influenced by the strengthening petroleum coke price, electrode producers showed strong concerns about high costs, while production levels remained low. The supply-demand imbalance will require time to recover.

From the perspective of domestic market demand, the average capacity utilization rate of 90 independent electric arc furnace steel plants nationwide was 56.54%, down 0.13 percentage points month-on-month, but up 26.01 percentage points year-on-year. From recent profitability data, electric arc furnace valley electricity profits remain in a loss-making state. With finished steel inventories accumulating, prices may still face downward pressure. The pressure to cut production to stabilize prices is significant, weighing negatively on graphite electrode demand and prices.

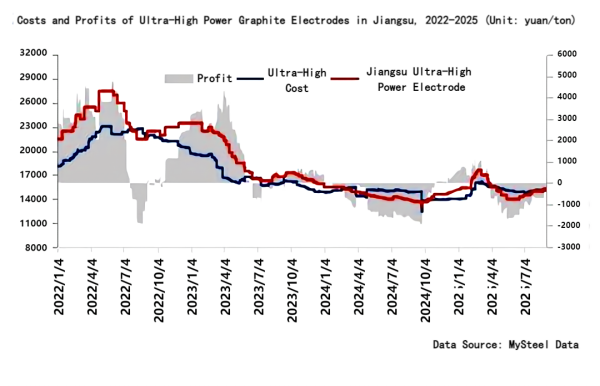

III. Narrowing Losses, Strengthening Cost Support

Taking Jiangsu φ500 ultra-high power graphite electrode prices as an example, with electrode prices rising, theoretical model calculations show that ultra-high power graphite electrode profits improved from -716 yuan/ton in early August to -409 yuan/ton at the end of August. Profitability has somewhat recovered. Looking at petroleum coke prices over the past three months, the trend has been relatively strong. On the first day of September, petroleum coke prices rose slightly, strengthening cost support and potentially driving ultra-high power electrode prices higher.

IV. Summary and Outlook

Based on the fundamentals of ultra-high power graphite electrodes in August, the September market may still follow a cost-driven trajectory. As the supply-demand imbalance eases and recovers, whether raw material petroleum coke and needle coke prices can continue rising will be the key focus of the ultra-high power electrode market. In the game between costs and demand, the September ultra-high power graphite electrode market is expected to face pressured upward movement.

(Source: Mysteel)

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies