【Petroleum Coke】Price Correction! High-End Coke Drops Over 9%...

【Petroleum Coke】Price Correction! High-End Coke Drops Over 9%, Market Trading Remains Sluggish—What's Next?

Entering March, domestic petroleum coke prices have returned to rational levels. Refinery shipment speeds have slowed compared to earlier periods, and some refineries are facing inventory pressure, prompting price adjustments to boost sales. Meanwhile, graphite electrode operating rates remain low, leading to cautious purchasing of low-sulfur coke. Refinery inventories for low-sulfur coke are under pressure, driving further price declines.

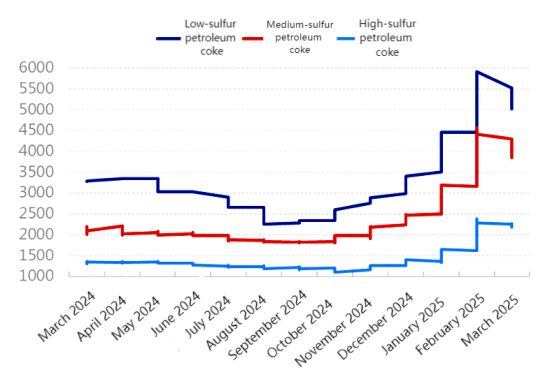

1. Petroleum Coke Market Prices

Figure 1: Domestic Petroleum Coke Average Price Trend Chart

Source: Oilchem

Anode material enterprises, affected by profit inversion, have slowed their purchasing plans for high-cost raw materials. The shipment speed of independent refineries has declined, and some refineries are experiencing inventory pressure, leading to price reductions to facilitate sales.

For aluminum carbon materials, although the benchmark procurement price of prebaked anodes in March increased month-on-month, anode enterprises remain in a marginal profit state and are cautious about purchasing high-priced materials.

As of March 13:

· #1 High-End Coke: ¥5,525/ton, down 9.23% MoM

· 2A Coke: ¥4,651/ton, down 13.3% MoM

· 3B Coke: ¥3,969/ton, down 4.46% MoM

· 4B Coke: ¥2,180/ton, down 2.91% MoM

With cautious procurement sentiment on the demand side, petroleum coke prices lack strong support and have undergone a slight downward adjustment.

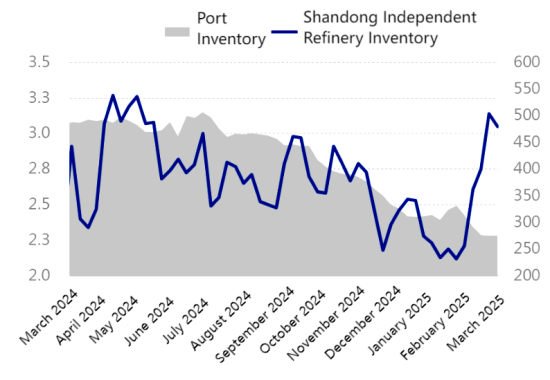

2. Refinery and Port Inventories

Figure 2: Shandong Refinery and Port Inventory Trend Chart

Source: Oilchem

In the Shandong market, as of March 13, independent refinery inventories stood at 30,500 tons, a 0.09-million-ton decrease MoM but a 38.01% increase MoM from February. Shipment speeds have slowed, leading to price reductions to ease inventory pressure.

Meanwhile, port inventories stood at 2.7456 million tons, down 0.68% MoM. Recent petroleum coke arrivals have been concentrated, but previous customer contracts are still being fulfilled, causing a slight decline in port inventories.

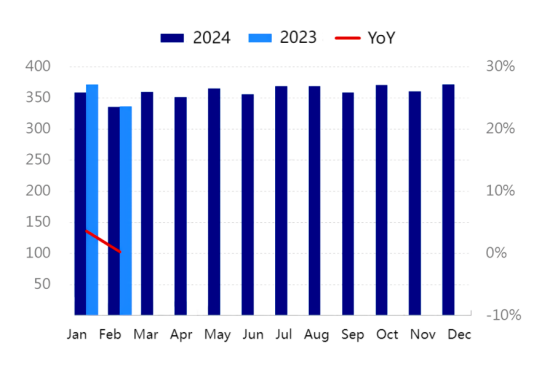

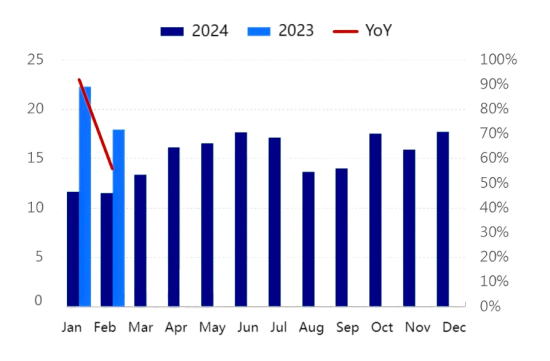

3. Industry Demand Outlook

Figure 3: Monthly Electrolytic Aluminum Production Comparison (2024-2025)

Figure 4: Monthly Anode Material Production Comparison (2024-2025)

Source: Oilchem

Currently, electrolytic aluminum operating rates remain high, but with squeezed anode profits, enterprises are cautious about purchasing high-priced petroleum coke. In the new materials sector, anode material companies are facing profit inversion and primarily producing based on sales orders. Operating rates remain around 70%, and procurement of high-priced petroleum coke is limited to essential demand.

Conclusion

Overall, the petroleum coke market remains sluggish, with limited support from the demand side. Inventory levels offer some resistance to further price drops, but market participants continue to take a wait-and-see approach toward high-priced petroleum coke.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies