【Calcined Petroleum Coke】Market Weak and Stable; Low-Sulfur Prices Face Further Downward Pressure

【Calcined Petroleum Coke】Market Weak and Stable; Low-Sulfur Prices May Face Further Downward Pressure

Market Overview

As of May 19, the average national price of calcined petroleum coke stood at RMB 3,088/ton, unchanged from the previous working day. Currently, the market for low-sulfur CPC shows weak sales performance, with limited cost support and scarce electrode purchasing orders from downstream. Producers are under pressure, and transaction prices remain at low levels. In contrast, the medium- and high-sulfur CPC (Calcined Petroleum Coke) market sees stable trading, with feedstock petroleum coke prices fluctuating slightly and downstream demand holding steady. Most deals are executed at previously agreed prices.

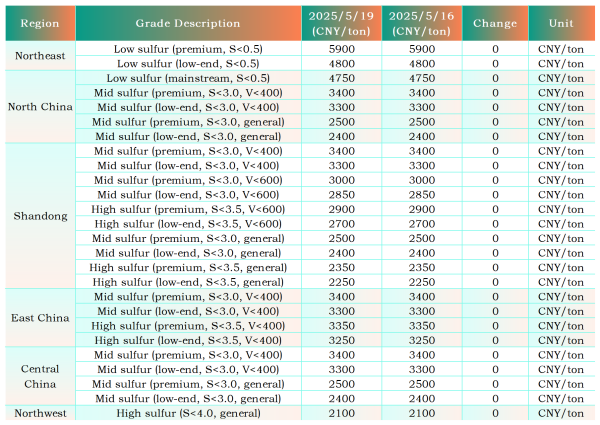

Main Transaction Prices by Region

Low-sulfur CPC (using Jinxi/Jinzhou petcoke): RMB 4,750–5,000/ton

Low-sulfur CPC (using Fushun petcoke): RMB 5,800–5,900/ton (ex-works)

Low-sulfur CPC (using Liaohe/Binzhou CNOOC petcoke): RMB 4,800–5,000/ton

Medium-high sulfur CPC (S 3.0%, no trace element limits): RMB 2,400–2,500/ton cash ex-works

Medium-high sulfur CPC (S 3.5%, no trace element limits): RMB 2,250–2,350/ton cash ex-works

Medium-high sulfur CPC (S 3.0%, V 400 ppm): RMB 3,300–3,400/ton cash ex-works

Supply Conditions

National daily supply of commercial calcined petroleum coke is currently 26,841 tons, with an operating rate of 56.94%, remaining stable compared to the previous working day.

Upstream Market

Petroleum Coke:

Sinopec refineries are maintaining stable pricing. In the Yangtze River region, Hunan Petrochemical is still under maintenance, while Anqing Petrochemical offers stable prices; others ship as needed.

In North China, Yanshan Petrochemical mainly produces medium-sulfur coke and reports smooth sales and low inventory; Tianjin Petrochemical is under maintenance.

In South China, Guangzhou Petrochemical ships as needed, and Beihai Refining is scheduled to restart production on May 25.

CNPC's refineries in Northeast China ship steadily, with Jinxi Petrochemical expected to resume by month-end.

In North China, Dagang Petrochemical's auction on May 16 saw prices drop by RMB 200/ton.

Refineries in Northwest China show stable sales.

CNOOC refineries are shipping based on orders.

Downstream Market

1. Graphite Electrodes:

Producers maintain a wait-and-see stance due to uncertain downstream demand. The electrode market remains fragmented, with a wide range of transaction prices. Weak demand and unstable raw material costs result in most mainstream enterprises holding prices steady. Overall, the graphite electrode market is in a weak and stagnant phase.

2. Aluminum Electrolysis:

Market sentiment cooled due to recent remarks from former President Trump regarding tariffs, along with a narrowing of social inventory drawdowns for aluminum ingots. Spot aluminum prices continue to decline.

3. Anode Materials:

Market feedback indicates lukewarm demand for anode materials. Downstream purchases remain demand-driven, and orders are limited. To secure deals, competition on price remains intense. Current prices linger at low levels, with some companies already operating at a loss, reflecting continued pressure on business operations.

Market Outlook

Low-sulfur CPC sees poor sales and prevalent low-price offers in the market. Prices at higher levels are expected to face further downward pressure. Medium- and high-sulfur CPC prices remain stable as feedstock prices fluctuate narrowly and downstream demand holds firm. A stable price outlook is expected for future shipments.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies