【Petroleum Coke】 "No Sharp Rise, No Sharp Fall"? Don't Misjudge the Q4 2025 Market!

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】 "No Sharp Rise, No Sharp Fall"? Don't Misjudge the Q4 2025 Market!

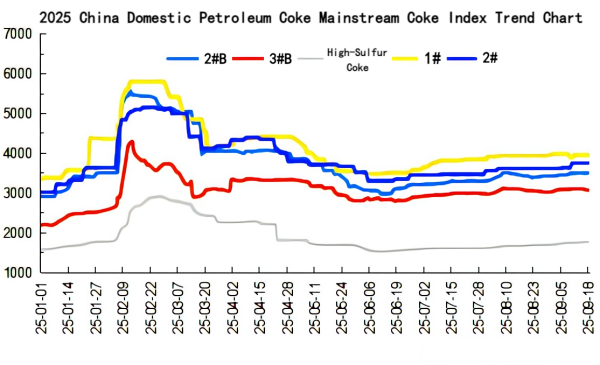

In the third quarter of 2025, China's petroleum coke market showed a clear structural divergence during the traditional "Golden September and Silver October" peak season: low-sulfur petroleum coke prices rose strongly, while medium- and high-sulfur petroleum coke prices were under pressure. This divergence mainly stemmed from structural changes in downstream demand, competition from imported resources, and differences in cost support. In Q3 2025, petroleum coke prices experienced significant fluctuations, with particular attention paid to the performance during the traditional "Golden September and Silver October" peak season.

Entering July, market prices continued some of the previous trends, overall remaining in a relatively stable range, but signs of price divergence appeared in certain regions. Some major refineries adjusted petroleum coke pricing based on their production arrangements and market expectations. Local refineries, due to differences in cost structures and sales strategies, also showed varying degrees of price fluctuations. In August, price volatility intensified. However, not all companies experienced price declines—some, thanks to resource advantages and market positioning, managed to keep prices relatively stable, with even slight increases. By September, as the traditional peak season of "Golden September and Silver October" arrived, the market atmosphere shifted. Major refineries gradually raised petroleum coke prices, while local refineries saw improved sales, leading to upward price fluctuations.

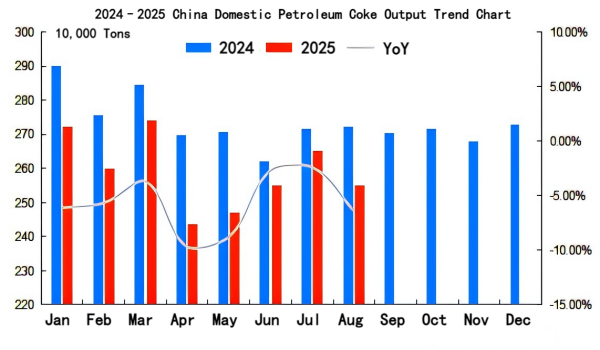

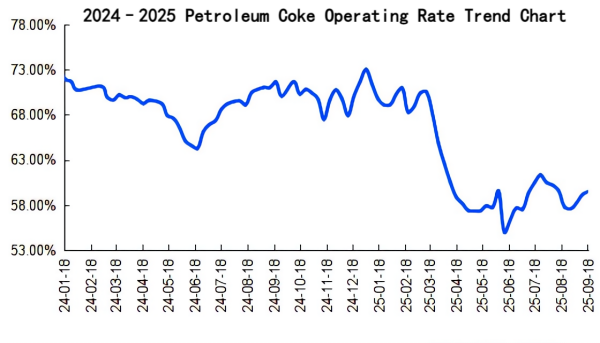

From the perspective of domestic supply, in Q3, under the continued constraints of the "dual-carbon" policy and adjustments to fuel oil import tariffs, refinery coking unit operating loads remained sluggish. Some refineries, faced with rising raw material costs and shrinking profit margins, chose to reduce coking unit operating rates or even conduct phased shutdowns for maintenance. According to relevant statistical data, from January to June 2025, China's cumulative petroleum coke output reached 15.516 million tons, down 6.09% year-on-year. Although specific output data for July–September has not yet been fully counted, based on refinery operating conditions, production in Q3 is estimated to have continued the declining trend of the first half of the year.

On the import side, petroleum coke imports in Q3 2025 remained at a high level, particularly with large arrivals of petroleum coke from the United States. Imported resources mainly impacted the medium- and high-sulfur petroleum coke market, exerting downward pressure on domestic medium- and high-sulfur coke prices. In Q3, port inventories of petroleum coke showed a "high before low" trend. In July–August, major port petroleum coke inventories continued to accumulate, while earlier import trade losses still had lingering effects. Port inventories of low-sulfur sponge coke were quickly consumed. Although general-purpose petroleum coke from Russia and other suppliers maintained a certain level of arrivals, overall inventories still showed a downward trend, especially with significant reductions in medium- and low-sulfur petroleum coke stocks. By September, with increased downstream procurement, inventories further declined but remained relatively high compared with historical levels for the same period.

On the domestic demand side, in the traditional consumption peak season, downstream enterprises showed strong procurement enthusiasm. The anode materials industry maintained high prosperity, with robust demand for low-sulfur petroleum coke. The "Golden September and Silver October" sales season for new energy vehicles boosted power battery demand, providing strong support for low-sulfur petroleum coke. The prebaked anode–electrolytic aluminum industry chain showed steady demand. Although electrolytic aluminum prices remained high, the issue of overcapacity in the prebaked anode industry persisted, leaving enterprises with thin profits. As a result, their petroleum coke procurement remained mainly on a just-in-need basis, with high sensitivity to prices. The carbon sector showed relatively weak demand, with limited growth in demand for graphite electrodes and other carbon products, thus restricting petroleum coke procurement.

The divergence seen in the petroleum coke market in Q3 2025 not only reflects the current supply–demand landscape but also signals the future direction of the industry. Looking ahead, the Q4 petroleum coke market is expected to continue this divergence: low-sulfur petroleum coke prices are likely to remain firm, supporting high price levels, while medium- and high-sulfur petroleum coke prices will remain under pressure. Competition from imported resources and weak downstream demand will continue to suppress price increases. Overall, market fluctuations are expected to narrow, with a low probability of sharp rises or falls. Market participants must deeply understand these structural changes and adjust business strategies in time to seize opportunities and achieve sustainable development in this complex and dynamic market environment.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies