【Coke】Coal down 5%, Petroleum Coke up 1%! Amid the Russia–Ukraine–U.S.–Venezuela ...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Coke】Coal down 5%, Petroleum Coke up 1%! Amid the Russia–Ukraine–U.S.–Venezuela geopolitical game, the discount of petroleum coke narrows by 20%

Oil Market Analysis

The U.S. Energy Information Administration (EIA) stated that the situation in Venezuela, negotiations over the Iran nuclear deal, and Ukraine's continued attacks on Russian oil facilities have all led to a premium in Brent crude prices, while the market is actually in a state of oversupply. Its reasonable price level may be below USD 60/barrel.

The Organization of the Petroleum Exporting Countries and its partners (OPEC+) will re-evaluate the baseline calculation method and have temporarily kept production cuts unchanged. The European Union has decided to ban imports of Russian natural gas and oil starting in 2027 and 2028 respectively. Despite multiple sanctions, Russian natural gas still accounts for 12% of EU imports. Whether these sanctions will continue if a peace agreement is reached on the Ukraine issue remains to be seen. Influenced by geopolitical factors, oil prices remain fluctuating within the range of USD 61–67/barrel, with Brent crude stabilizing at USD 63.50/barrel.

For the full year of 2026, prices at the Dutch Title Transfer Facility (TTF) gas hub are down 15% to EUR 26.50/MWh, while EU gas inventories have fallen to 73%, still below the levels of the past two years over the same period. Brannvoll ApS forecasts that the Brent crude trading range in 2026 will shift lower to USD 55–80/barrel, with an average of USD 68/barrel.

Coal Market Analysis

In the absence of concrete positive news, coal prices edged lower. Russia continues to supply discounted coal to the market, while Colombian coal exports have declined. Although some Australian ports experienced brief production disruptions due to protests, these did not have a material impact on the market.

India's domestic coal output has increased, while China reduced coal imports in autumn. Together, these factors have led to weaker demand in the international seaborne coal market, keeping coal prices at low levels during November–December.

For the first quarter of 2026, the API2 Index / front-quarter (FQ) contract fell 5% quarter-on-quarter to USD 96.50/tonne, with an expected trading range of USD 95–102/tonne. The full-year 2026 API2 Index contract is down 5% to USD 99/tonne. The API4 Index / front-quarter contract for Q1 2026 fell 2% quarter-on-quarter to USD 91/tonne, with a short-term expected trading range of USD 90–98/tonne.

Brannvoll ApS forecasts that in Q1 2026, the API2 Index contract will trade within USD 85–115/tonne, with an average of USD 100/tonne, while the API4 Index contract will trade within USD 80–105/tonne.

Petroleum Coke Market Analysis

Petroleum coke FOB prices remained stable, but discounts narrowed slightly due to the decline in coal prices. Producers along the U.S. Gulf Coast reduced supply, offsetting the impact of year-end inventory drawdowns and lower purchasing volumes from Chinese and Turkish buyers.

Freight rates in the petroleum coke market have been highly volatile, but this has not affected the stability of FOB prices. Venezuelan petroleum coke exports may remain on hold, leading to reduced supply of 4.5% sulfur petroleum coke. The price spread between 4.5% sulfur and 6.5% sulfur petroleum coke remained at USD 6/tonne.

The FOB contract price for 6.5% sulfur petroleum coke from the U.S. Gulf Coast rose 1% month-on-month to USD 69.00/tonne, with the discount to the API4 Index narrowing to 39%. The CFR ARA contract price for 6.5% sulfur petroleum coke from the U.S. Gulf Coast to Amsterdam–Rotterdam–Antwerp remained flat month-on-month at USD 96.00/tonne, with the discount further narrowing to 20%.

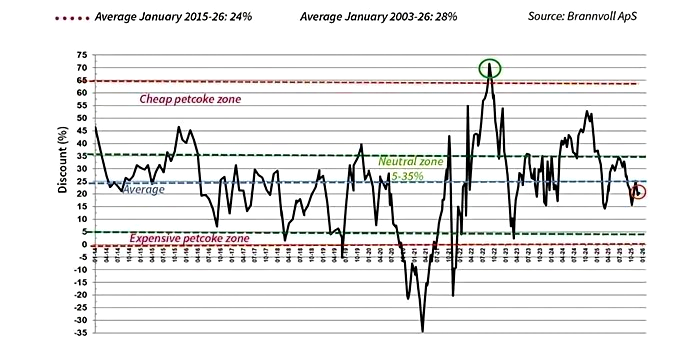

The discount of petroleum coke relative to coal, based on the API2 Index (6,000 kcal), U.S. Gulf Coast 6.5% sulfur petroleum coke, and CFR prices to Amsterdam–Rotterdam–Antwerp, stood at 25% as of December 2025.

The FOB contract price for 4.5% sulfur petroleum coke from the U.S. Gulf Coast rose 1% month-on-month to USD 75.00/tonne, with a discount of 34% to the API4 Index. The CFR ARA contract price for 4.5% sulfur petroleum coke rose 1% month-on-month to USD 102.00/tonne, with the discount narrowing to 15%.

Brannvoll ApS expects that in 2026, the trading range for 6.5% sulfur petroleum coke at Amsterdam–Rotterdam–Antwerp will be USD 85–105/tonne, with an average of USD 95/tonne and a discount of 25%.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies