Petroleum coke semi-annual report

Petroleum coke semi-annual report:

Riding the wind and waves to a new high in the first half of the year, and making further efforts in the second half of the year!

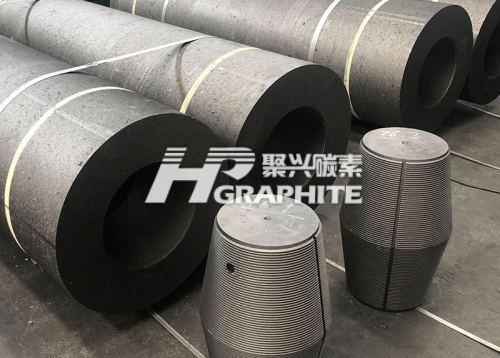

In the first half of 2022, petroleum coke rose strongly under the help of many aspects. At the beginning of the year, the Winter Olympics helped petroleum coke "ride the wind and waves". Subsequently, some refineries in China were overhauled, and aluminum prices remained high. Graphite electrode produced from petroleum coke is used for smelting electric furnace steel with excellent performance. Under the positive effect of supply and demand, petroleum coke hit another record high. In the second half of the year, influenced by economic environmental factors such as the Federal Reserve's interest rate hike, petroleum coke may face a test.

1. Petroleum coke market analysis

From January to June 2022, the overall petroleum coke market maintained a strong trend. From January to June 2021, petroleum coke average price in China was 4726.1 yuan/ton, an increase of 2676.1 yuan/ton or 130.54% over the average price from January to June 2021. To be specific, affected by the Winter Olympics in early 2022, the overall operating load of domestic refineries was relatively low, and the supply of petroleum coke resources was limited. In addition, the downstream maintained good demand, and petroleum coke kept rising. From April to early May, some domestic refineries ushered in the overhaul plan. At this time, the aluminum price has been fluctuating on the 20000 line, and petroleum coke has moved to a new height on this basis. After late May, due to the strong rise of petroleum coke, the capital situation of downstream carbon enterprises was difficult, the concerns about high price petroleum coke intensified, and the willingness to buy was weak. Petroleum coke began to stop rising and turn to falling, opening a wide-ranging shock trend.

2. Petroleum coke production analysis

From January to June 2022, China's petroleum coke production was 12.7784 million tons, a decrease of 6.29% compared with the same period last year. The reasons for the decline include that petroleum coke production was in a positive trend due to the refined oil market last year, petroleum coke, as a by-product, the output was correspondingly high. In addition, this year, the refining profit and overall operating load are low, resulting in a low output of petroleum coke.

3. Petroleum coke import analysis

From January to May 2022, the total import volume of petroleum coke was 5,503,200 tons, an increase of 420,200 tons or 8.23% compared with January to May 2021. The import volume of petroleum coke maintained an overall upward trend from January to May 2022, and the import volume was relatively low in February and March due to special factors; Petroleum coke imports in April increased by about 600,000 tons compared with March, mainly due to the maintenance of domestic refineries and the tight supply of petroleum coke. In April and May, domestic petroleum coke resources were still relatively tight, and the import volume was basically flat.

From the perspective of import sources, the petroleum coke import sources from January to May 2022 are mainly the United States, a country in the Americas, Canada, a country in Europe, Saudi Arabia, Canada, etc., of which the United States still accounts for the largest proportion of 48.23%, a country in the Americas ranks second, accounting for 8.95%, and a country in Europe and Saudi Arabia account for an equal proportion of 6.85% and 6.20% respectively.

4. Petroleum coke export analysis

From January to May 2022, the export volume of petroleum coke was 82,700 tons, a decrease of 65000 tons or 44% from January to May 2021. From January to May 2022, the export volume of petroleum coke showed an overall downward trend. From January to February, the export volume of petroleum coke was basically flat at about 20,000 tons.From March to April, domestic petroleum coke resources were in short supply, and the export volume continued to decline, falling to a low of about 3000 tons in April. In May, with the resumption of domestic inspection and refining plants, the supply of petroleum coke gradually recovered and the export volume increased.

From the perspective of export consumption places, the petroleum coke exporting countries from January to May 2022 were mainly India, Japan, South Korea, Vietnam, etc., of which India accounted for the largest proportion of 45.36%, which was basically the same as that from January to May last year. Japan ranked second, accounting for 27.93%, South Korea accounting for 15.83%, and Vietnam accounting for 10.34%.

5. Petroleum coke apparent consumption analysis

From January to May 2022, the apparent consumption of China's petroleum coke was 16.2068 million tons, an increase of 0.34% over the same period last year. The main reason is that the import volume in 2022 increased significantly compared with last year, and the export volume also decreased accordingly. The above factors led to an increase in apparent consumption year-on-year.

6. Comparative analysis of Petroleum coke and electrolytic aluminum price trend

In the first half of 2022, with the electrolytic aluminum strong market, stimulated by many factors, petroleum coke price rose all the way.In the first half of this year, electrolytic aluminum was supported by terminal demand. Electrolytic aluminum enterprises are profitable, maintain a high operating load, which have strong support for the demand.

7. Market outlook

Domestic supply side: In the second half of the year, the international crude oil price is still difficult to shake off the trend of shock and weakness. Concerns about the decline in oil demand caused by the economic recession continue to grow, and the slowdown in economic growth in the euro zone and the United States has masked concerns about supply uncertainty, which has become a key factor leading to the recent decline in oil prices.

The wait-and-see sentiment in the domestic refined oil market will continue to be strong. In addition, although domestic gasoline demand is relatively strong, the current situation of weak diesel demand is difficult to improve. Therefore, it is expected that the operating load of coking unit will be restricted in the second half of the year, and the domestic petroleum coke supply is difficult to increase significantly.

Import supply side: Except for the relatively low price of the long-term association, most of the external prices are overall at a high level in general. Coupled with the strong demand in India and Europe, the overall imported coke quantity will be difficult to reach a high level in the second half of the year, and the actual impact on domestic coke will be limited.

Demand side: As the Federal Reserve enters the cycle of raising interest rates and shrinking its balance sheet, the profit of electrolytic aluminum gradually decreases with the decline of electrolytic aluminum price. In the second half of the year, electrolytic aluminum enterprises may operate around the edge of profit and loss. However, with the national 12 trillion stimulus plan, the domestic economy will be strongly supported, and the operating capacity of electrolytic aluminum may still increase. Electrolytic aluminum production is expected to remain high in the second half of the year. Anode materials are still in production stage, with the new round of stimulation of new energy vehicles and digital products, the demand for petroleum coke remains good.

Related products: In the thermal coal market, in terms of supply, China's coal output remains at a high level. Mainstream coal mines continue to pay attention to long-term cooperation and ensure the supply of resources, and the incremental space of coal market is relatively limited; In terms of demand, it is expected that the peak summer and the macro-economy will improve, and the demand will increase compared with the current situation, forming a certain support for the market. Overall, in the second half of 2022, the coal market will still be supported, or there will be a boom in supply and demand, but at the same time, we still need to pay attention to policy regulation.

In terms of comprehensive supply and demand side and related products, from the supply side, the overall second half of the year, domestic petroleum coke production and imports are difficult to increase significantly. From the demand side, the production capacity of electrolytic aluminum and anode materials is still high, and the demand for petroleum coke raw materials remains stable. The supply and demand of related products and the thermal coal market are booming.

In the context of the game between domestic and foreign economic condition, in the second half of the year, the downstream industry maintained a good demand for petroleum coke. However, with the intensification of the impact of the Fed's interest rate hike, if the high price level of electrolytic aluminum is gradually reduced, petroleum coke price is difficult to maintain high, however, it is not realistic for petroleum coke to fall back to lower prices under strong supply and demand. It is suggested that all parties should also take risk control as the primary task, followed by profit. Contact us for more petroleum coke market analysis and forecast.

No related results found

0 Replies