【Petroleum Coke】Favorable Demand from Downstream, Continued Mild Market Fluctuations

【Petroleum Coke】Favorable Demand from Downstream,

Continued Mild Market Fluctuations

Starting in September, domestic petroleum coke supply in China has gradually recovered, and there has been a noticeable reduction in imported coke volumes and inventory levels. As a result, the petroleum coke market has reached a relatively balanced supply and demand situation. Traders and some end-user enterprises have adopted a cautious approach, while refineries have actively reduced inventory and increased sales volume. The petroleum coke market has once again entered a phase of stable consolidation, with transaction prices remaining largely stable with minor fluctuations.

As the third quarter gradually comes to a close, a new round of order plans from the demand side is expected to provide a positive boost to petroleum coke market shipments. Therefore, the petroleum coke market is likely to continue to maintain relatively stable trading.

Data Source: Oilchem

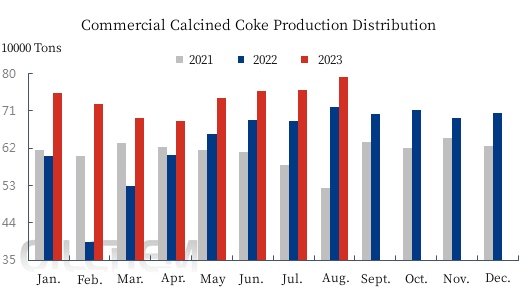

According to market research, as of the end of August, China's total production capacity for calcined petroleum coke for industrial use is approximately 14.4 million tons. Low-sulfur calcined petroleum coke accounts for 13.47% of the production capacity, mainly concentrated in the Northeast region. Meanwhile, medium to high-sulfur calcined petroleum coke represents 86.53% of the production capacity, with a higher concentration in the East and North China regions. From January to August, China's commercial calcined petroleum coke production reached 5.95 million tons, showing a year-on-year increase of 22.14%. In August alone, commercial calcined petroleum coke production reached 760,200 tons, marking the highest monthly production volume in nearly three years, with a 4.08% month-on-month increase and a 10.21% year-on-year increase.

Data Source: Oilchem

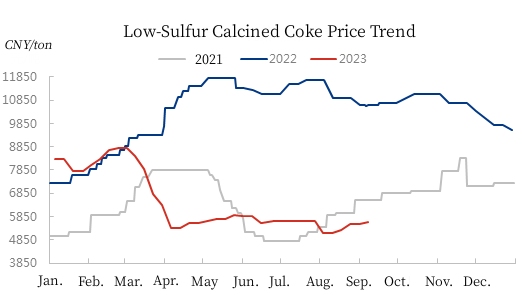

Driven by continuously rising raw material prices, the low-sulfur calcined petroleum coke market has seen price increases. Calcined petroleum coke made from Jinxi raw coke is priced in the range of 5,000 to 5,300 CNY/ton, while calcined petroleum coke made from Fushun raw coke is priced at around 6,060 CNY/ton. The steel carbon market remains supportive, and there has been a slight increase in profit margins for low-sulfur calcined petroleum coke. In the third quarter, the operating rate of electric arc furnaces for steelmaking has consistently remained above 70%, with strong market activity in the graphite electrode industry driving shipments of low-sulfur petroleum coke.

Data Source: Oilchem

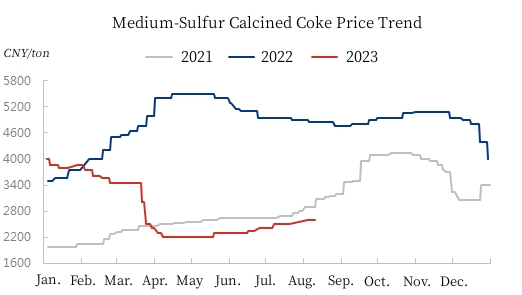

The supply of medium to high-sulfur calcined petroleum coke has increased significantly. However, prices for prebaked anodes, a downstream product, have remained stable. This has led to reduced profit margins for prebaked anode manufacturers and a gradual stabilization of prices. The mainstream price for general-grade calcined petroleum coke with 3% sulfur content is 2,650 CNY/ton, while the mainstream price for calcined petroleum coke with 3% sulfur and a vanadium content of 450 PPM is 3,100 CNY/ton. Calcined petroleum coke with 3% sulfur and a vanadium content of 350 PPM is priced at 3,400 CNY/ton. The prebaked anode market has continued to see slight increases in production rates, with capacity in the Southwest region nearly fully utilized. Market demand remains strong. Although some prebaked anode enterprises in Shandong have reported a slight decrease in new orders, overall production rates have continued to rise, driven by favorable demand conditions. Additionally, since September, the operating rate of commercial calcined petroleum coke facilities has continued to rise, and with the ongoing release of additional capacity for negative electrode materials, demand for general-grade calcined petroleum coke has continued to increase, providing support for its shipments.

Market Forecast

In the latter part of September, carbon enterprises have maintained stable production levels, and the terminal market has remained relatively strong. Carbon production enterprises have mostly been operating on scheduled sales contracts, which is expected to keep petroleum coke prices in a state of mild and oscillating fluctuations. Follow us and continue to learn the market operation of petroleum coke.

No related results found

0 Replies