【Petroleum Coke】Market Prices

【Petroleum Coke】Market Prices

Market Overview: On October 23rd, the average price of petroleum coke in China was 2,123CNY/ton, down by 5CNY/ton, representing a 0.24% decrease. The petroleum coke market exhibited overall stability, with steady trading in major refinery operations. Some local high-sulfur petroleum coke refineries saw improved shipments, resulting in a slight increase in petroleum coke prices. Take a look at the recent price trends in the petroleum coke market.

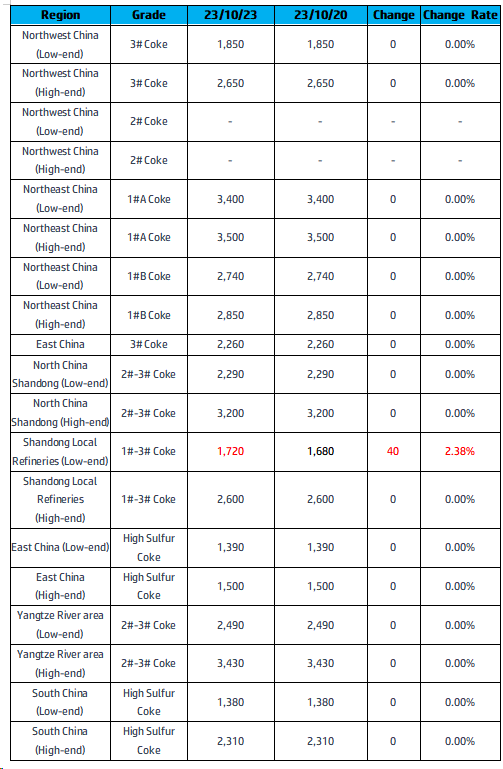

Key Regional Market Transaction Prices:

Regarding Sinopec, the overall trading of petroleum coke in its refineries remains stable. In the North China region, Yanshan Petrochemical has relatively reduced its supply of petroleum coke, resulting in fewer shipments. Refineries in Shijiazhuang and Cangzhou are maintaining stable shipments, and Tianjin Petrochemical's self-use quantity remains steady, with acceptable trading. Sinopec's refineries in the Northeast are primarily focused on maintaining stability in trading, with Liaoyang Petrochemical holding a bid for petroleum coke. Refineries in the Northwest maintained stable pricing and shipments with low inventory levels. China National Offshore Oil Corporation (CNOOC) continues to sell based on orders.

Regarding local refineries, currently the petroleum coke market remained generally stable. Some refineries adjusted their prices, and with the continuous decline in previous coke prices, high-sulfur petroleum coke refineries have seen a modest increase in shipments with prices rebounding by 30-100 CNY/ton. Trading of low and medium-sulfur petroleum coke is ordinary, and prices have temporarily stabilized. However, the downstream enterprise market is performing averagely, with many maintaining just-in-time purchases. Therefore, it predicts that the short-term market for local refinery petroleum coke will continue to exhibit weak stability with slight fluctuations. Market fluctuations: The sulfur content of the old plant of Dongming Petrochemical has decreased to around 1.0%. The sulfur content of petroleum coke from Shandong Haihua has increased to approximately 3.5-4.0%.

Regarding imported coke, there have been relatively few recent arrivals of imported vessels, and many of the arriving vessels have already been presold. The sale of spot sponge coke is under pressure, with the main focus on fulfilling contract deliveries. Demand downstream remains acceptable, and high-sulfur pellet coke is selling well, while low and medium-sulfur pellet coke is trading steadily.

Supply Side: As of October 23rd, there have been a total of seven routine maintenance inspections for coking units nationwide. The daily production of petroleum coke in China is 89,960 tons, with a coking operation rate of 71.11%, marking a 0.24% decrease compared to the previous working day.

Demand Side: The downstream carbon market for aluminum remains stable, with purchases based on demand for petroleum coke. The market for negative electrode materials has relatively weak purchasing sentiment. The graphite electrode industry has limited downstream demand, with the market running steadily, and demand for petroleum coke remains stable. The silicon carbide industry is seeing increased production, and there is no decrease in demand for high-sulfur pellet coke.

Future Outlook: The petroleum coke market is expected to remain relatively stable, with some refineries experiencing improved shipments due to the continuous decline in previous coke prices. However, downstream demand is average, and purchases for petroleum coke are expected to be on an as-needed basis. Therefore,it predicts that the short-term petroleum coke market will exhibit a stable trend with narrow fluctuations, with a range of 20-100 CNY/ton. The market for high-sulfur pellet coke is experiencing supply tightness, and prices are expected to remain on the rise. If you have any more questions or need additional information, feel free to ask.

No related results found

0 Replies