【Petroleum Coke、Calcined Coke】 Price Trends at the End of October 2023

【Petroleum Coke、Calcined Coke】 Price Trends at the End of October 2023

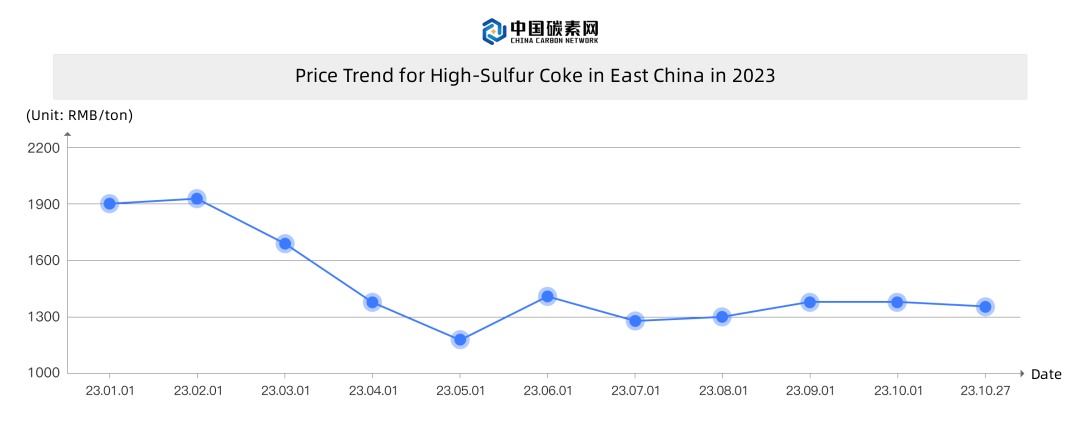

01. Petroleum Coke

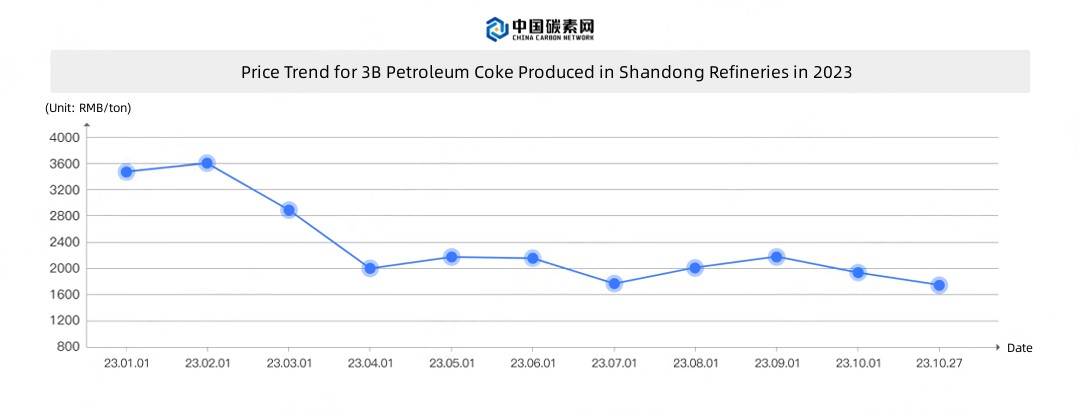

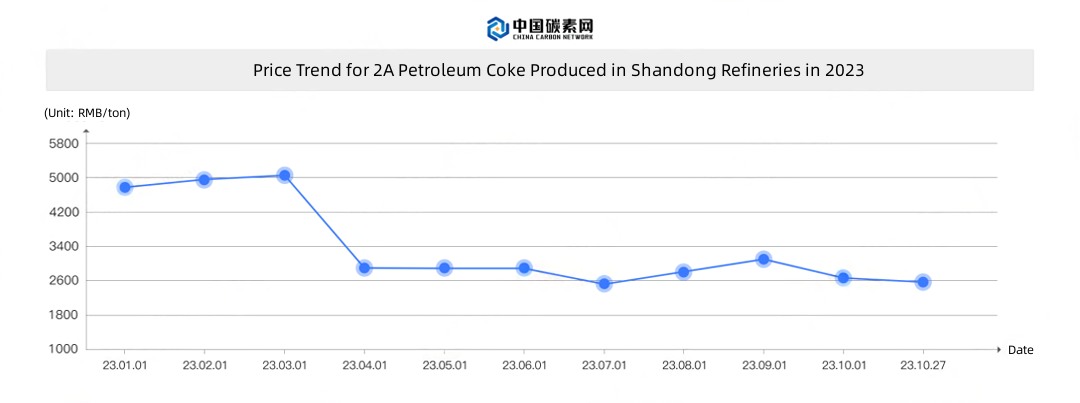

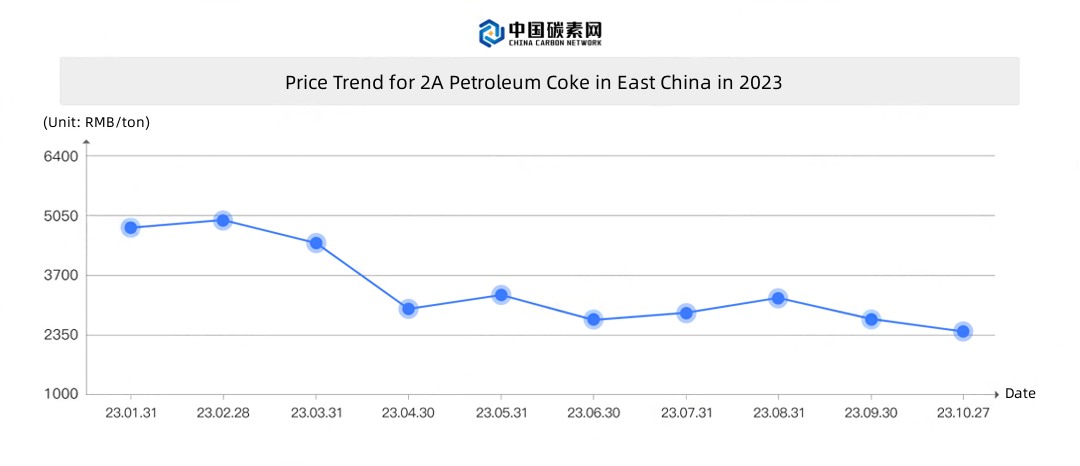

This week (10/23-10/27), China domestic petroleum coke market had moderate trading activity, with refineries making average shipments and coke prices fluctuating. In terms of supply, petroleum coke production was stable, and coupled with port stocks, overall supply was sufficient. However, the demand in the downstream market was weak, leading to a pricing pressure as companies maintained just-in-time procurement approaches.

Key Markets:

Shandong: Prices for domestically refined petroleum coke in the Shandong region fell this week, with low-sulfur prices dropping by 300 RMB/ton. Deliveries of medium and high-sulfur coke were moderate, and market conditions were unfavorable. Overall, the supply of petroleum coke in Shandong was ample, but the lackluster demand from downstream companies, mainly executing long-term contracts, resulted in subdued market activity and lower coke prices. The average prices in Shandong this week were 2360 RMB/ton for 2A coke, 2076 RMB/ton for 2B coke, 2004 RMB/ton for 3A coke, 1722 RMB/ton for 3B coke, and 1875 RMB/ton for 3C coke.

Northeast: The petroleum coke market in the Northeast continued to be weak this week. Some companies adjusted coke prices according to market conditions. Baolai Petrochemical's 4A coke had a new round of auctions with lower starting prices and reduced transaction prices, leading to smooth deliveries. Haoye Petrochemical switched to producing 3.5% sulfur petroleum coke and implemented new pricing, with moderate auction results and average deliveries. Huajin Petrochemical had a new round of auctions, and downstream purchasing enthusiasm improved, resulting in higher transaction prices.

North China: The petroleum coke market in North China had light trading this week. Similar to the Northeast, the market generally adjusted petroleum coke prices. Xinhai Petrochemical actively reduced its inventory, leading to a price drop of 100 RMB/ton, with no pressure on stock levels.

East China: The petroleum coke market in East China had average trading activity this week, with refineries implementing a tender pricing model. Downstream companies had just-in-time procurement, resulting in narrow fluctuations in coke prices.

Central China: The petroleum coke market in Central China had no significant differences from other major regions. Market trading was generally quiet and stable, with refinery coke prices remaining low. Jinao Technology mainly produces 4A-type petroleum coke, and the downstream purchasing enthusiasm was moderate. Refinery coke prices remained stable for export.

Future Predictions:It is expected that in the coming period, petroleum coke prices in the mainstream markets will mainly fluctuate downward. Weak market trading support continues.

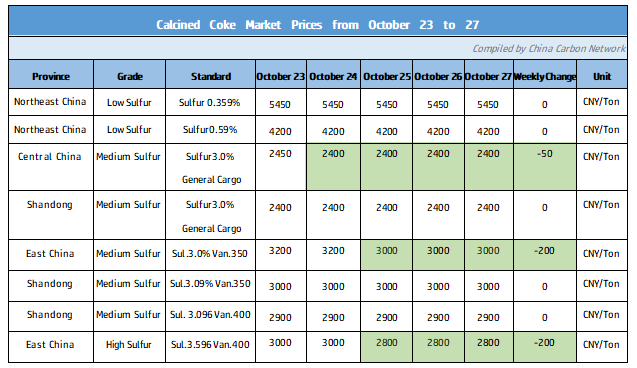

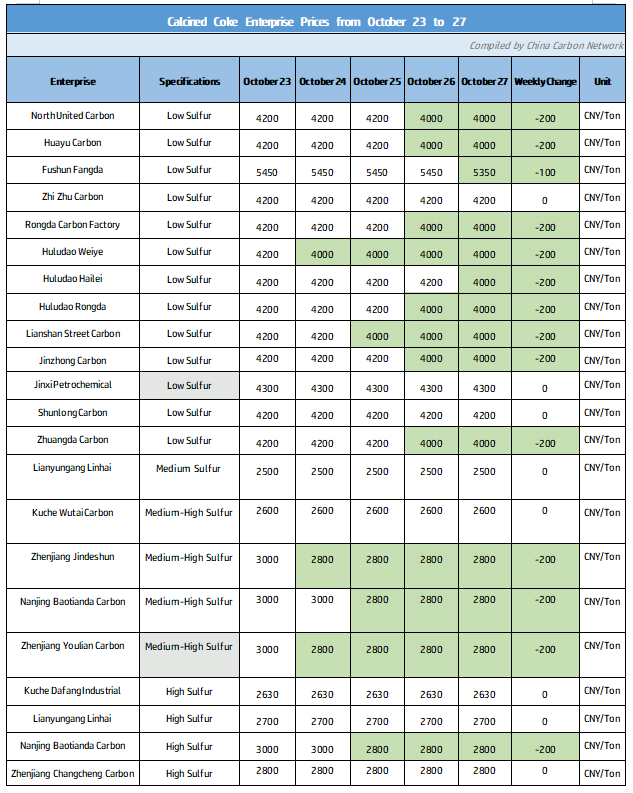

02. Calcined Coke

This week (10/23-10/27), China domestic calcined coke market had moderate transactions, and market prices declined. Most companies did not show significant improvements in deliveries. The enthusiasm for downstream markets to take on goods was low, with most purchasing based on immediate needs. In the downstream market for anode materials, there were pricing pressures, resulting in a somewhat weak market. The graphite electrode market had insufficient willingness for buyers to pick up goods, but overall, the market remained stable. Contact us if you have any inquiries about CPC products.

No related results found

0 Replies