【Petroleum Coke】2023 Chinese Domestic Petroleum Coke Refineries inventory Overview

【Petroleum Coke】2023 Chinese Domestic Petroleum Coke Refineries inventory Overview

Throughout 2023, Chinese domestic petroleum coke market experienced an oversupply situation, with significant fluctuations in the import sources of petroleum coke. Additionally, the frequent adjustments in domestic petroleum coke indicators, influenced by raw material changes, gradually shifted towards high-sulfur general cargo. The market demand was cautious in procurement, resulting in a lackluster transaction atmosphere. Both domestic and imported petroleum coke inventories continued to rise, reaching near-record levels. And product analysis of graphitized petroleum coke, to learn more.

Data Source: Oilchem

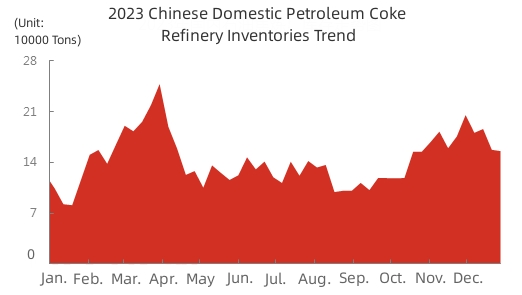

Market research data indicates that by the end of 2023, the inventory of petroleum coke in sample refineries in China was 155,600 tons, a year-on-year increase of 33,500 tons, with a growth rate of 27.44%.

In the first quarter of 2023, petroleum coke inventories in refineries remained in an accumulation phase. Delayed coking unit startups and stable refinery operations, coupled with poor downstream demand, slowed overall refinery shipments. By late March, the inventory reached the annual high of 248,200 tons. Starting in the second quarter, with the recovery of downstream operations and some refineries undergoing planned maintenance in April and May, the domestic supply of petroleum coke decreased, supporting a turnaround in domestic petroleum coke shipments. Refinery petroleum coke inventory remained in the range of 80,000 to 150,000 tons. The second wave of small peak maintenance occurred in the third quarter, and with the cost of high-imported petroleum coke, traders were reluctant to sell, providing a slight advantage for domestic resources. Petroleum coke inventory decreased again to around 80,000 tons. In the fourth quarter, with low-cost imported coke arriving in China, coupled with the impact of shrinking profits for downstream carbon enterprises, purchasing enthusiasm weakened, negatively affecting petroleum coke shipments. Domestic petroleum coke inventory increased slightly again.

Data Source: Oilchem

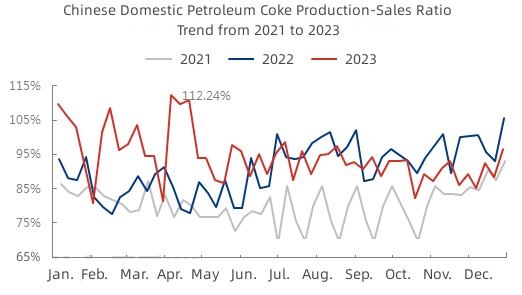

Looking at the petroleum coke shipments from Chinese domestic production in 2023, the average production-sales ratio reached 94.72%, a year-on-year increase of 4.04 percentage points.

As seen in the chart, although downstream procurement slowed down, and the production-sales ratio hit the annual low of 81.46% at the end of March, the overall production-sales ratio for petroleum coke in the first half of 2023 was higher than the same period last year. The weak trading in the petroleum coke market in the first quarter, with prices continuously falling, significantly impacted the overall production-sales ratio, showing a large fluctuation. Starting in the second quarter, as refinery petroleum coke shipments improved with the increase in downstream demand, the production-sales ratio reached a high point in early April, reaching 112.24%. In the second half of the year, overall petroleum coke supply stabilized, and the cautious market entry of demand-side enterprises kept the production-sales ratio around 90%. Approaching the end of the year, with some downstream enterprises stocking up before the holidays and the demand for replenishing inventories after the rain and snow, the production-sales ratio for petroleum coke rose again to above 96%.

Future Market Forecast:

In the opening of 2024, Chinese domestic petroleum coke supply is expected to decrease. Due to the technological adjustments in refineries, monthly production is expected to decrease by 30,000 to 40,000 tons. The purchasing enthusiasm of demand-side enterprises is warming, and mainstream market shipments are good, driving a gradual reduction in petroleum coke inventory. It is predicted that the production-sales ratio of domestic petroleum coke in January will remain around 90%. The rise in domestic coke prices will boost the turnaround of port petroleum coke shipments. For more analysis on port petroleum coke inventory and clearance volume, please feel free to contact us. Feel free to contact us for market forecasts for petroleum coke products in 2024.

No related results found

0 Replies