【EAF Steel】Southwest Electric Arc Furnaces Take a Break, Scrap Steel Slightly Falls

【EAF Steel】Southwest Electric Arc Furnaces

Take a Break, Scrap Steel Slightly Falls

This week, China's domestic construction steel market prices remained relatively stable, with many construction sites entering a phase of suspension or reduced activity. The downstream replenishment enthusiasm is not high, while steel mills express a strong willingness to maintain prices. As of January 18th, the average price of domestic rebar is 3958 yuan, a decrease of 13 yuan compared to the end of last week, and the market has accumulated inventory for five consecutive weeks.

In terms of raw materials, this week, the prices of domestic scrap steel remained stable with a slight decrease. Suppliers increased their shipments, leading to a significant rise in the arrival and inventory of scrap steel at steel mills. However, many traders have planned to gradually take holidays starting from the end of next week, resulting in a noticeable reduction in the supply of scrap steel.

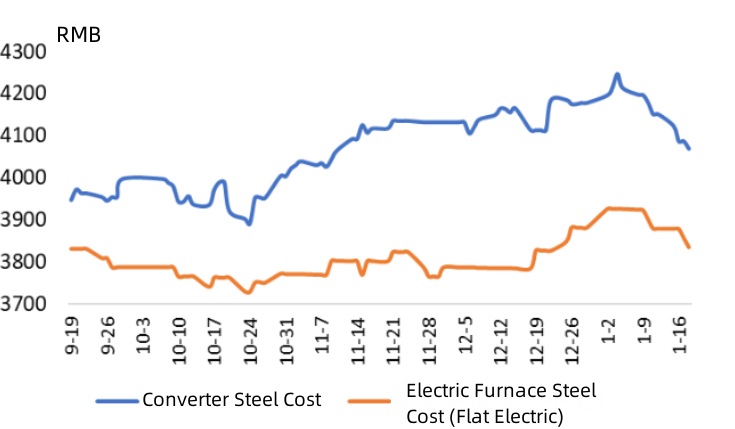

Due to a significant narrowing of profits in the past half month, a few independent electric arc furnace steel mills in Sichuan, Fujian, and Guizhou have started to gradually shut down for the Chinese New Year. The majority of electric arc furnace enterprises also plan to start production shutdowns around January 25th, leading to a continued decline in electric arc furnace steel production.

Although some electric arc furnace steel mills in the southern region still have certain profit margins, considering the significant sales pressure around the Spring Festival, it is reasonable for electric arc furnace steel mills to proactively shut down. From the recent market environment, many long-process steel mills are still facing severe losses. However, in the macro perspective, driven by steel consumption, the steel market continues to stabilize and improve. Steel exports also maintain a relatively high level. Many electric arc furnace steel mills hold a relatively optimistic attitude towards the post-holiday market.

No related results found

0 Replies