【Petroleum Coke】Market Commentary at the End of January

【Petroleum Coke】Market Commentary at the End of January

Market Overview:

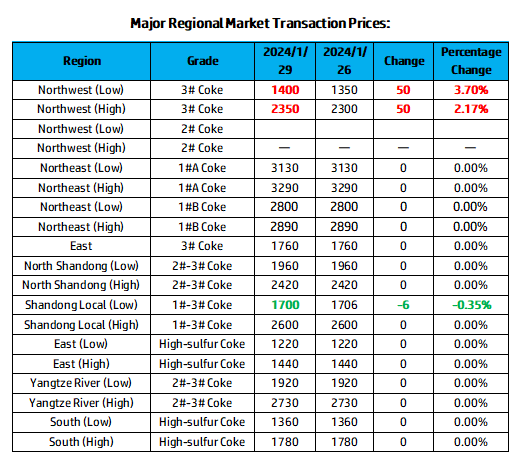

On January 29th, the average price of petroleum coke was 1848 RMB/ton, a decrease of 7 RMB/ton or 0.38% from the previous working day. Currently, the main refinery trading remains stable, and locally refined coke prices are under pressure, decreasing by 10-200 RMB/ton.

Sinopec: Sinopec's refinery petroleum coke inventories are currently at low levels, and downstream deliveries are being fulfilled based on executed orders. In the Yangtze River region, medium-sulfur petroleum coke shipments are still viable. In East China, high-sulfur petroleum coke is well-traded, and in South China, high-sulfur coke transactions remain stable. In North China and Shandong, medium to high-sulfur petroleum coke is smoothly executing orders. In Northwest China, high-sulfur petroleum coke is being shipped without pressure. PetroChina's Northeast petroleum coke market is currently stabilizing shipments, with downstream enterprises having completed pre-holiday raw material reserves, maintaining just-in-time procurement. The petroleum coke market in Northwest China is performing well, with some downstream enterprises starting to stock up as the Spring Festival approaches. Prices in Karamay, Urumqi, and Dushanzi in Xinjiang have seen an overall small increase of 50 RMB/ton. CNOOC's various refineries are currently stabilizing prices and focusing on executing orders.

Local Refineries: From the weekend to the present, the overall shipments of locally refined petroleum coke have been under pressure, with refinery coke prices decreasing by 10-200 RMB/ton. Approaching the Chinese New Year, some local refineries have started to sign orders for the holiday. Combined with the gradual completion of stocking activities by downstream long-distance enterprises, market procurement enthusiasm has decreased, putting downward pressure on petroleum coke market prices. Current market fluctuations: Xintai's southern region petroleum coke has a sulfur content of 2.8%; Haiyou Petrochemical's petroleum coke sulfur content has risen to 4.0%.

Imported Coke: In the imported sponge coke market, shipments are still viable, and traders are actively delivering. The speed of deliveries at ports remains fast. In the shot coke market, demand is stable, and prices are holding steady in transition.

Supply Aspect:

As of January 29th, there are 8 regular maintenance shutdowns for coking units in China. The daily production of petroleum coke in China is 87,858 tons, and the coking plant operating rate is 69.28%, a decrease of 0.01% from the previous working day.

Demand Aspect:

The stocking and replenishment of downstream long-distance aluminum carbon enterprises have basically ended, maintaining just-in-time procurement for petroleum coke. The production sentiment in the negative electrode material market is not optimistic, with a decline in unit operating rates and a low willingness to purchase raw materials. The graphite electrode market is relatively quiet, primarily adopting an on-demand procurement approach for petroleum coke. The demand for high-sulfur shot coke remains in the silicon carbide industry and the southern fuel market.

Future Forecast:

The overall trading performance of the petroleum coke market is average, with cautious acceptance of deliveries by downstream enterprises. The overall market support is limited, and there is a significant downward trend in coke prices. Therefore, it predicts that the main refinery petroleum coke prices will generally remain stable tomorrow, while local refinery coke prices may continue to decline, possibly by around 20-50 RMB/ton. The demand for shot coke downstream remains stable, and it predicts that shot coke prices will continue to hold steady in the short term. Forecast the future market of petroleum coke and its products, communicate with us to learn more.

No related results found

0 Replies