【Graphite Electrode】2023 Market Review

【Graphite Electrode】2023 Market Review

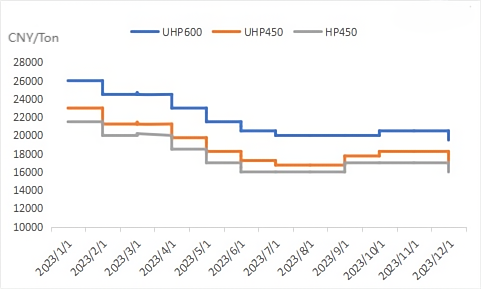

In 2023, the graphite electrode market experienced a situation of weak supply and demand, with the decline in operating rates of short-process steelmaking driving a weakening demand for graphite electrodes. Consequently, graphite electrode prices showed an overall trend of fluctuation and decline, leading to industry-wide losses.

During the first half of the year, as the losses and production restrictions of short-process steel mills increased, the overall sales of the graphite electrode industry were sluggish. Internal competition for orders intensified, leading to low-price competition for resources. Small and medium-sized graphite electrode manufacturers faced intensified losses and were confronted with the possibility of restructuring or halting production. In the latter half of the year, as profits of short-process steel mills increased and their operations gradually expanded, there was a slight increase in demand for large-sized graphite electrodes. Additionally, driven by rising raw material prices, graphite electrode companies actively sought price increases. However, due to overall weak downstream demand and some companies dumping products at low prices, actual transaction prices for graphite electrodes increased only slightly and did not meet expectations.

1. Market Supply – "Production Control" Throughout the Year

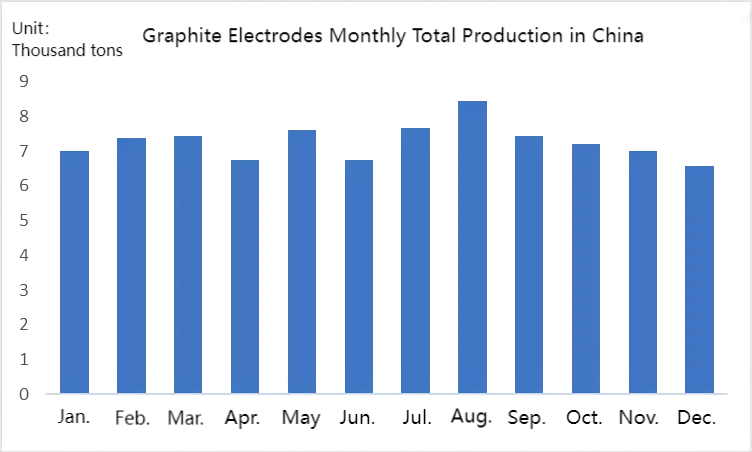

In 2023, with overall market demand continuing to decline, "production control" became the norm for graphite electrode manufacturers. The capacity utilization rate of the graphite electrode industry showed a significant decline. According to statistics, China's graphite electrode capacity utilization rate was 43.5% in 2023, with the annual production volume of graphite electrodes reaching 872,500 tons, a year-on-year decrease of 12.75%. Although the production volume of leading graphite electrode companies remained stable in 2023, the decline in production was more pronounced among some small and medium-sized manufacturers or those with incomplete processes. Despite the significant decline in the production volume of China's graphite electrode industry in 2023, industry concentration continued to increase.

2. Market Demand – Below Expectations, Showing Weak Performance

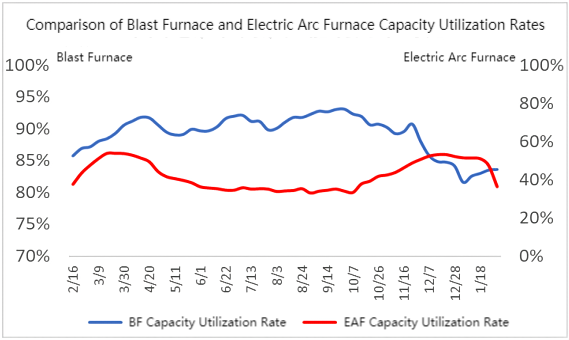

Total graphite electrode demand in 2023 reached 900,000 tons, with the steel industry remaining the main downstream sector for graphite electrodes. From the perspective of graphite electrode demand structure, the performance of China's steel industry in terms of total demand in 2023 was weak, with overall declining profits among steel enterprises. In the first half of 2023, the production volume of electric arc furnace steel in China was consistently suppressed by converter furnaces. In the latter half of the year, due to the continuous rise in the prices of iron ore and coke, and the suppression of scrap steel prices by steel mill output controls, electric arc furnace steel mills began to reap benefits. Production volumes rebounded for 11 consecutive weeks from the fourth quarter, with year-end profits exceeding those of blast furnaces by 100-200 yuan. Feel free to contact us for the 2024 graphite electrode market forecast.

No related results found

0 Replies