【Petroleum Coke】 2024 January-July Petroleum Coke Import Data and Future Market Outlook

【Petroleum Coke】 2024 January-July Petroleum Coke Import Data and Future Market Outlook

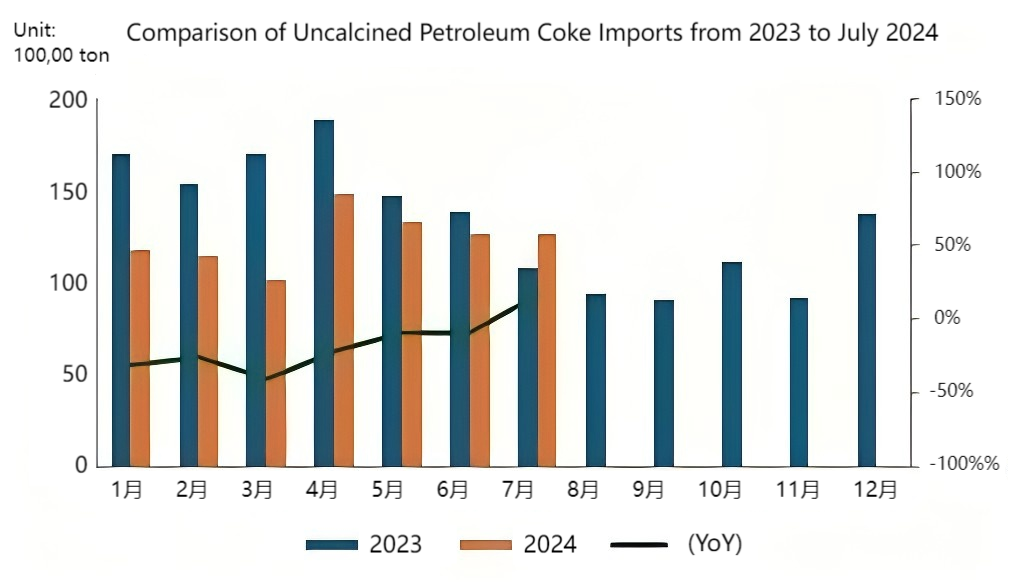

According to customs data, China imported 1.2598 million tons of petroleum coke in July 2024, a month-on-month decrease of 0.14%. From January to July 2024, China imported 8.6721 million tons of petroleum coke, a year-on-year decrease of 19.43%. To learn more about Calcined Petroleum Coke (CPC) Import and Export Market.

From January to July 2024, petroleum coke imports dropped significantly compared to the same period in 2023. The top five sources of imports were the United States, Russia, Saudi Arabia, Canada, and Colombia, with the majority consisting of high-sulfur sponge coke and high-sulfur shot coke.

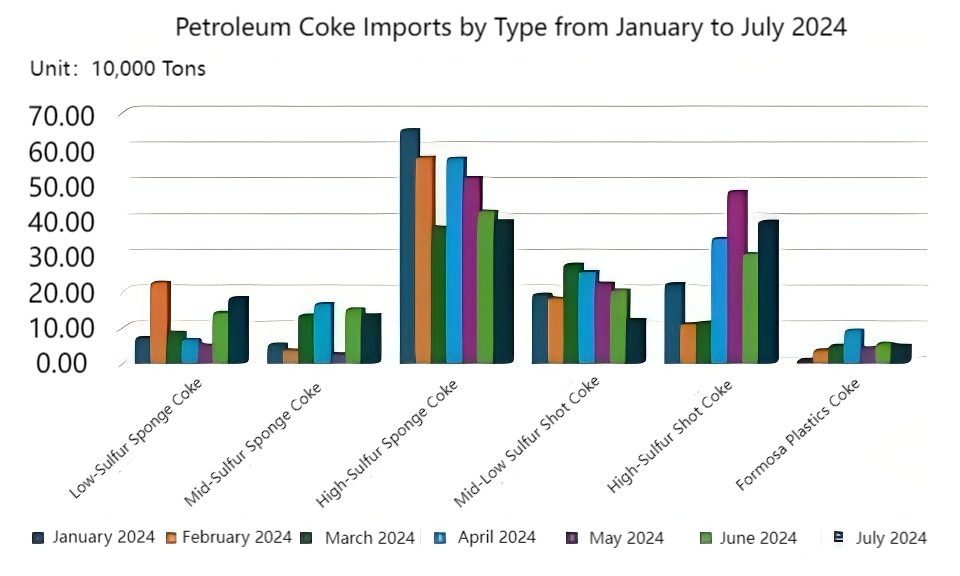

Petroleum coke can be broadly classified by sulfur content and form as follows:

High-sulfur sponge coke: Primarily imported from Russia, the U.S., Kazakhstan, Canada, Saudi Arabia, and Venezuela, accounting for about 40% of total imports.

High-sulfur shot coke: Mainly imported from Saudi Arabia and the U.S., accounting for about 23% of total imports.

Medium-low sulfur shot coke: Primarily from the U.S. and Colombia, making up 16% of total imports.

Low-sulfur sponge coke: Mainly imported from Brazil, Argentina, Indonesia, and Romania, contributing to about 9% of total imports.

Medium-sulfur sponge coke: Sourced mainly from Russia, Kazakhstan, and Kuwait, comprising 8% of imports.

Taiwan Formosa coke: Accounts for about 4% of total imports.

Detailed Analysis by Category:

Low-sulfur sponge coke: Imports surged in February compared to January due to falling international prices and favorable domestic market conditions, leading to increased shipments from Indonesia, Argentina, and Brazil. Imports decreased between March and May, but rose again in June and July, driven by concentrated shipments from Argentina and Azerbaijan.

Medium-sulfur sponge coke: Mainly from the U.S., Kuwait, Russia, Canada, and Kazakhstan. Imports declined in January, February, and May due to high international prices, causing traders to be cautious about purchasing.

High-sulfur sponge coke: Imports fell continuously from January to March. However, in April, Russia ramped up exports to China, and other countries maintained a steady supply. From May, with domestic market weakening and high international prices, imports gradually declined.

Medium-low sulfur shot coke: Demand was strong from the downstream glass industry from January to March, boosting imports. Starting in April, as some glass factories began maintenance, demand weakened, and high prices further discouraged imports.

High-sulfur shot coke: Imports declined sharply in February and March due to high international prices, but from April to July, import volumes remained high.

Taiwan Formosa coke: Imports fell sharply in January due to an unexpected plant shutdown, but volumes recovered in late January. Imports increased significantly in April as Taiwan Formosa’s prices dropped and remained steady in other months.

2024 January-July Petroleum Coke Market Overview

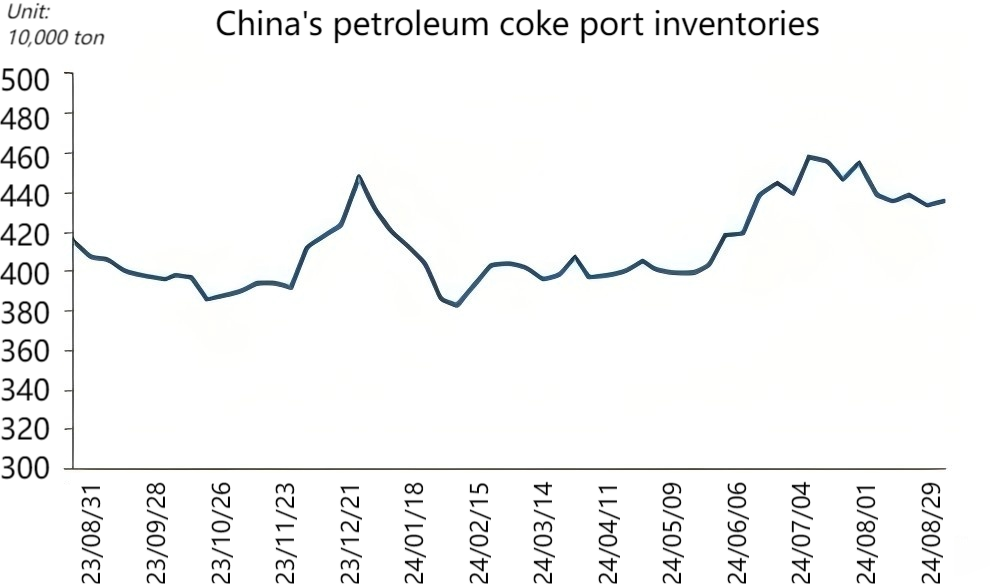

Petroleum coke prices initially rose from January to mid-May before slowly retreating. From January to May, domestic petroleum coke prices climbed, driving active sales of imported coke. Port inventories fluctuated around 4 million tons. From late May, a large volume of imported petroleum coke arrived in the market, increasing supply and causing downstream buyers to adopt a cautious, on-demand purchasing approach. Port inventories began to rise.

In late June, domestic petroleum coke supply grew as previously idled coking units resumed operations. However, downstream demand weakened, especially in the anode material sector, where orders decreased, and the price of silicon metal continued to fall. Although the demand in the carbon materials market remained stable, overall support was limited, and pressure on petroleum coke sales persisted, with port inventories continuing to rise. Starting in August, the volume of imported coke arriving decreased, and although downstream demand remained weak, port inventories began to slowly decline.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies