【Negative Electrode Material】Demand Holds Steady, Market in Wait-and-See Mode

【Negative Electrode Material】Demand Holds Steady,

Market in Wait-and-See Mode

1. Current Focus:

1)BTR expressed that the negative electrode material industry still faces fierce competition, and driving down costs and increasing efficiency is an important measure for companies to enhance their competitiveness. It is expected that there is limited room for further price reductions in the short term for negative electrode materials. In the battery industry, graphitized petroleum coke (gpc) is often used as an negative electrode material.

2)On April 20th, the first production line of the second phase of the lithium-ion battery negative electrode material graphite project of Qinghai Tianlan New Energy Materials Co., Ltd. in Yurun Town, Yudong District, Haidong City officially started production. The first phase of graphite and pre-carbonization processes are also operating at full capacity. The first phase invested 150 million yuan to build a production line with an annual output of 10,000 tons of lithium-ion battery negative electrode material graphite processing; the second phase invested 880 million yuan to build a production line with an annual output of 20,000 tons of lithium-ion battery negative electrode material graphite processing and a supporting production line with an annual output of 30,000 tons of negative electrode materials.

2. Current Market

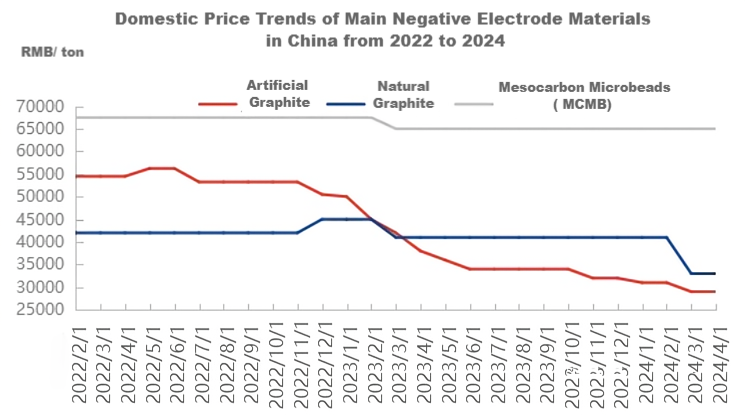

Data Source: Oilchem

Chinese Domestic Negative Electrode Materials Market Prices

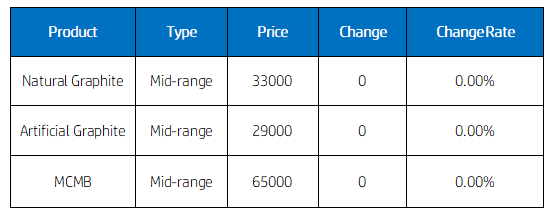

Data Source: Oilchem

For mainstream negative electrode materials, natural graphite is priced at 33,000-37,000 yuan/ton, artificial graphite at 24,000-39,000 yuan/ton, and mesocarbon microbeads (MCMB) at 65,000-70,000 yuan/ton.

3. Current Production & Sales Dynamics

1)Supply: The enthusiasm for production of negative electrode materials is still good, with leading companies maintaining a high level of production and no inventory pressure for the time being.

2)Demand: The focus of demand is on executing previous orders, with battery factories increasing their production schedules.

4. Related Markets

1)Petroleum Coke: Chinese domestic petroleum coke market is stable, with transaction prices largely stable with slight adjustments. In terms of mainstream, sales and production of Sinopec and PetroChina refineries remain stable, with shipments stable and mainly based on executing order contracts, leading to a stable transition in prices.

2)Needle Coke: The current needle coke market is running smoothly, with downstream negative electrode material manufacturers increasing production plans. Needle coke prices are stable for the time being. Mainstream prices for green coke are 4,800-5,500 yuan/ton, and for calcined coke are 6,500-7,800 yuan/ton.

5. Market Forecast

The downstream demand is still good, with new orders being executed, and the significant rebound in demand for power batteries. The supply and demand situation in the negative electrode material market is stable, with market prices temporarily stable in a wait-and-see mode. Feel free to contact us for more information on the lithium battery anode material market.

No related results found

0 Replies