【Petroleum Coke】 Active Inventory Reduction at Ports: What's Next for June Import Coke Market?

【Petroleum Coke】 Active Inventory Reduction at Ports:

What's Next for June Import Coke Market?

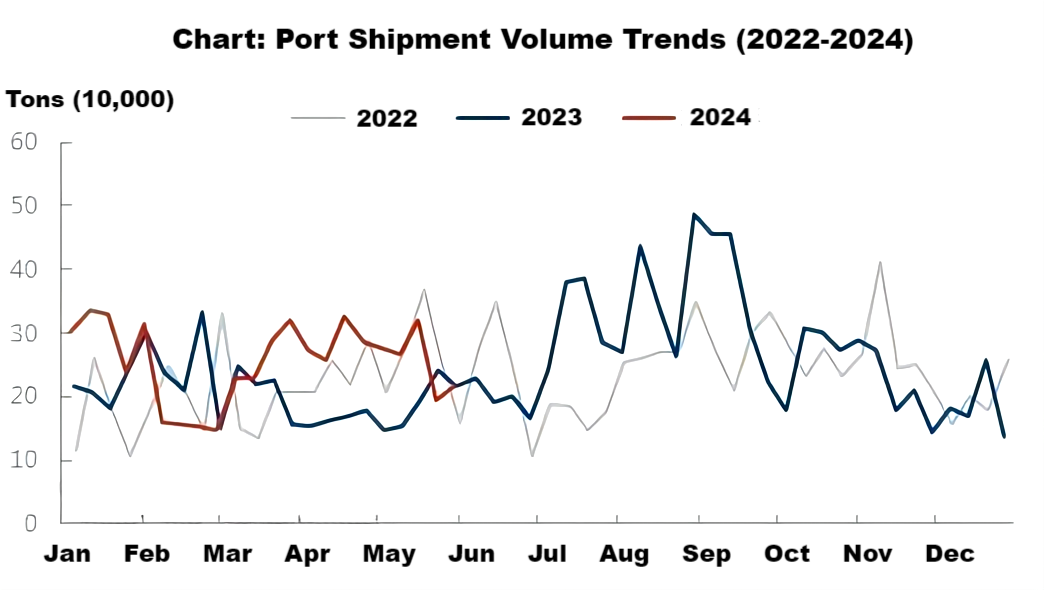

Since the second quarter, the import volume of petroleum coke has significantly increased, with continued arrivals of high-sulfur petroleum coke from the United States and Russia into the domestic market. These imports have a high overlap with domestic resources in terms of specifications. Due to weak domestic market activity and cautious reception by downstream customers, despite active signing and sales efforts by traders, the rate of inventory clearance at ports slowed from late May onwards. With the continuous arrival of petroleum coke into storage, port inventories remain at high levels. To learn more of the Calcined Petroleum Coke Market.

1. Demand Support Limited, Port Inventory Clearance Volume Declines

Source: Oilchem

According to data, as of the end of May, the weekly clearance volume of petroleum coke at major domestic ports was 218,000 tons, a decrease of 24.04% compared to the end of April, and a year-on-year decline of 10.29%.

Currently, demand from silicon enterprises is relatively strong, which could positively affect the clearance of high-sulfur shot coke at ports. However, the performance of Russian petroleum coke, which has similar specifications to domestic coke, is generally moderate due to the impact of the domestic market. The concentrated arrival of Brazilian coke has seen some traders resort to low prices to boost volumes, but this has not effectively supported coke prices. Since late May, the market activity for domestic petroleum coke has been weak, and downstream enterprises have shown limited enthusiasm for procurement. In June, with increased domestic market supply, there is limited room for petroleum coke price increases. The continuous arrival of imported petroleum coke into the domestic market, coupled with weak demand pull, negatively impacts new orders for port petroleum coke.

2. Decline in Import Coke Prices, Port Inventory Remains High

Source: Oilchem

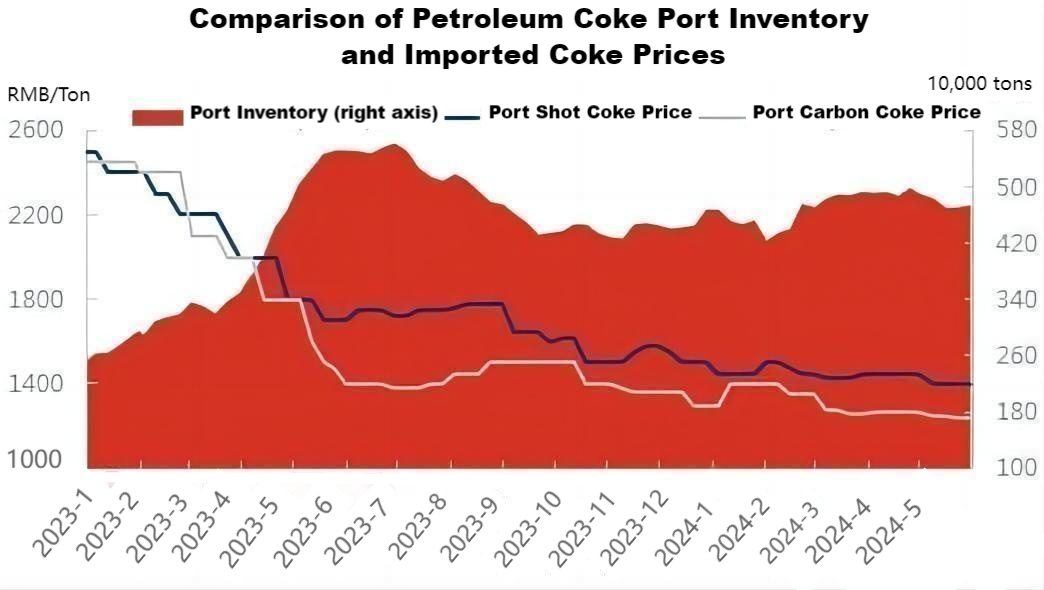

Based on statistical analysis, by the end of May 2024, the total inventory of petroleum coke at major domestic ports was 4.732 million tons, a decrease of 178,000 tons compared to the end of April, and a year-on-year decrease of 14.15% compared to 2023. In terms of port spot prices, due to the continuous decline in domestic petroleum coke prices and weak market entry enthusiasm from the demand side, port spot costs remain high. Compared to domestic resources, the price advantage of port inventory is limited. Some traders, driven by a desire to quickly turn over and recoup funds, have been continually lowering the transaction prices of port spot petroleum coke.

In June, approximately 1 million tons of imported coke are planned to arrive and be stored, predominantly consisting of high-sulfur coke, with the majority expected to be stored at ports in Shandong and South China. The “2024-2025 Energy Conservation and Carbon Reduction Action Plan” has prompted cautious procurement attitudes from end-users such as power plants and cement factories, negatively impacting the sales of high-sulfur fuel-grade imported coke, and exerting downward pressure on fuel-grade petroleum coke prices.

Currently, most carbon-grade petroleum coke is considered standard goods, with some American high-sulfur imported sponge coke containing small amounts of shot coke. Downstream buyers are predominantly cautious, showing limited procurement enthusiasm and leaving little room for transaction price increases.

3. Market Outlook

At present, the trading activity in the downstream carbon market shows no significant improvement, and the fuel sector maintains a short-term cautious attitude. Demand support for imported coke sales is insufficient. In June, a continuous influx of imported coke is expected into the domestic market, with ample supply of domestic resources, perpetuating the market supply-demand imbalance. It is anticipated that port inventory of petroleum coke will show a noticeable year-on-year decline compared to last year, yet the speed of inventory clearance for imported coke remains limited due to the influence of domestic supply and demand. Port inventory is expected to remain around 4.6 million tons. Although the external price of imported petroleum coke remains high, port spot prices will largely follow the trend of domestic market prices, with traders continuing to actively sign contracts and ship goods, leaving room for slight price adjustments.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to assist you wholeheartedly.

No related results found

0 Replies