【Needle Coke】 Application of Needle Coke in Graphite Electrode Materials in China

【Needle Coke】 Application of Needle Coke in

Graphite Electrode Materials in China

Overview of Steel Production Methods

Steel production primarily relies on two methods: blast furnace (BF) and electric arc furnace (EAF). Compared to BF, EAF steelmaking reduces energy consumption per ton of steel by 50%, and significantly decreases solid waste, waste gas, and CO2 emissions by 96%, 78%, and 73% respectively. These energy-saving and environmental benefits make EAF increasingly favored by major steel plants.

Importance of Needle Coke in EAF Steelmaking

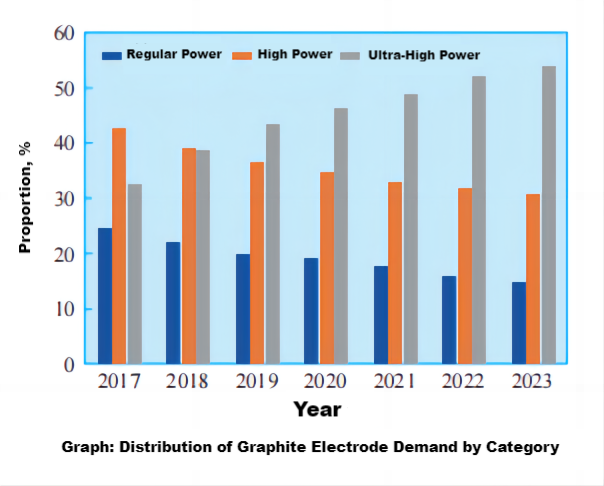

Large EAF steelmaking requires high-power (HP) or ultra-high-power (UHP) graphite electrodes. Needle coke is the preferred raw material for producing UHP graphite electrodes, which offer advantages such as high impact resistance, strength, oxidation resistance, low electrode consumption, and high current density.

Production Process of UHP Graphite Electrodes

UHP graphite electrodes are made using needle coke as the primary aggregate, supplemented by petroleum coke and coal tar pitch. The production process includes raw material crushing, mixing, forming, baking, impregnation, secondary baking, graphitization, machining, and packaging. As the power requirements for graphite electrodes in EAF steelmaking increase, the proportion of needle coke used also rises. In China, needle coke accounts for 100% of the aggregate in UHP graphite electrodes.

Market and Consumption Data

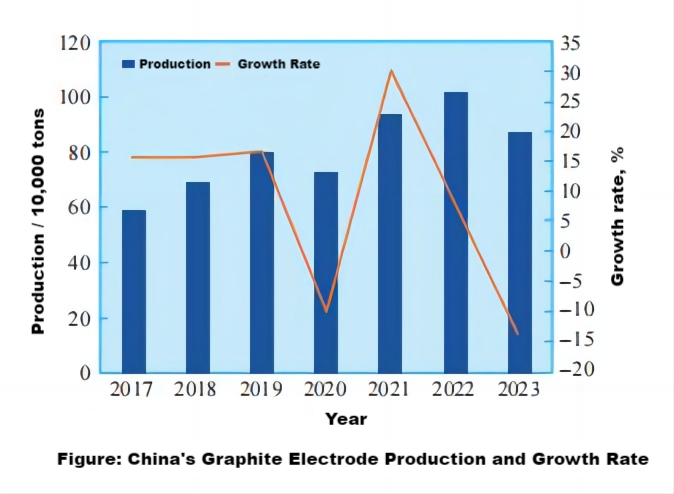

In 2023, China's graphite electrode production was 873,000 tons, down 14.2% year-on-year, mainly due to increased production restrictions and losses in EAF steel plants, which dampened graphite electrode demand. The domestic graphite electrode industry consumed 471,000 tons of needle coke in 2023, with domestic needle coke accounting for 83.2% and imports 16.8%. Within the graphite electrode sector, oil-based needle coke usage is 65%, while coal-based needle coke is 35%. Imported coal-based needle coke, primarily used for UHP graphite electrodes, mainly comes from Mitsubishi Chemical in Japan and PMC in South Korea.

Future Demand and Projections

In 2023, EAF steel production accounted for less than 10% of China's total crude steel output, significantly lower than the global average of 28.9%. According to the "Industrial Field Carbon Peak Implementation Plan" issued by the Ministry of Industry and Information Technology and other departments in 2022, the share of short-process steelmaking is required to reach 15% and 20% by 2025 and 2030, respectively. As the proportion of UHP EAF increases, the demand for UHP graphite electrodes will also rise. Higher EAF power ratings enhance efficiency and cost-effectiveness, increasing the need for larger UHP graphite electrodes and, consequently, more needle coke.

If the target of EAF steel production reaching 15% of total crude steel output by 2025 is achieved, and assuming an annual crude steel production of 1 billion tons, China's graphite electrode demand in 2025 will be approximately 800,000 tons. Based on the requirement of 1.08 tons of needle coke for each ton of UHP graphite electrodes and 0.30 tons for HP graphite electrodes, the expected needle coke demand will be about 650,000 tons.

Feel free to contact us at any time for technical guidance on graphite electrode processes. Our team is dedicated to providing you with in-depth insights and tailored assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies