【Calcined Petroleum Coke】Latest Market Update on September 25: Prices on the Rise!

【Calcined Petroleum Coke】 Latest Market Update on September 25: Calcined Petroleum Coke with Indicator Goods Prices on the Rise!

Market Overview

As of September 25, the average market price for calcined petroleum coke (cpc) was 2135 CNY/ton, remaining stable compared to the previous working day. Currently, the calcined petroleum coke market is running steadily, with low-sulfur calcined petroleum coke prices holding firm. Although downstream market demand remains generally flat, some electrode manufacturers have been stocking up ahead of the holiday, leading to decent sales of low-sulfur calcined petroleum coke recently. The trading environment for medium- and high-sulfur calcined petroleum coke is fair, with a few enterprises in the medium- and high-sulfur segment reporting reduced inventories and slightly raising their quotations. The downstream electrolytic aluminum market for indicator goods is showing stable demand, creating a positive outlook for indicator goods prices, which are trending upward.

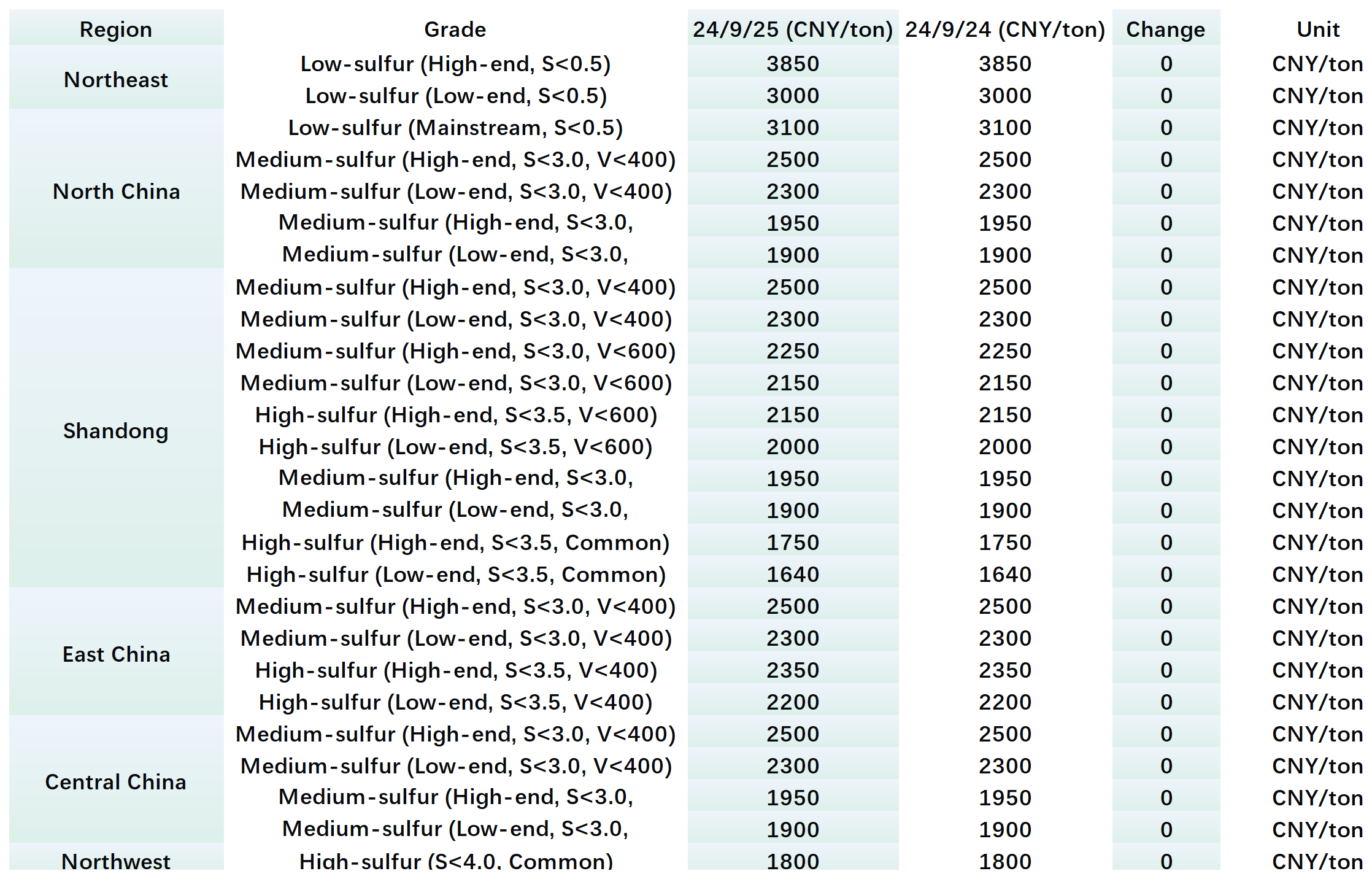

Key Regional Market Transaction Prices

Market Prices

Low-sulfur calcined petroleum coke (using Jinxi and Jinzhou petroleum coke as raw materials): Mainstream transaction price is 3100-3200 CNY/ton.

Low-sulfur calcined petroleum coke (using Fushun petroleum coke as raw material): Factory price is 3500-3850 CNY/ton.

Low-sulfur calcined petroleum coke (using Liaohe and Binzhou Zhonghai petroleum coke as raw materials): Mainstream transaction price is around 2850-3050 CNY/ton.

Medium- to high-sulfur calcined petroleum coke (S<3.0%, no trace element requirements): Previous factory contract price was 1950 CNY/ton (cash); current negotiation prices are 1900-1950 CNY/ton.

Medium- to high-sulfur calcined petroleum coke (S<3.5%, no trace element requirements): Previous factory contract price was 1640-1750 CNY/ton (cash); current negotiation prices are 1640-1750 CNY/ton.

Medium-sulfur calcined petroleum coke (S<3.0%, V<400): Previous contract price was 2400 CNY/ton (cash); current negotiation price remains at 2400 CNY/ton.

Supply

Currently, the daily supply of commercial calcined petroleum coke in China is 26,533 tons, with an operating rate of 62.34%. The supply level has remained stable compared to the previous working day.

Upstream Market

Petroleum Coke: Sinopec's petroleum coke sales remain stable. In the Yangtze River region, Anqing Petrochemical and Hunan Petrochemical mainly supply the anode material market. Wuhan Petrochemical plans to halt production for maintenance starting October 10. Jingmen and Jiujiang's coke for carbon production is selling smoothly. In South China, Maoming Petrochemical's entire production is for internal use, while Guangzhou Petrochemical mainly sells to the 3C market, and Beihai Refinery's production and sales are stable.

Currently, CNPC-affiliated refineries are keeping prices stable. In the Northeast, low-sulfur coke sales are steady, with Liaohe Petrochemical's tender price dropping by 30 CNY/ton yesterday. In the Northwest, refinery output mainly flows to the aluminum and silicon markets, while in South China, Guangdong Petrochemical is currently holding a tender. In the Southwest, Yunnan Petrochemical is mainly producing high-sulfur coke. CNOOC's Huizhou Petrochemical is seeing decent sales, with prices rising by 50 CNY/ton, while other refineries are maintaining stable prices.

Downstream Markets

Graphite Electrodes: The overall trading environment in the graphite electrode market remains weak, with flat downstream demand. Market improvement is not evident, and electrode manufacturers are seeing general sales performance. Low-price resources within the market are disrupting prices at the low end, creating confusion in the trading environment. Most graphite electrode companies are focusing on stable transactions.

Electrolytic Aluminum: Recently, alumina prices have continued to rise on the cost side, and downstream restocking has picked up slightly. Domestic policies are being introduced intensively, stimulating market sentiment and driving a sharp increase in spot aluminum prices.

Anode Materials: The trading sentiment for anode materials has been generally weak this week. Overcapacity issues are becoming more pronounced, and product homogenization is severe, intensifying competition among companies. Additionally, downstream demand has fallen short of expectations, leading to continuous order competition in the market. In general, anode material companies are facing survival pressure from multiple factors, with many adopting a wait-and-see approach.

Market Outlook

It is expected that low-sulfur calcined petroleum coke mainstream prices will remain stable tomorrow. Due to the increase in petroleum coke prices, some quotes for medium- and high-sulfur calcined petroleum coke with indicators may see a slight uptick.

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies