【Petroleum Coke Moderate Supply and Demand Support, Market Downturn Begins in July

【Petroleum Coke Moderate Supply and Demand Support,

Market Downturn Begins in July

In the first half of the year, Chinese domestic petroleum coke market experienced weak trading. Although there was a slight reduction in domestic supply, the continuous arrival of imported coke eased the impact. On the demand side, market participants were cautious due to fluctuating profits around the breakeven point, leading to moderate purchasing activity and weak support for spot petroleum coke shipments. As the second half of the year begins, the petroleum coke market continues to face supply-demand imbalances. Increased caution among downstream buyers has led to further price declines in petroleum coke.

1. Sales Pressure: Petroleum Coke Prices Decline Again in July

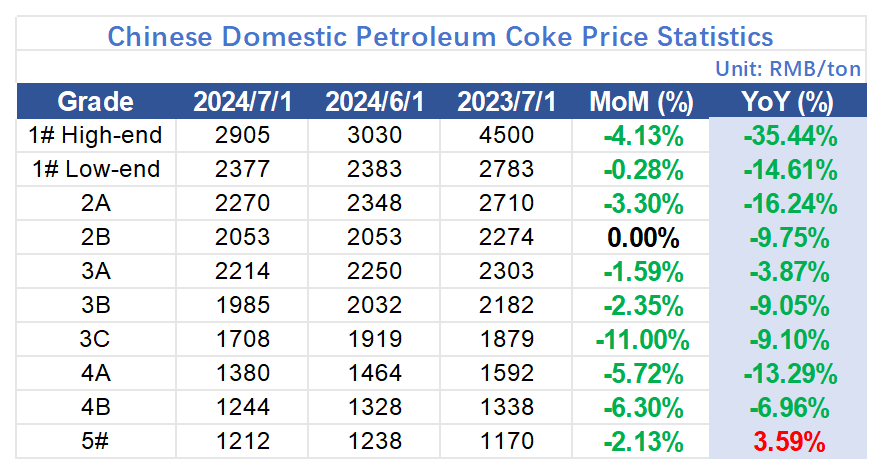

Data source: OILCHEM

According to market price statistics, Chinese domestic petroleum coke prices fell again at the beginning of July, with month-on-month declines of 0.2% to 44% and year-on-year decreases of 3% to 17%.

The low-sulfur petroleum coke market continues to experience weak trading, with refinery transaction prices mainly trending downward. PetroChina's 1# coke price dropped by 100-150 RMB/ton at the end of the month, and July prices are primarily locked in. CNOOC refineries have slowed their petroleum coke shipments, with cautious acceptance in the anode material field, leading to partial price adjustments of 30-70 RMB/ton.

The performance of medium- and high-sulfur petroleum coke shipments varies, with significant impacts on overall petroleum coke prices due to differences in downstream application fields. Medium-sulfur petroleum coke is mainly directed towards the aluminum carbon market, with stable refinery supply. The latest pricing for pre-baked anodes has dropped again, negatively affecting petroleum coke shipments, resulting in further price declines. Demand in the anode storage field remains stable, supporting a 30 RMB/ton increase in petroleum coke prices in the Yangtze River region. High-sulfur petroleum coke shipments are generally under pressure. With the resumption of production in some previously shut-down refineries, the supply of domestic high-sulfur coke continues to increase. Downstream purchasing enthusiasm remains low, with refinery shipments under pressure and prices falling by 2-6% month-on-month.

2. Refineries Resuming Production: Slight Increase in Domestic Supply in July

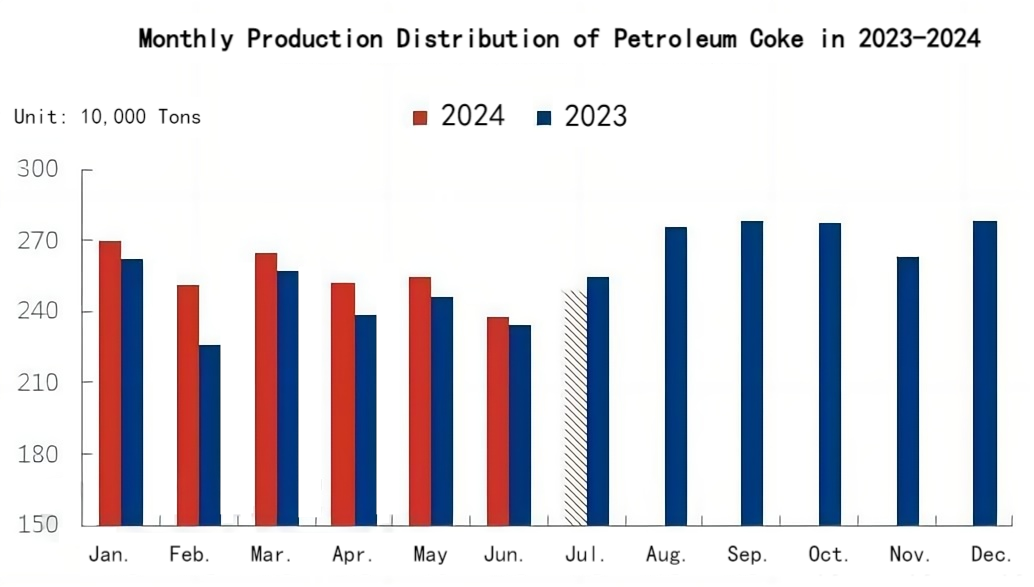

Data source: OILCHEM

According to market research statistics, the total domestic production of petroleum coke in the first half of the year reached 15.51 million tons, an increase of 5.9% year-on-year. With the normal release of production capacity commissioned last year and the non-major overhaul year in 2024, monthly petroleum coke production has been higher than the same period last year.

It is understood that in July, two refineries with a combined capacity of 4.9 million tons are expected to shut down for maintenance, with a maintenance loss of around 56,000 tons. Meanwhile, six refineries with a combined capacity of 8.1 million tons are expected to resume production, with some refineries increasing production. Overall, petroleum coke supply is expected to increase, with monthly production estimated to reach around 2.5 million tons, a month-on-month increase of about 5%.

3. Weak Demand Support: Downstream Operations Expected to Decline

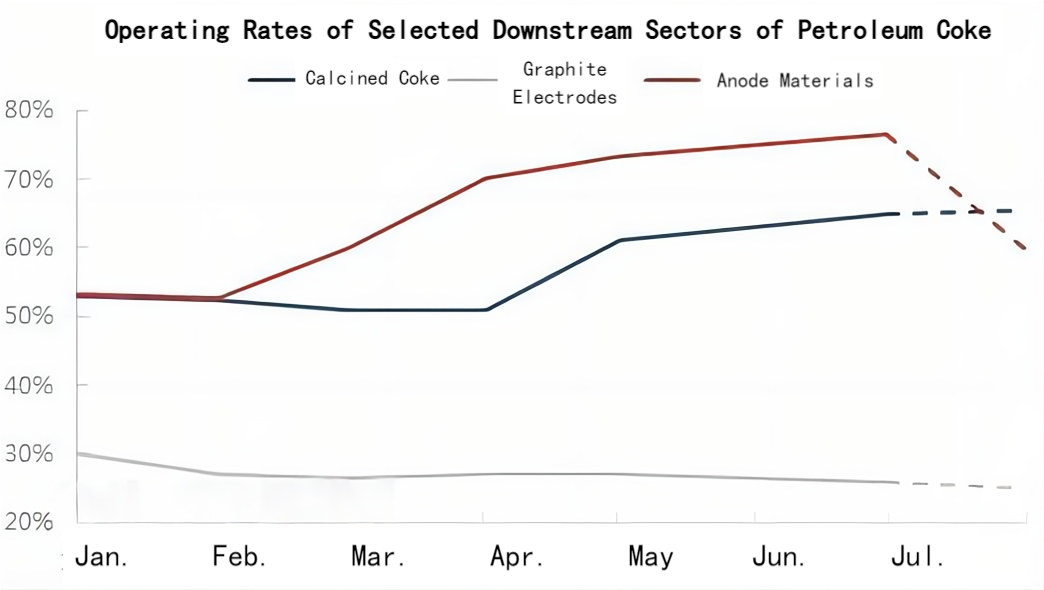

Data source: OILCHEM

From the performance of downstream operations, the anode material market performed relatively well in the first half of the year, with enterprises producing according to order contracts and an average operating load of around 64.3%. However, with the shrinking demand in the terminal market starting in the third quarter, leading enterprises are signing fewer new orders, and the operating load is expected to drop to around 60% in July, a decrease of about 17 percentage points month-on-month.

The calcined coke market shows a clear polarization. The operating load for supporting calcined coke remains around 70%, with good trading in terminal electrolytic aluminum enterprises, supporting shipments from calcined enterprises. A calcining unit in Hubei ignited at the end of June and is expected to gradually start shipments in July, mainly supplying anode use within the system. The commercial calcined coke market remains weak, with shrinking production profits for specification-grade calcined coke and fewer orders for ordinary-grade calcined coke, leading to a poor trading atmosphere. The average operating rate of calcined enterprises in July is expected to remain around 65.5%, mainly due to the release of new and resumed production capacity, raising the operating rate by 0.5 percentage points.

The graphite electrode market continues to operate weakly, with limited improvement in the operation of terminal electric arc furnace steelmaking, further declines in raw material prices, and a dual weak supply-demand phase for the graphite electrode market. Most graphite electrode enterprises are expected to maintain low-load operations, executing existing orders mainly, with the operating load expected to drop to around 25% in July.

4. Limited Support Factors: Petroleum Coke Prices May Continue to Decline

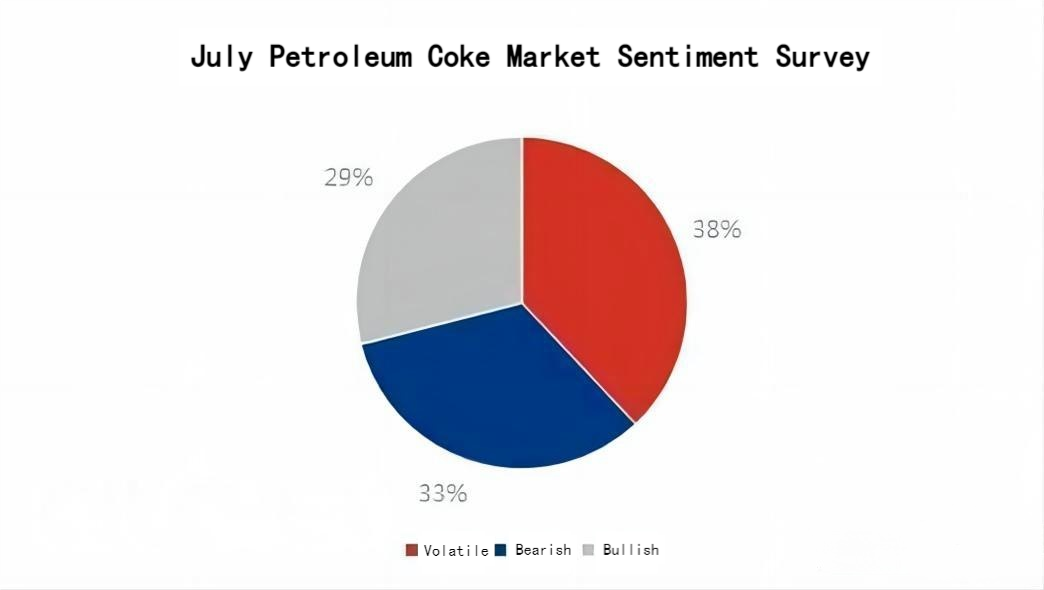

Data source: OILCHEM

In July, some previously shut-down refineries will resume production, slowing the destocking of imported petroleum coke at ports, leading to ample overall supply. The market shows clear polarization on the demand side, with cautious market entry by production enterprises and weak stable operation in the petroleum coke market. Low-sulfur coke prices are expected to range from 2200 to 3000 RMB/ton, medium-sulfur coke from 1500 to 2500 RMB/ton, and high-sulfur coke from 900 to 1600 RMB/ton.

Feel free to reach out to us at any time for more information regarding the needle coke market. Our team is dedicated to providing you with in-depth insights and tailored assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to assist you with the utmost dedication.

No related results found

0 Replies