【Petroleum Coke】New Market Trends: Aluminum Carbon Material Demand Driving the Market!

【Petroleum Coke】New Market Trends: Aluminum Carbon Material Demand Driving the Market!

Market Overview

As of October 8, the average price of petroleum coke in the market was 1,696 yuan/ton, up 11 yuan/ton from the previous working day, an increase of 0.65%. Currently, petroleum coke sales are decent, with active procurement from aluminum carbon materials providing positive support for price increases at some refineries. To learn more of the calcined petroleum coke market. Anode materials and graphite electrodes are being purchased as needed. Prices at major refineries showed slight fluctuations of 30-40 yuan/ton, while prices at local refineries mostly increased, with a few decreasing, with overall price movements ranging from 10-150 yuan/ton.

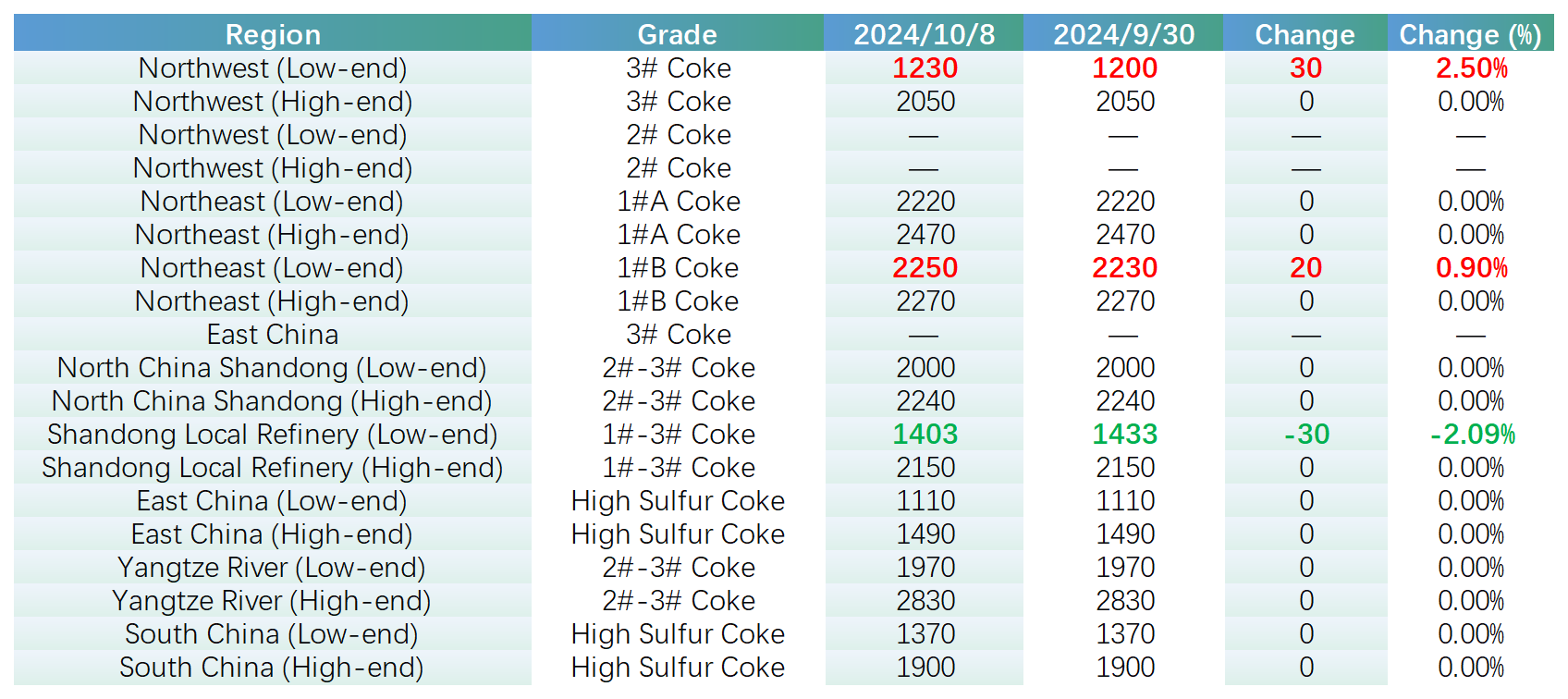

Key Regional Market Transaction Prices

Prices at Sinopec refineries remain mostly stable, with increasing procurement enthusiasm from aluminum carbon material companies. Refiners are inclined to push prices up. Wuhan Petrochemical, located in the Yangtze River region, plans to halt production for maintenance on the 10th, while other refineries are operating normally. Anode material procurement is demand-based, and procurement from aluminum carbon material companies is strong. In Shandong, refineries are maintaining stable prices, and with the support of strong aluminum demand, there is an expectation of follow-up price increases. PetroChina refineries mostly kept prices stable, with some adjustments. In the Northeast and North China regions, sales were decent, with Jinxi Petrochemical increasing prices by 20 yuan/ton on the 1st, Dagang Petrochemical by 40 yuan/ton, and Dushanzi Petrochemical by 30 yuan/ton due to strong aluminum demand in the Northwest region. In South China, Guangdong Petrochemical lowered its tender price by 40 yuan/ton. CNOOC refineries maintained stable prices during the National Day holiday, and have not yet initiated the first round of post-holiday tenders.

Local Refinery Situation

From the holiday until now, local refinery petroleum coke sales have generally performed well, with most refineries increasing prices and only a few reducing them. As it is the beginning of the month, aluminum carbon material companies are entering the market for procurement, leading to active inquiries. Additionally, long-term low inventories at refineries have provided support for price increases of 20-150 yuan/ton at some refineries. However, at other refineries where prices were higher or product quality worsened, prices dropped by 10-101 yuan/ton. Current market fluctuations: Huajin Coking in Liaoning has resumed operations with the latest price at 1,180 yuan/ton, and the vanadium content in Jinbo Petrochemical's petroleum coke has risen to 900-1000 PPM.

Imported Petroleum Coke

Due to the rise in local refinery petroleum coke prices and operational issues at some Indonesian refineries, shipments of petroleum coke have been temporarily halted. October shipments from Indonesia have been delayed, and sponge coke shipments from Brazilian ports have also been delayed due to grain loading. The speed of petroleum coke shipments from ports has accelerated, and the inventory of imported petroleum coke is gradually decreasing.

Supply

As of October 8, there are 12 refineries under routine maintenance, with a national daily petroleum coke production of 88,065 tons. The operational rate of coking units is 69.44%, an increase of 0.72% from the previous working day.

Demand

Aluminum carbon material companies are actively entering the market for procurement, showing strong willingness to purchase petroleum coke.The anode material market has ample supply, with most companies producing based on orders, leading to moderate demand for raw petroleum coke. Demand from the downstream graphite electrode market remains limited, with stable market conditions and cautious petroleum coke purchasing. Demand for high-sulfur shot coke in the silicon carbide industry and South China's fuel market continues to exist.

Market Outlook

Although petroleum coke supply remains ample, the increased inquiries from aluminum carbon material companies at the beginning of the month are expected to provide short-term support to the market. Therefore, petroleum coke prices are expected to remain mostly stable, with some lower-priced products seeing slight increases of 10-50 yuan/ton. Shot coke prices are expected to remain steady in the near term.

Feel free to contact us anytime for more information about the carburant market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies