【Price Outlook】October Low-Sulfur Petroleum Coke and Needle Coke Prices May Diverge

【Price Outlook】October Low-Sulfur Petroleum Coke and Needle Coke Prices May Diverge

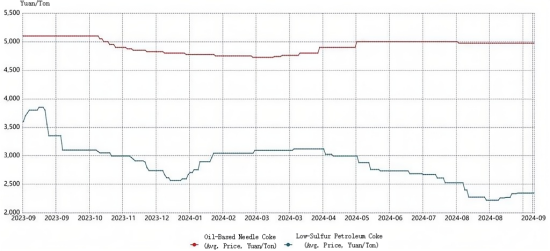

In September, the average price of low-sulfur petroleum coke was 2,312 yuan/ton, a month-on-month decrease of 0.69%. The downstream demand for low-sulfur petroleum coke remained weak, and the peak season did not bring significant improvement. However, due to the substantial price reductions in previous periods, which reached some downstream customers' psychological expectations, there was some sales activity, leading to reduced inventory pressure and a slowdown in price declines.

In October, as customers consumed their previous inventories and purchasing increased, current refinery inventory levels are relatively healthy. Therefore, there is an expectation of price increases, and low-sulfur petroleum coke prices are anticipated to rise.

In September, the average price of oil-based needle coke was 4,975 yuan/ton, a month-on-month decrease of 0.04%. The expected surge in demand during the "Golden September and Silver October" period did not materialize, resulting in low purchasing volumes for needle coke. Refineries chose to reduce needle coke production to control inventory and stabilize prices. Downstream graphite electrode prices have risen against the trend, for more details.

In October, due to favorable sales conditions for downstream anode materials and the consumption of previous inventories, demand for needle coke is expected to increase. However, needle coke prices are likely to remain weak and stable, with limited upward momentum.

Feel free to contact us anytime for more information about the needle coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies