【Graphite Electrodes】Japan Stunned! After Imposing 95% Heavy Tariffs on China, South Korea...

【Graphite Electrodes】Japan Stunned! After Imposing 95% Heavy Tariffs on China, South Korea Becomes the Winner

China's Supply Decreases, Imports from India and South Korea Increase

According to the Japan Metal Daily, in recent months, the import pattern of synthetic graphite electrodes used in electric arc furnaces in Japan has undergone significant changes. Since April 2025, after imposing anti-dumping (AD) duties on electrodes produced in China, imports from China have sharply declined. Meanwhile, electrodes from South Korea have begun to enter the Japanese market.

This shift has raised concerns about possible "export circumvention" practices. Currently, Japanese anti-dumping laws do not include specific provisions to prevent such circumvention, which may lead to calls for new trade protection measures.

China's Import Volume Drops, India's Supply Rises

To prevent unfair pricing, Japan imposed a provisional anti-dumping duty of 95.2% on Chinese graphite electrodes at the end of March 2025. This duty officially took effect on July 3. Following this, imports from China sharply decreased. Between April and June 2025, Japan imported only 490 tons from China, a quarter of the 2,040 tons imported between January and March.

This sharp decline indicates that the anti-dumping duties have had an impact. However, before the duty took effect, exports from China to Japan surged, likely aiming to complete transactions before the tariff implementation. This has resulted in a large inventory of Chinese products stockpiled in the Japanese market.

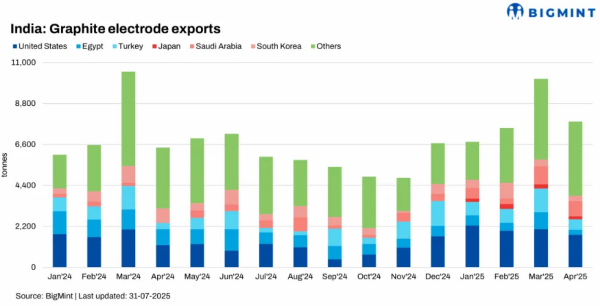

Meanwhile, imports from India increased rapidly. From April to June 2025, Japan imported 1,033 tons of electrodes from India, a rise of about 67% compared to the previous quarter. With Chinese imports facing high tariffs, demand for Indian products may further increase in the coming months.

South Korea Enters the Market, Raising Suspicions

Unexpectedly, South Korea has become a new exporter of graphite electrodes to Japan. South Korea exported 50 tons in May and 18 tons in June. Although the quantities remain small, this has raised concerns in the Japanese industry. The key issue is that South Korea lacks integrated graphite electrode manufacturers producing from raw materials to finished products.

Industry experts suspect that semi-finished electrodes are shipped from China to South Korea, processed locally, and then exported to Japan. This practice allows these products to circumvent Japan's anti-dumping duties on Chinese goods, thereby undermining the intended effect of the trade measures.

Low Prices and the Need for Policy Action

In May and June, the average import price of Korean products was about 380,000 yen/ton (approximately $2,550.8/ton), far below the overall market average of 500,000 yen/ton (approximately $3,356.4/ton). Such a significant price difference has raised concerns that Korean products may aggressively expand in the Japanese market by undercutting prices.

This situation reflects a broader trend in the steel industry, where low-cost steel products are entering Japan as global anti-dumping measures expand. Regarding electrode trade, Japan urgently needs to implement policies to prevent export circumvention. These measures are essential not only to ensure the effectiveness of anti-dumping duties but also to protect domestic industries from the impact of indirect import channels.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies