【Petroleum Coke】Steady with Fluctuations — Price Amplitude Reached 10.6% in the Third Quarter

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Steady with Fluctuations — Price Amplitude Reached 10.6% in the Third Quarter

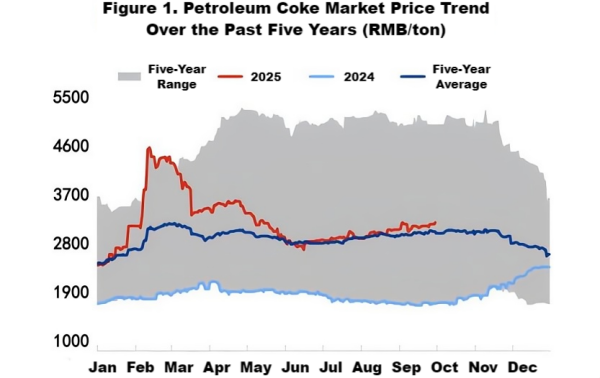

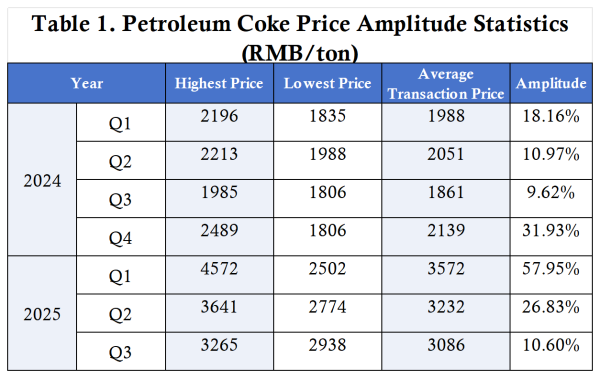

In the third quarter, domestic petroleum coke prices generally maintained a steady and fluctuating upward trend. Market supply slightly tightened, downstream procurement remained active, and petroleum coke sales stayed stable. After the ups and downs in the first half of the year, the price amplitude in the third quarter narrowed to 10.6%, reducing market transaction risks.

1. Market Transactions Stabilized, Petroleum Coke Prices Steadily Rose

In the third quarter, the domestic petroleum coke market maintained a steady and modest upward trend, with overall prices fluctuating above the average level of the past five years. During July and August, market trading remained generally stable, and prices were basically aligned with the five-year average. Favorable supply and demand conditions supported this stability, and market sentiment remained positive.

In September, downstream purchasing enthusiasm surged, with both port and domestic inventories declining. Prices for low-sulfur coke held firm, and prices for all grades of coke continued to rise. Spot prices in the market kept increasing. In September, the average monthly market price was 3,191 RMB/ton, up 3.98% month-on-month and 74.83% year-on-year. By the end of September, the transaction price had reached 3,258 RMB/ton, an increase of 307 RMB/ton compared with the end of June, representing a rise of 10.42%.

2. Petroleum Coke Price Amplitude at 10.6% in Q3, Market Transaction Risk Reduced

According to statistical analysis, after the wide fluctuations in the first half of the year, the petroleum coke market entered a rational adjustment phase in July, with the quarterly price low appearing in early July at 2,938 RMB/ton. In September, market activity was strong; pre-holiday restocking sentiment and rigid demand from downstream enterprises' production plans drove petroleum coke prices up to 3,265 RMB/ton.

In the third quarter, the domestic petroleum coke market showed a high-low price difference of 327 RMB/ton, with an average quarterly price of 3,086 RMB/ton and a price amplitude of 10.6%, down 16.23 percentage points from the previous quarter. Overall market trading became more stable. It is expected that petroleum coke prices will continue to fluctuate steadily in the fourth quarter. However, as downstream demand slows, some refineries may see price pullbacks. The overall price fluctuation range is expected to be around 18%.

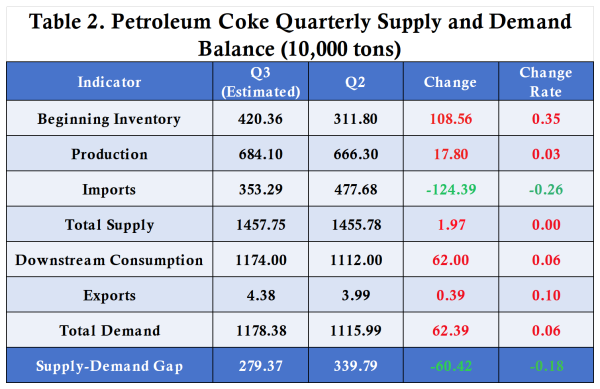

3. Supply-Demand Gap Narrowed, Demand Supported Market Improvement

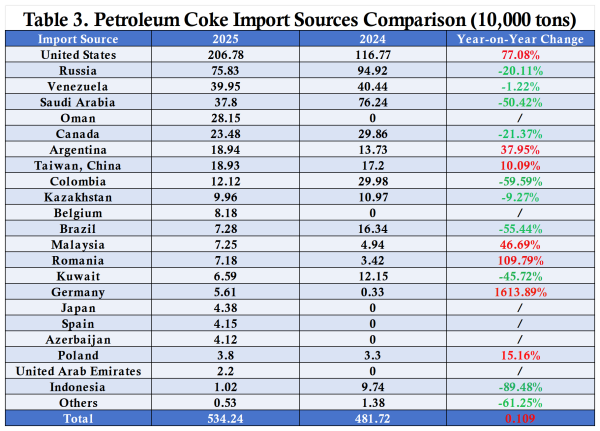

In the third quarter, the total domestic supply of petroleum coke was about 14.5775 million tons, up 0.14% quarter-on-quarter; total market demand was about 11.7838 million tons, up 5.59% quarter-on-quarter. With tightening supply and sustained demand growth, the supply-demand gap narrowed by 17.78% year-on-year. Favorable demand conditions drove petroleum coke prices continuously higher.

Looking into the fourth quarter, domestic market demand is expected to slightly decline, domestic supply will remain stable, and total imports are anticipated to decrease. As the supply-demand imbalance eases, petroleum coke prices are expected to maintain a generally steady and fluctuating trend. The estimated monthly average prices are as follows: low-sulfur coke at 3,600–4,000 RMB/ton, medium-sulfur coke at 2,800–3,200 RMB/ton, and high-sulfur coke at 1,500–1,800 RMB/ton.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies