【Petroleum Coke】Independent Refinery Supply Enters Growth Phase While Imports ...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Independent Refinery Supply Enters Growth Phase While Imports Remain Under Decline Expectation

After the traditional peak maintenance season in summer, entering Q4, the restart of independent refineries has gradually increased, pushing supply into a growth phase. Demand from carbon and anode industries remains stable in supporting the petroleum coke market. Import volume in November is expected to decline due to various factors, while December shows potential for an increase. With stable demand, attention should be paid to the impact of supply-side adjustments on the petroleum coke market, particularly under the noticeable trend of changes in major refiners and import volumes. The supply volume and index trends of independent refineries are especially crucial.

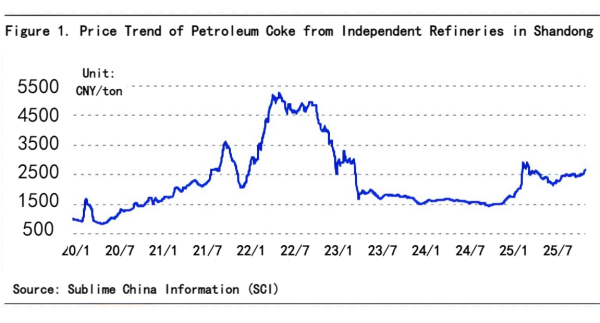

In October, the domestic petroleum coke market generally showed the trend of "post-holiday surge followed by steady upward movement in the mid-to-late period." Main reasons:

– Post-holiday restocking demand: After the National Day holiday, downstream enterprises had restocking demand, driving a strong start for the market.

– Cost and supply support: Frequent price adjustments by refineries provided strong support, especially for high-sulfur coke with stable supply, pushing its price continuously upward.

– Demand differentiation by sulfur content: Low-sulfur coke demand recovered in late October, medium-sulfur coke remained relatively stable, while high-sulfur coke demand remained strong, leading to diverging price trends among different grades.

After the holiday, the market saw a "good start," especially with significant price fluctuations in Shandong independent refineries. In mid-October, the market became more differentiated, maintaining overall stability with frequent localized adjustments, and sustained upward momentum throughout the month. At month-end, market sentiment was positive, trading was active, and some resources were sold quickly.

For state-owned refiners, prices were generally raised with more proactive operations. CNPC first increased low-sulfur coke quotations in the Northeast and its Dalian and Liaoyang subsidiaries. Sinopec made several adjustments throughout the month, with cumulative increases of 40–100 RMB/ton in most plants. CNOOC refineries saw both increases and decreases but mainly followed the broader upward trend.

Independent refineries were more active with greater volatility than major refiners. After the holiday, a strong rebound occurred across all grades. The market then entered a high-level consolidation stage with mostly stable posted prices and occasional fluctuations. Overall, the independent refinery market showed strong upward momentum in mid and late October, achieving significant monthly gains.

For low-sulfur petroleum coke, market performance shifted this month. Prices were steady to weak early in the month due to cautious downstream procurement, but sentiment improved in late October with higher purchasing enthusiasm, driving price recovery and overall improvement.

For medium- and high-sulfur petroleum coke, supportive supply and demand conditions persisted throughout the month. Producers raised prices slightly and frequently, forming a "stable to upward" trend. Only mid-month showed slight pressure with weaker sentiment.

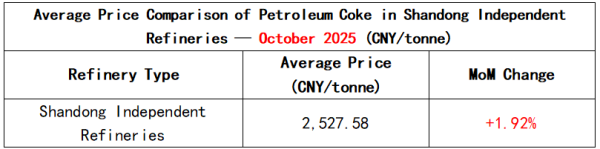

In October, the average price of petroleum coke in Shandong independent refineries was 2527.58 RMB/ton, up 48.51 RMB/ton (+1.92%) MoM.

On October 31, the average price reached 2661 RMB/ton, up 201 RMB/ton (+8.17%) compared with September 30.

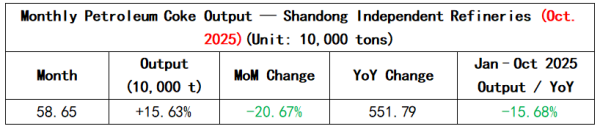

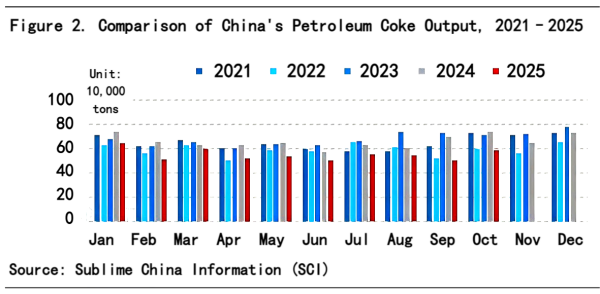

In October 2025, the petroleum coke output from Shandong independent refineries was 5.865 million tons, up 15.63% MoM but down 20.67% YoY. The MoM increase was mainly due to the recovery of some refineries previously under maintenance.

From January to October 2025, total output reached 55.179 million tons, down 15.68% YoY.

Methodology: Petroleum coke output refers to the total petroleum coke produced by refinery coking units. The data are monitored by Sublime China Information (SCI), based on over 30 petroleum coke producers in Shandong, whose combined capacity accounts for 90% of the province's total. Data are updated monthly.

In October 2025, petroleum coke output in China reached 24.196 million tons, up 5.92% MoM but down 8.82% YoY, mainly due to refinery recovery after maintenance.

Unit Operations

For major state-owned refiners:

– In November, the #2 CDU at Zhenhai Refining & Chemical is expected to complete maintenance by mid-to-late month.

– The #3 CDU at Guangzhou Petrochemical remains under maintenance.

– Yunnan Petrochemical may undergo full-plant maintenance.

– With lower gasoline/diesel demand, crude processing volume and average operating rate may decline.

For independent refineries:

– No newly added maintenance projects in November.

– Huaxing and Shengxing plan to resume operation.

– Others remain stable.

Overall, primary operating rates in Shandong independent refineries may rise, increasing gasoline/diesel supply.

Petroleum Coke Supply Level

For domestic production:

Refineries such as Qingyishan, Haiyou, Hualong, Jincheng, Huifeng, Jujiu, Zhonghaiwai, Dongming, and Lanchiao remain in long-term shutdown. In November, Huaxing and others are scheduled to restart.

For imports:

Petroleum coke imports are expected to remain in a declining trend in November.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies