【Petroleum Coke】Falling Oil Prices, Widening Discount of Petroleum Coke vs Coal — 2026 Forecast

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Falling Oil Prices, Widening Discount of Petroleum Coke vs Coal — 2026 Forecast

2026 Forecast Summary

The 2026 forecast indicates that oil prices may fall below 2025 levels. Since coal and petroleum coke prices are influenced by the oil market, both are also expected to decline. The impact of geopolitics and tariff levels is expected to gradually weaken, allowing fundamental factors to play a more significant role again. Overcapacity will keep oil prices in a relatively low range, with this effect extending to natural gas and coal, indirectly keeping petroleum coke prices near current levels. The US dollar is expected to depreciate 5%-10% relative to the Euro, providing moderate support for commodity prices. Wars and trade disputes (including tariff issues) remain unpredictable uncertainties.

In October, under US political leadership, the “Gaza Peace Agreement” was implemented. However, a potential US strike on Venezuela could destabilize the current situation. A productive meeting between President Trump and Chinese President Xi Jinping led to a delay in planned tariff increases. The US government shutdown issue has now been resolved. Unfortunately, the previously expected peaceful solution in Ukraine has not been achieved.

The US Federal Reserve (Fed) cut the benchmark interest rate by 0.25 percentage points to 4.25%, while the European Central Bank (ECB) kept rates unchanged. The rate cut slightly weakened the US dollar, as the Fed may wish to monitor inflation rising again toward 3%. In 2025, both the ECB and Fed are expected not to cut rates further. The volatility index (VIX) has risen from 17 to 21, reflecting some market concerns, particularly in AI-focused equity markets.

Currently, the USD/EUR exchange rate has risen to 1 EUR = 1.550 USD, but remains within the 1.15–1.2 USD range. Brannvoll ApS predicts that in 2026 the USD/EUR range will be 1.1–1.25, with an average rate of 1 EUR = 1.19 USD.

Oil Market Analysis

In December, OPEC+ increased oil production again. The International Energy Agency (IEA) currently forecasts a global oil supply surplus. Even US sanctions on Russian oil companies Rosneft and Lukoil failed to boost market confidence. Concerns remain that a global GDP slowdown could reduce oil demand. Potential sanctions on Russia and Iran, as well as any intervention in Venezuela, could trigger oil price rises. Continuous Ukrainian attacks on Russian refineries provide short-term support, but as geopolitical tensions ease, oil prices may remain below $65/bbl.

Currently, oil prices are in the $62–67/bbl range, mainly driven by geopolitics and OPEC+ production increases. Brent crude has fallen 3% to $63.50/bbl. TTF gas prices for 2026 (Cal26) have fallen to €31, and EU gas storage remains at 83%, lower than the past two years. Brannvoll predicts Brent crude in 2026 will range from $55–80/bbl, with an average of $68/bbl.

Coal Market Analysis

The coal market remains generally stable. However, the near-month contract (FQ) moved from 4Q25 to the higher-priced 1Q26, causing the benchmark coal price used to calculate petroleum coke discounts to rise. In 2026, weak Chinese coal demand and rising domestic coal production are expected to limit international coal shipping volumes. Colombian coal supply remains sufficient; South African shipments have increased due to improved rail efficiency; Russian coal prices remain low, with production expected to decline; Australian coal exports are gradually recovering. API2 coal prices in 2026 are expected to remain $10/ton higher than API4 coal prices.

For 1Q26, API2 near-month coal contracts (1Q26/FQ) rose 9% to $101.5/ton and are expected to remain within $95–105/ton. API2 Cal26 contracts rose 4% to $104/ton. 1Q26 API4 near-month contracts rose 10% to $93/ton, expected in a $90–100/ton range short-term. Brannvoll predicts 2026 near-month coal prices will range $85–115/ton, averaging $100/ton; API4 coal will range $80–105/ton.

Petroleum Coke Market Analysis

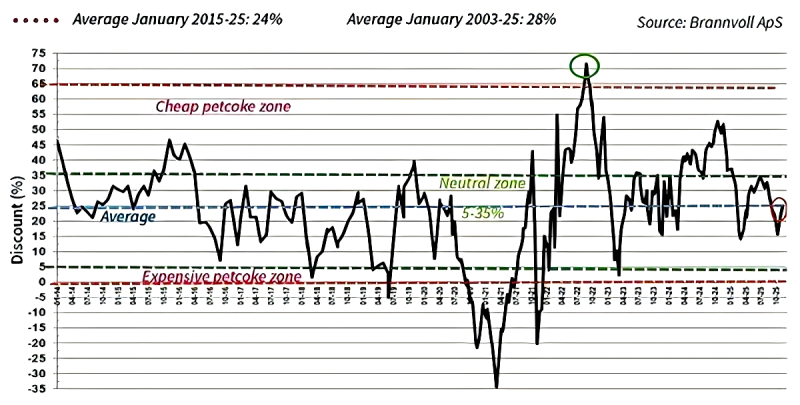

In 2026, petroleum coke discounts versus coal are expected to remain at current low levels. China and the US have reduced mutual tariffs, and no increases are expected next year, maintaining Chinese interest in US petroleum coke. Despite low-priced Russian coal, Turkish buyers have returned to the petroleum coke market. Shipping costs have slightly decreased, supporting FOB prices. US refineries undergoing maintenance and shutdowns have reduced supply, while new petroleum coke suppliers gradually enter the market.

Conflicts between the US and Venezuela may disrupt Venezuelan petroleum coke exports, affecting the medium-sulfur market. Nevertheless, the ARA region (Rotterdam-Antwerp-Amsterdam) 6.5% sulfur petroleum coke discount to coal is expected to remain around 20–25%.

US Gulf Coast (USGC) 6.5% sulfur FOB contract prices rose 1% to $68/ton, with a $42/ton discount to API4 coal. USGC 6.5% sulfur CFR ARA prices fell 3% to $95/ton; due to lower freight and higher coal prices, the discount widened to 25%. USGC 4.5% sulfur FOB prices fell 1% to $74/ton, with a $36/ton discount to API4 coal. USGC 4.5% sulfur CFR ARA prices fell 4% to $101/ton, a 120% discount versus coal.

Brannvoll predicts that in 2026, ARA 6.5% sulfur petroleum coke prices will range $85–105/ton, averaging $95/ton, with an average discount to coal of 25%.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies