Epidemic is spreading rapidly, petroleum coke market trend analysis

Epidemic is spreading rapidly, petroleum coke market trend analysis

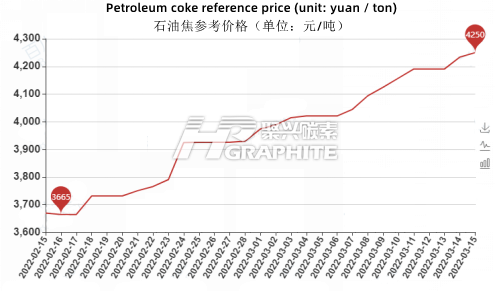

The COVID-19 outbreak has spread to several provinces in China, exerting a significant impact on the market. The logistics transportation in some urban areas is blocked, in addition, petroleum coke price continues to be high, and the heat of receiving goods has decreased; In general, the downstream operation is rising, petroleum coke market demand is good. Graphite electrodes made of petroleum coke for reference. As of March 15, the market reference price of petroleum coke was 4250 yuan/ton, an increase of 328 yuan/ton or 8.38% compared with the end of February.

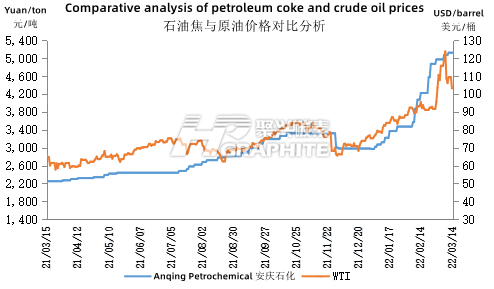

Crude oil soared, refining costs increased, and petroleum coke supply remained tight

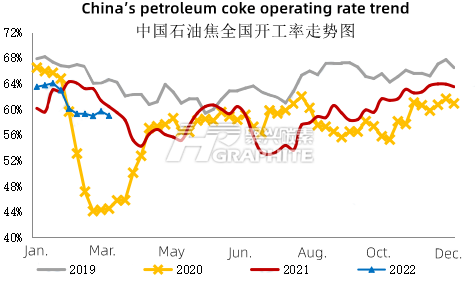

Due to the outbreak of COVID-19, in addition to the low operation rate in 2020, the current operation rate of coking units in China is at a low level compared with the same period of previous years, a decrease of 5.63% compared with 2019, and a decrease of 1.41% compared with 2021. Mainly affected by the war, the international situation is rising tensions since late February, the crude oil price has exceeded the $100/barrel mark, the refining cost of refineries has increased, some refineries’ refining cost has been upside down. In addition, March and April is the peak maintenance season of traditional refineries, coking units maintenance is expected to increase by 9 times, affecting coking unit capacity 14.5 million tons/year.

The impact of environmental protection is gradually weakened and the downstream demand increases

Since late January, most downstream enterprises in Hebei, Shandong, Henan and Tianjin have been affected by environmental protection and production restrictions of "Winter Olympic Games", "two sessions", "Paralympic Games" and "heavily polluted weather", forced to reduce production and shut down, and the overall market demand for petroleum coke has weakened; Since March 11, the impact of environmental protection has been gradually eliminated, and the enterprises that stopped work and reduced production in the early stage have gradually resumed construction. As the raw petroleum coke prices continue to be high, the raw material inventory of downstream enterprises has been low, and the market demand for petroleum coke is good. The negative material market is strongly supported by the petroleum coke market.

Affected by the epidemic, logistics and transportation in some regions are limited

Since March, the epidemic has broken out in many places across China, the anti epidemic situation is grim. The major petroleum coke producing areas such as Jiangsu, Shandong, Hebei and Liaoning outbreak continually, which has a great impact on logistics and transportation. As of March 15, Qingdao, Dezhou, Zibo, Binzhou, Weihai, Yantai, Weifang and Rizhao in Shandong Province, Panjin in Liaoning Province and Lianyungang in Jiangsu Province have been reported to be infected with the novel coronavirus, and the epidemic situation is severe. At present, many places have clearly issued a notice to implement 14 day centralized isolation or home monitoring for personnel from medium and high-risk areas or travel codes with asterisks. This notice has a great impact on market logistics and transportation. In some areas, the pressure of refinery logistics and transportation is large, and the storage of petroleum coke begins to increase.

Imported coke is mainly medium and high sulfur coke, small impact on the market

Since January, there have been few ships arriving from ports, and some ports have sold all petroleum coke and have no inventory. Due to the impact of the epidemic, the shipment of ports in South China is limited, while shipments from other major ports are good, and petroleum coke storage in ports is decreasing. It is understood that the subsequent imported petroleum coke is mainly medium and high sulfur petroleum coke, with limited impact on the domestic market.

Future forecast:

The demand for downstream negative materials is strong, the supply of low sulfur petroleum coke is still tight, the market inventory continues to be low, it is expected that low sulfur petroleum coke price will be stable with a slightly upward in the short term.

The medium and high sulfur petroleum coke market is affected by the rise of crude oil price, the increase of refinery refining cost, and the traditional peak maintenance season in March and April. There are many shutdown and maintenance of coking units. It is expected that the supply of Petroleum Coke will continue to decline in the short term; In addition, downstream carbon enterprises affected by environmental protection in the early stage have started to resume production, and the downstream has a good demand for petroleum coke; However, due to the impact of epidemic, the logistics and transportation in some areas are limited, and refineries inventory is increasing. Therefore, the price of medium and high sulfur petroleum coke is expected to be stable in the near future, and some refineries coke price is expected to decline due to the impact of the epidemic, contact us to get the latest carbon market news.

No related results found

0 Replies