【Petroleum Coke】Downstream essential procurement as the main driver, market weakly stable

【Petroleum Coke】Downstream essential procurement as the main driver, petroleum coke market weakly stable

Market Analysis of Petroleum Coke

Market Overview:

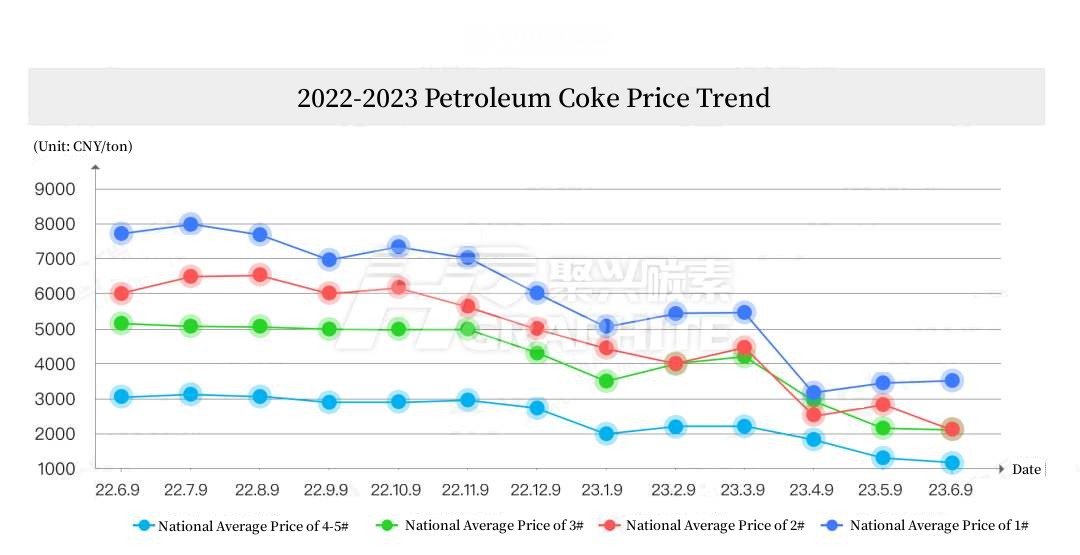

On June 9, 2023, the overall trading in the petroleum coke market is still acceptable. Main refineries maintain stable trading, while local refineries have moderate shipments. Carbon companies mainly focus on purchasing low-sulfur coke for immediate needs, leading to slower market shipments. Refer to the specifications and supply and demand information of calcined Petroleum coke products. The demand for medium to high-quality coke remains relatively stable. Overall, downstream enterprises exhibit a strong wait-and-see attitude, with slightly insufficient proactive purchasing. As of now, the average price of petroleum coke is 2,300 yuan/ton, a 2% decrease compared to the previous week.

Main Players:

The coke price remains stable. Sinopec maintains overall stable trading, and the downstream demand for medium to high sulfur coke remains stable. Refineries maintain stable shipments, with no significant inventory pressure. Sinopec's Da Gang Petrochemical has reduced its listed price by 250 yuan/ton and continues to implement price protection sales. Sinopec's Northeast region maintains reasonable shipments, and CNOOC refineries execute order-based sales, stabilizing coke prices.

Local Refineries:

Local refinery inventories remain at a relatively low level. Shipments are active, resulting in narrow price fluctuations with occasional price increases of 30-200 yuan/ton and decreases of 50-150 yuan/ton. Dongming Petrochemical's Zhongyou plant mainly produces sponge coke with a sulfur content of 3.8%, which follows the latest quotation. Jingbo Petrochemical has adjusted the sulfur content of its petroleum coke to around 2.5%, with prices following the market. In the eastern region, Jiangsu Xinhai's petroleum coke shipments have improved slightly, leading to a minor price rebound. In the northeast region, Liaoning Baolai has adjusted the sulfur content of its petroleum coke to 3.8% and 3.3%, implementing competitive bidding sales. Currently, port inventories are high, and the price of electrolytic aluminum remains at a high level with volatile trends. The resumption of work by enterprises is slow, and domestic supply and demand contradictions still exist. It is expected that petroleum coke prices will largely remain stable in the short term, with some minor adjustments.

Future Forecast:

In the short term, downstream demand remains relatively stable, driven by essential users. The petroleum coke market will continue to focus on depleting inventories, with no significant positive factors. Petroleum coke prices are expected to experience narrow fluctuations in the short term. For a deeper understanding of the petroleum coke market, please feel free to inquire with us.

No related results found

0 Replies