【Needle Coke】Market Situation Moderate, Facing Production Pressure

【Needle Coke】Market Situation Moderate, Facing Production Pressure

The prices of petroleum slurry continue to rise, putting significant production pressure on needle coke, leading to compressed profits and an overall subdued atmosphere in the needle coke supply and demand. The mainstream price for green coke is in the range of 4,500-5,300 RMB/ton, while the mainstream price for calcined coke is between 7,500-9,300 RMB/ton.

Supply side: Many needle coke coal-related enterprises have either suspended production or shifted to producing pitch coke, and the resumption time remains uncertain. Petroleum-based enterprises are maintaining low-load operation.

Demand side: Demand from negative electrode material enterprises has shown a slight upward trend. There is a discrepancy in the trend of independent electric arc furnace startup rates and capacity utilization rates across the country, with an increase in startup rates but a decrease in capacity utilization rates. The weak demand for needle coke comes from the graphite electrode sector.

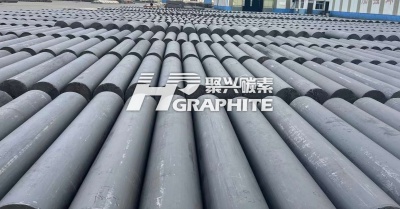

The mainstream price for medium-low sulfur petroleum slurry has been adjusted to 3,850-4,500 RMB/ton, while the mainstream price for modified coal tar pitch is in the range of 4,550-4,800 RMB/ton, and for medium-temperature coal tar pitch, it is between 4,600-4,700 RMB/ton. The price for mid-range artificial graphite is 34,000 RMB/ton, and for ultra-high power 700mm graphite electrodes, it is 24,000 RMB/ton.

Downstream demand for negative electrodes shows a slight upward trend, but there is not much enthusiasm for external sourcing of raw materials. The supply and demand for graphite electrodes remain weak, providing no positive support to the needle coke market. For more information on the carbon market, feel free to communicate with us.

No related results found

0 Replies