【Graphite Electrodes】Cost Pressure Drives Price Increase for Most Enterprises

【Graphite Electrodes】Cost Pressure Drives Price Increase for Most Enterprises

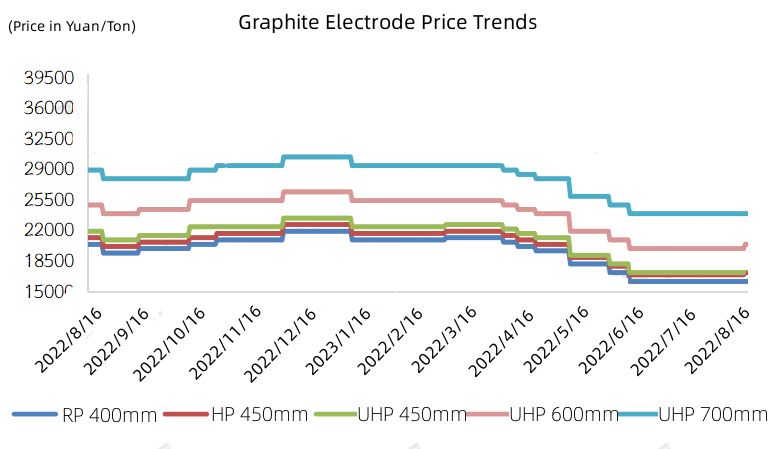

Entering mid-August, a strong upward sentiment is evident among most graphite electrode enterprises. This is primarily due to the rise in prices of certain upstream raw materials, which has increased the cost pressure on graphite electrode manufacturers. Coupled with the previous period of losses faced by these enterprises, a majority of them are raising the transaction prices of graphite electrodes. Additionally, there are still a few graphite electrode enterprises aiming for low-price transactions to secure orders, thereby keeping a pool of low-priced resources available. As of August 16, 2023, mainstream prices for China's graphite electrodes with diameters of 300-600mm are as follows: Regular Power - 16,000 to 17,500 yuan/ton; High Power - 16,000 to 18,500 yuan/ton; Ultra High Power - 17,000 to 20,500 yuan/ton; Ultra High Power 700mm electrodes - 23,500 to 24,500 yuan/ton.

Cost Aspect

The cost pressure on graphite electrodes is increasing. The price of petroleum coke, a key upstream material for graphite electrodes, at a certain refinery in the Northeast region is 3,950 yuan/ton. The market transaction price for low sulfur calcined coke (which is derived from petroleum coke at a certain refinery in the Northeast) ranges from 4,200 to 4,500 yuan/ton. The market price of needle coke experienced an uptrend in early August due to continuous increases in raw material slurry prices. As a result, the cost of petroleum-based needle coke remains high, leading some enterprises in this sector to raise their prices by around 300 to 500 yuan/ton. The average price of modified coal pitch is 5,236 yuan/ton, marking a 12.60% increase compared to the previous month. When calculating the graphite electrode market's production cost based on current prices of low sulfur petroleum coke, coal tar pitch, and needle coke, the theoretical cost would be around 18,000 yuan/ton. However, current graphite electrode order prices are below this cost level, contributing to an ongoing situation of losses for graphite electrode enterprises.

Demand Aspect

The terminal steel market experienced a sluggish period in July and August, leading to moderate enthusiasm among electric arc furnace (EAF) steel enterprises. This, in turn, resulted in lower-than-expected demand for graphite electrodes. The uptake of bids by EAF steel enterprises has shown slow improvement, especially for ultra-high large-sized graphite electrodes. Furthermore, some EAF steel enterprises still aim to negotiate lower prices, limiting the pricing power of graphite electrode enterprises and presenting resistance to price increases in the graphite electrode market.

Future Forcast

In terms of demand, EAF steel enterprises might increase their raw material inventory for September, potentially boosting demand for graphite electrodes. In the long run, there is an expectation of stabilization and improvement in the graphite electrode market. On the supply side, following the previous period of inventory depletion and considering the low operating rates of graphite electrode facilities, a positive supply outlook is anticipated. This could result in a potential price increase of 500 to 1,000 yuan/ton in the graphite electrode market in the coming period. September Forecast for Graphite Electrode Market Prices, Feel Free to Contact Us.

No related results found

0 Replies