【Petroleum Coke】Carburant Cost Pressure and Future Price Trend

【Petroleum Coke】Carburant Cost Pressure and Future Price Trend

Data Source: Oilchem

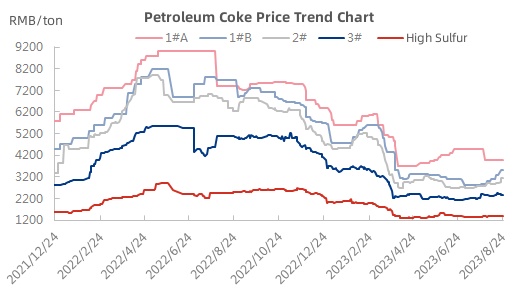

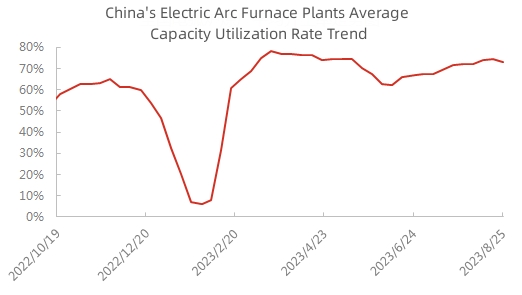

Cost Aspect: As of the time of writing, in the petroleum coke market, the average price of 1# petroleum coke is 3750 RMB/ton, up by 200 RMB/ton or 5.63% compared to the previous period; 2# coke is priced at 3151 RMB/ton, up by 293 RMB/ton or 10.25% from the previous period, further information about calcined petroleum coke prices. In the recent period, trading in the petroleum coke market has been relatively active. Prices for low-sulfur petroleum coke have mainly risen, while prices for medium to high sulfur coke have shown a narrow upward trend, and prices for refinery petroleum coke have fluctuated. On the supply side, a slight increase in production is expected in the next cycle. On the demand side, the average capacity utilization rate of electric arc furnaces for steelmaking has improved, providing a strong boost to the steel carbon market. Petroleum coke prices are expected to experience narrow fluctuations. As for calcined coal, the price of anthracite coal remains stable. In terms of supply, the overall pace of shipments has slowed down, and sales are moderate. However, due to relatively low pressure on bulk coal inventories, prices for mainstream large mines have not been adjusted. On the demand side, the environmental control measures in the Jincheng area have led to varying degrees of production halts or restrictions in some chemical enterprises, further affecting the demand for raw coal.

Data Source: Oilchem

Downstream Demand: China's independent electric arc furnace startup rate and capacity utilization rate have slightly decreased. Steel mills have indicated a recent contraction in demand, resulting in reduced shipments from steel mills. To avoid continuous inventory accumulation, they have slightly reduced production time. Recent performance of finished products has been poor, and scrap steel prices remain relatively high. The price gap between scrap and rebar has consistently remained below 800 RMB/ton, making it difficult for steel mills to maintain profits. Overall, it is expected that the startup rate and capacity utilization rate of independent electric arc furnace plants may continue to decrease slightly next week.

Data Source: Oilchem

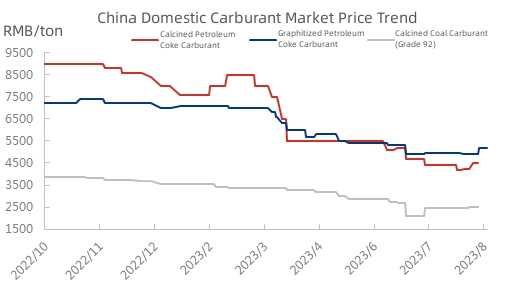

Price Aspect: The market quotation for low-sulfur calcined coke carburant is 5000 RMB/ton, up by 500 RMB/ton from the previous period; the market quotation for graphitized carburant is 5200 RMB/ton, up by 300 RMB/ton from the previous period. The market quotation for calcined coal carburant is in the range of 2100 to 3400 RMB/ton, remaining stable compared to the previous period. The purchasing enthusiasm on the demand side is moderate, resulting in supply-demand imbalance. In the recent period, the entire carburant market has been characterized by supply-demand imbalance, with supply remaining at high levels and limited downstream demand. Coupled with increased cost pressures on raw materials for petroleum coke, carburant prices have been driven up. Due to relatively low market entry enthusiasm from downstream sectors, it is expected that carburant prices will mainly remain stable in the short term, with occasional price adjustments. Feel free to communicate with us for updates on the petroleum coke market dynamics.

No related results found

0 Replies