【Low-Sulfur Petroleum Coke】Northeast China Upstream & Downstream Production and Trends Analysis

【Low-Sulfur Petroleum Coke】Analysis of Upstream & Downstream

Production and Market Trends in Northeast China

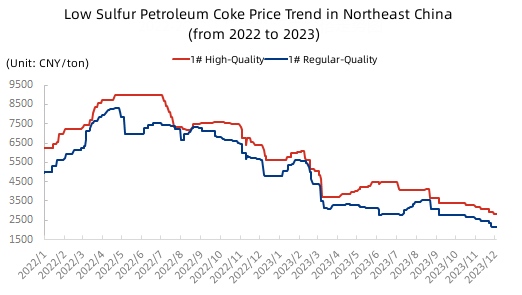

2023 has been a dramatic year for petroleum coke. After experiencing a rapid surge in coke prices in 2022, 2023 witnessed a rapid decline. Northeast low-sulfur coke, as the ceiling for quality and price in the petroleum coke industry, is closely related to the overall situation in the industry.

In the first quarter of 2023, Northeast low-sulfur coke still maintained relatively high price levels. The average price for high-quality 1# coke was 5,622 yuan/ton, and for general quality 1# coke, it was 5,010 yuan/ton. However, by the fourth quarter, coke prices had experienced three consecutive quarters of decline. The average price for high-quality 1# coke had dropped to 3,229 yuan/ton, a decrease of 42.56% compared to the previous quarter. The price of general quality 1# coke fell to 2,618 yuan/ton, a decrease of 47.74%.

Source: Oilchem

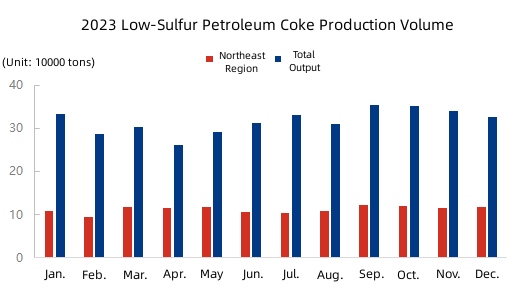

In 2023, the total production of low-sulfur coke in China was 3.7978 million tons, and the production in the Northeast region reached 1.3405 million tons, accounting for 35.3% of the total. The Northeast is a major production area for low-sulfur coke in China, and the quality of petroleum coke is relatively high. The low-sulfur coke in this region is generally low in sulfur and vanadium, with all kinds of trace elements at relatively low levels. It is not an exaggeration to call it the highest quality in China. Therefore, the price of low-sulfur coke in the Northeast has always been the highest in China.

Source: Oilchem

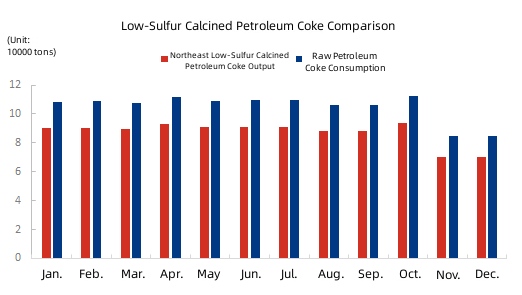

The Northeast region not only produces a large amount of low-sulfur coke but also consumes a large amount. In 2023, the production of low-sulfur calcined coke in the Northeast was about 1.04 million tons, and the consumption of low-sulfur green coke was 1.2583 million tons, which is almost the same as the production of low-sulfur green coke in the Northeast. The Northeast region integrates production and consumption, has a large industrial cluster, and has a complete industry chain.

Source: Oilchem

As we approach 2024, the petroleum coke industry faces more challenges. Downstream production enterprises are advancing their technologies, relaxing requirements on elements like sulfur content in petroleum coke. With a greater emphasis on cost reduction and enhanced production technology in the downstream, the advantage of Northeast low-sulfur coke is gradually diminishing. Low-sulfur coke enterprises need to explore more possibilities to cope with increasingly severe challenges. Feel free to contact us for more coke industry news.

No related results found

0 Replies