【Graphitization】Third-party Graphitization Processing Share May Fall Below 30% in 3 Years

【Graphitization】Third-party Graphitization

Processing Share May Fall Below 30% in 3 Years

Data indicates that by the end of November, the lowest price for some 340mAh/g artificial graphite fell below 16,000 yuan/ton, and for some 350mAh/g artificial graphite, it fell below 25,000 yuan/ton, which is lower than the cost line of over 90% of the enterprises. It is expected that by 2024, China's graphitization capacity will exceed 3.5 million tons/year, more than three times the level in early 2022. With the long-term trend of cost reduction, extreme cost reduction is expected to become the core competitiveness of the graphitization and downstream negative electrode industry in the next 2-3 years. The detailed specifications of graphitized petroleum coke products are for reference. Due to this impact, the industry may experience the following phenomena:

Ⅰ. Self-sufficiency rate of graphitization may exceed 70%. Non-integrated graphitization projects generate costs for packaging, transportation, etc. For cost reduction, the proportion of integrated or nearby (within 500 km) graphitization processing may exceed 90%.

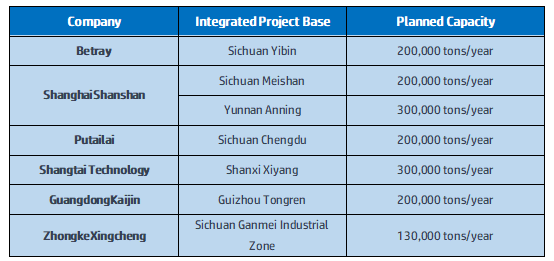

Integrated projects of negative electrode materials for leading Chinese companies

Ⅱ. There are still many crucible furnaces producing artificial graphite products with less than 350mAh/g, allowing companies to have flexibility in accepting orders. In 2024, graphitization will develop towards professional differentiation, with crucible furnaces mainly supporting 350mAh/g and above artificial graphite products, while box-type furnaces will mainly support 340, 345mAh/g artificial graphite products.

Ⅲ. In the next 2 years, the peak price of graphitization processing may reach 10,000-12,000 yuan/ton, and 3 years later, the proportion of continuous furnaces in application may exceed 30%, which is expected to further drive down the average price of graphitization processing by more than 15%.

It is expected that the market share of third-party graphitization processing enterprises will be less than 30% in 3 years. Most companies will face elimination or acquisition. The surviving companies will have the following characteristics:

1. Possess medium/high sulfur coke graphitization processing capability;

2. Proximity to major customers, supporting large negative electrode (with order consumption) production bases;

3. Have projects with lower electricity prices than peers (such as electricity price discounts, self-generated electricity, etc.). For more market reports of graphitization enterprises, welcome to contact us.

No related results found

0 Replies