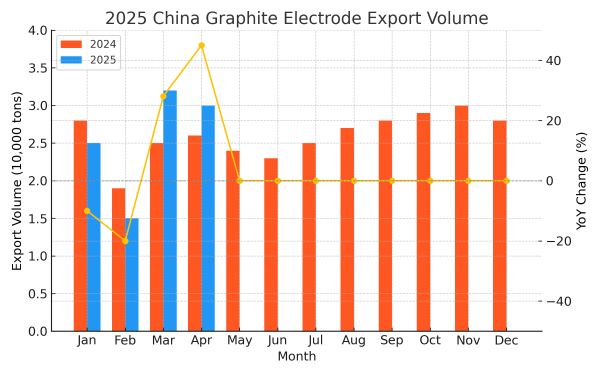

【Graphite Electrode】China's Exports Surge 80.02% MoM in March

【Graphite Electrode】Driven by Rush Exports and Post-Holiday Effects, China's Exports Surge 80.02% MoM in March

A V-shaped Rebound under Dual Engines

News — According to customs data, China's graphite electrode exports performed strongly in March 2025, reaching 32,000 tons, an 80.02% increase month-on-month and a 28.10% rise year-on-year. Behind this surge lies a dual logic of "post-Spring Festival recovery" and "policy-driven risk aversion":

01 Dissipation of Spring Festival Effects: Restored Working Days Released Backlogged Demand

Due to the Spring Festival holiday in February 2025 (only 28 days), the export base was relatively low, and downstream overseas orders were postponed and concentrated for shipment in March. After adjusting for the holiday factor, actual export growth in March is estimated at around 45%-50%, still significantly higher than historical averages, suggesting that tariff-driven policy factors were a more critical driver.

02 Rush Exports Triggered by Countdown to U.S. Retaliatory Tariffs

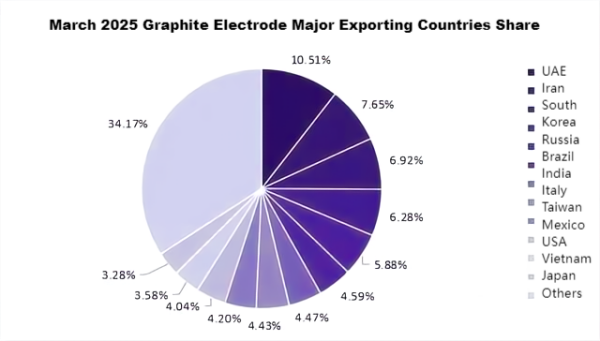

Global trade policy uncertainties, particularly the impending implementation of U.S. retaliatory tariffs on April 10, prompted companies to accelerate exports. graphite electrode manufacturers and traders sped up shipments, some using re-export routes through countries such as the UAE, Mexico, and Southeast Asia, providing critical support for the sharp export increase.

Regional Market Divergence: Demand Boom in the Middle East

By country, the UAE, Iran, and South Korea ranked as the top three destinations for China's graphite electrode exports.

1. UAE: In March, China exported 3,400 tons of graphite electrodes to the UAE, up 300.35% MoM, topping the list. As the U.S. further tightened tariffs, normal trade channels between China and the U.S. were virtually cut off. Under squeezed profit margins, Chinese exporters are accelerating their shift to new markets. The UAE, with its 0% tariff policies, no foreign exchange controls, and Dubai's status as a logistics hub, is becoming a key strategic pivot in China's global supply chain layout.

2. Iran: China's graphite electrode exports to Iran reached 2,400 tons in March, surging 569.90% MoM. Iran has the world's highest proportion of electric arc furnace (EAF) steel production, with 90.3% of its steel capacity relying on the DRI-EAF process, which consumes graphite electrodes at 2.3 times the rate of the blast furnace-basic oxygen furnace (BF-BOF) process. Iran's crude steel output in March was 3.3 million tons, up 3.7% YoY.

3. South Korea: Exports to South Korea were 2,200 tons in March, up 40.46% MoM. Following consecutive anti-dumping investigations against Chinese steel products (e.g., a 12.7% tariff imposed on hot-rolled coils in February 2025), South Korea's domestic steelmakers revived EAF steel production, indirectly boosting electrode demand. South Korea's crude steel output in March was 5 million tons, down 5.3% YoY.

Outlook

In summary, the explosive growth in China's graphite electrode exports in March 2025 was essentially a "stress response" amid global trade restructuring. Export momentum may show signs of fatigue as early as next month, facing potential cliff-like decline pressures. In the short term, trade policy dynamics will remain the dominant variable.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies