【Petroleum Coke】2025 Market Review: High-End Transformation Under Supply–Demand Restructuring

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】2025 Market Review: High-End Transformation Under Supply–Demand Restructuring

Petroleum Coke Market in 2025

Driven by global energy structure adjustment, the deepening implementation of China's "dual-carbon" goals, and downstream industrial upgrading, China's petroleum coke industry in 2025 exhibited core development characteristics of "tight supply balance, dual demand drivers, high-end structural upgrading, and rising import dependence." As a key by-product of the refining industry, the petroleum coke market throughout the year operated along the main themes of capacity optimization, steady output growth, and expansion of output value, while undergoing structural reshaping amid tighter environmental constraints, the rise of new energy demand, and fluctuations in international crude oil prices.

1. Steady Output Growth, Imports Filling the Gap, and Stable Expansion of Market Value

In 2025, China's petroleum coke output showed steady growth, with domestic supply exhibiting clear peak characteristics, while imports became a key support in filling the supply–demand gap.

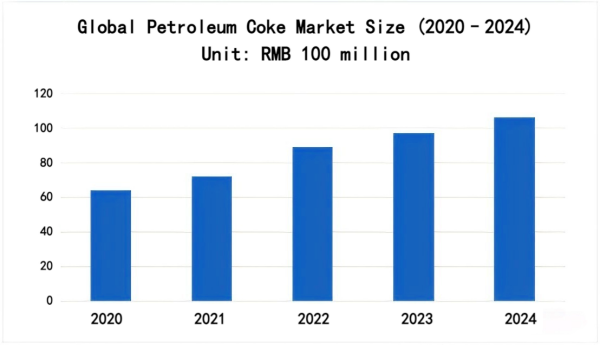

Global Petroleum Coke Market Size (2020–2024)

Source: China Report Hall

Data show that China's annual petroleum coke output reached 34.20 million tons, up 4.07% from 32.863 million tons in 2024. From a phased production perspective, cumulative output from January to October reached 26.174 million tons. Shandong Province ranked first nationwide with an output of 7.96 million tons, accounting for 30.4%, followed by Guangdong and Liaoning with 3.865 million tons and 2.346 million tons respectively, highlighting a significant regional clustering effect.

In terms of capacity, new additions were limited. Affected by delayed coking unit control policies and refinery maintenance, total industry capacity remained largely stable throughout the year, with overall operating rates maintained within a reasonable range of 78%–82%.

Regarding imports and market scale, China's dependence on imported petroleum coke increased significantly in 2025. Import volumes rose sharply from 13.39 million tons in 2024 to 18.00 million tons, up 34.4% year on year, effectively compensating for the domestic supply–demand gap. Market value expanded simultaneously, with the global petroleum coke market size rising to USD 17.235 billion in 2025, of which the domestic market size reached RMB 30.14 billion, maintaining a compound annual growth rate of 4.51%. The industry achieved steady expansion amid structural transformation. Price trends showed clear structural differentiation: the annual average price of low-sulfur coke (around 0.5% sulfur) rose by more than 70%, remaining in the RMB 3,000–4,000/ton range; mid-sulfur coke prices ranged from RMB 2,400–2,900/ton; while high-sulfur coke prices remained at low levels due to demand substitution, at only RMB 1,300–1,800/ton.

2. Supply-Side Analysis: Prominent Regional Concentration, Expansion of High-End Capacity, and Rising Import Dependence

In 2025, China's petroleum coke supply side exhibited three major characteristics: regional concentration, structural upgrading, and imports filling supply gaps. In terms of regional distribution, capacity was highly concentrated in four major regions—East China, South China, Northeast China, and Northwest China—with East China accounting for the largest share. From January to October 2025, East China accounted for 52.96% of total output, while South China accounted for 15.91%. As the core production region, Shandong Province ranked first nationwide with annual capacity of 15.6 million tons, accounting for 34.8% of total national capacity. Independent refinery clusters contributed 42% of national capacity output. Leveraging port advantages, the Yangtze River Delta region, including Jiangsu and Zhejiang, hosts multiple million-ton-scale producers, forming efficient import–export trade hubs and handling 93% of China's petroleum coke exports.

Upgrading of the capacity structure became a key highlight on the supply side. The proportion of high-quality low-sulfur petroleum coke capacity increased from 30% in 2024 to 50% in 2025. High-end capacities such as needle coke maintained a rapid compound annual growth rate of 12.7%. Newly built projects generally feature integrated calcination lines, including private refining and chemical projects such as Zhejiang Petrochemical and Shenghong Refining & Chemical, with product quality meeting SYB series standards. All six planned million-ton-scale coking projects are equipped with deep-processing carbon material facilities. Meanwhile, environmental policies continued to force the exit of inefficient capacity, with some small and medium-sized units shut down in 2025 due to substandard energy efficiency, further optimizing the supply structure. On the import side, overseas resources mainly came from refining expansion regions in the Middle East and Africa. Imported products were primarily low-sulfur coke, mainly supplementing high-end demand in China's new energy sector.

3. Demand-Side Drivers: Steady Growth in Traditional Sectors, New Energy as the Incremental Engine

In 2025, petroleum coke demand exhibited a dual-driven pattern of "stable fundamentals in traditional sectors and accelerated growth in emerging sectors," with total annual demand approaching 50 million tons and strong demand resilience. Among traditional sectors, the electrolytic aluminum industry remained the largest consumer, accounting for 51.7% of total demand in 2025. Driven by capacity replacement and output growth, incremental petroleum coke demand exceeded 1 million tons. The steel industry, as the second-largest application sector, accounted for approximately 18% of demand, maintaining stable consumption throughout the year and providing solid market support. Notably, demand for high-sulfur petroleum coke in the fuel sector continued to shrink. Affected by the Ministry of Ecology and Environment policy prohibiting the use of petroleum coke with sulfur content above 3%, fuel-grade petroleum coke consumption had decreased by 3.2 million tons compared with 2020.

The new energy sector became the core incremental growth engine for demand. The share of petroleum coke demand from the broader new energy sector (lithium battery anodes and photovoltaics) increased from 16% at the beginning of 2025 to 21% by year-end, with lithium battery anode demand rising from 8% to 11%. With the rapid development of the global electric vehicle market, demand for high-quality petroleum coke used in lithium battery anode materials continued to expand, directly driving the growth of the high-end market. In terms of exports, China's petroleum coke exports maintained stable momentum in 2025. Export volumes exceeded 5.8 million tons in 2024, mainly destined for aluminum alloy markets in Southeast Asia and carbon material markets in India. Export data for calcined petroleum coke with sulfur content below 0.8% in October were particularly strong, with the competitiveness of high value-added products continuing to improve.

4. Cost and Policy Pressures: Strong Oil Price Linkage and Increasingly Stringent Environmental Constraints

On the cost side, petroleum coke prices showed a high correlation of 0.8 with international crude oil prices. In 2025, the average Brent crude price of USD 67 per barrel provided fundamental support for petroleum coke prices. As a refinery by-product, petroleum coke production costs are heavily influenced by crude oil procurement and refining processes, with raw material costs accounting for more than 70%. Fluctuations in international crude oil prices are directly transmitted to petroleum coke prices, increasing uncertainty in industry profitability. Some leading enterprises stabilized costs through measures such as optimizing crude blending and signing long-term supply contracts, achieving significantly better profitability than small and medium-sized players.

At the policy level, environmental and carbon reduction constraints under the "dual-carbon" goals continued to tighten. Due to its relatively high carbon emission intensity (with the industry-wide carbon emission intensity of calcined petroleum coke reaching 2.8 tons of CO₂ equivalent per ton of product in 2023), the petroleum coke industry was included in key emission control categories. In 2025, energy consumption per unit of value added for above-scale industrial enterprises was required to decrease by 13.5% compared with 2020, and enterprises were required to submit carbon verification reports and accept environmental inspections.

As a pivotal year for structural transformation in the petroleum coke industry, 2025 laid the foundation for development characterized by "high-end orientation, low-carbon transition, and intensive integration." Looking ahead, with the steady development of the electrolytic aluminum industry and the continued expansion of new energy vehicle and photovoltaic sectors, petroleum coke demand is expected to maintain steady growth, with total demand projected to exceed 52 million tons in 2026. On the supply side, domestic capacity is expected to remain stable, the share of high-end capacity will continue to increase, import dependence may remain at a high level, and the global supply–demand landscape will gradually adjust as new refining projects in the Middle East and Africa come on stream.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies