【CPC】Monthly Overview and Forecast for Calcined Petroleum Coke Imports and Exports

【CPC】Monthly Overview and Forecast for Calcined Petroleum Coke

Imports and Exports

1、Import and Export Data Overview

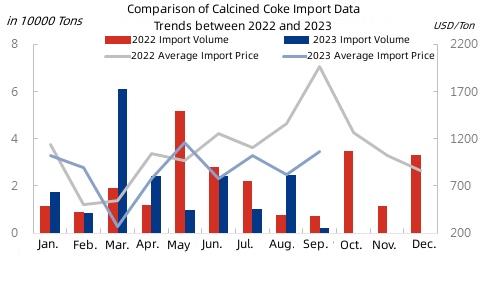

In September 2023, China imported 0.2 million tons of calcined petroleum coke, a decrease of 2.27 million tons or 91.90% compared to the previous month. The cumulative import volume for the first nine months of 2023 was 18.19 million tons, an increase of 1.35 million tons compared to the same period last year, representing an 8.02% growth.

Source: General Administration of Customs

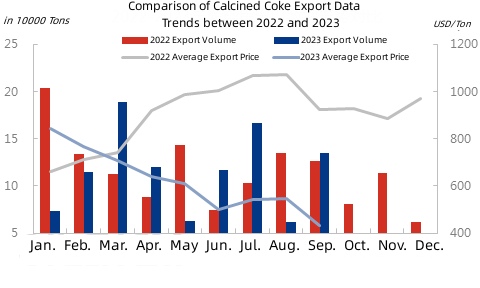

In September 2023, China exported 13.51 million tons of calcined petroleum coke, an increase of 7.34 million tons or 118.96% compared to the previous month. The cumulative export volume for the first nine months of 2023 was 104.11 million tons, a decrease of 8.13 million tons compared to the same period last year, indicating a 7.24% decline.

Source: General Administration of Customs

2、Influencing Factors

Imports: The sharp decrease in imports in September by 91.9% was primarily due to ample domestic supply, relatively low prices, and limited downstream demand, leading to reduced demand for imported coke.

Exports: The significant increase in exports in September by 118.96% was mainly driven by high domestic supply, low downstream operating rates, moderate domestic demand, and companies seeking more export opportunities.

3、Trend Forecast

In October, it is expected that China's imports of calcined petroleum coke will be around 0.35 million tons, a month-on-month increase of approximately 75%. Exports are projected to be around 1.5 million tons, an increase of about 11.03% compared to the previous month. This is mainly attributed to stable domestic calcined petroleum coke supply, combined with weak coke prices, low operating rates for graphite electrodes and graphite cathodes, and increased demand from downstream industries. Trading companies are likely to adopt a cautious approach. Considering the increased demand, October's export volumes may see a slight uptick. Any inquiries of calcined petroleum coke, welcome to commnicate with us!

No related results found

0 Replies