【Petroleum Coke】Slight Upsurge in Domestic Refinery Petroleum Coke Prices

【Petroleum Coke】Slight Upsurge in Domestic Refinery

Petroleum Coke Prices This Week

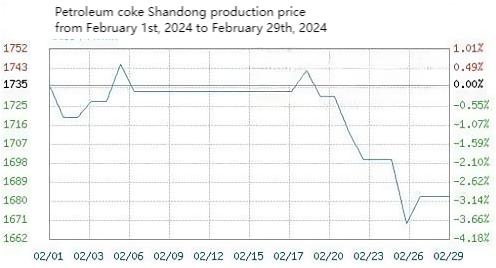

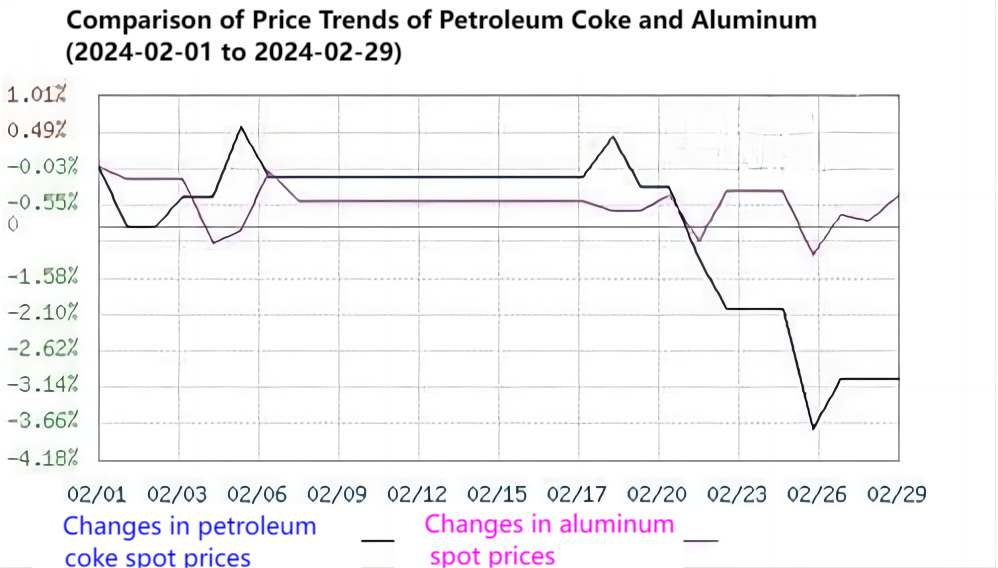

This week witnessed a minor increase in the prices of refinery petroleum coke. As of February 29th, the price of refinery petroleum coke in the Shandong market was 1682.50 yuan/ton, marking a 0.75% increase from 1670.00 yuan/ton on February 26th.

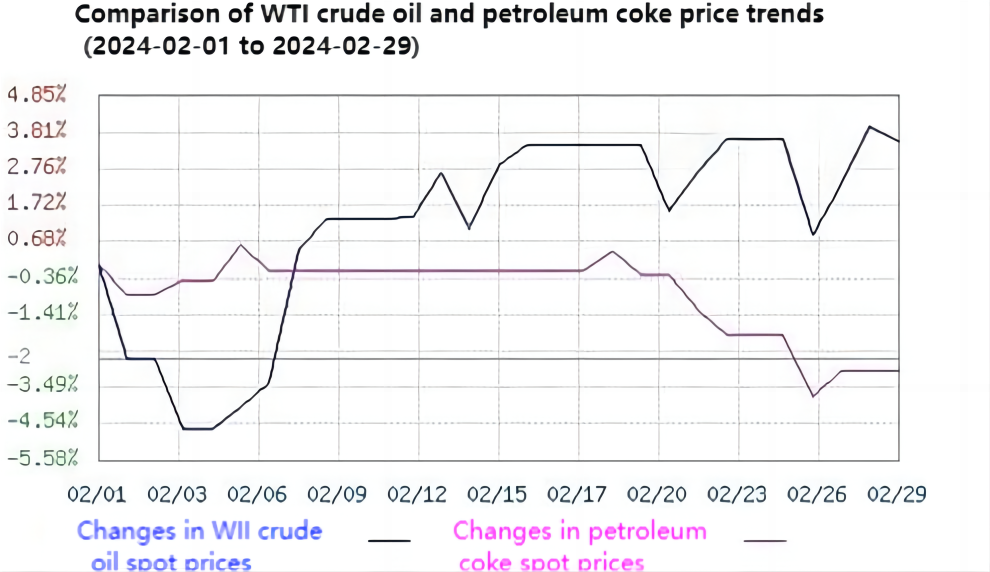

Cost Side: Recently, international crude oil prices have been fluctuating within a range. During the Spring Festival period, crude oil prices surged significantly. However, upon the return from the holiday, the crude oil market has been primarily characterized by fluctuations. On one hand, geopolitical tensions in the Middle East continue to be the primary driving force behind the crude oil market. Additionally, the anticipated production cuts by oil-producing countries serve as another important factor supporting oil prices. On the other hand, the hawkish signals from the Federal Reserve and the delay in expected interest rate cuts have dampened market confidence. Furthermore, the total number of oil and gas rigs in the United States has reached the highest level since August 2023, which has exerted pressure on crude oil prices.

Supply Side: Fluctuations were observed in petroleum coke prices this week, with downstream just-in-time procurement supporting petroleum coke prices. The shipment of imported sponge coke remained stable, with traders primarily executing orders.

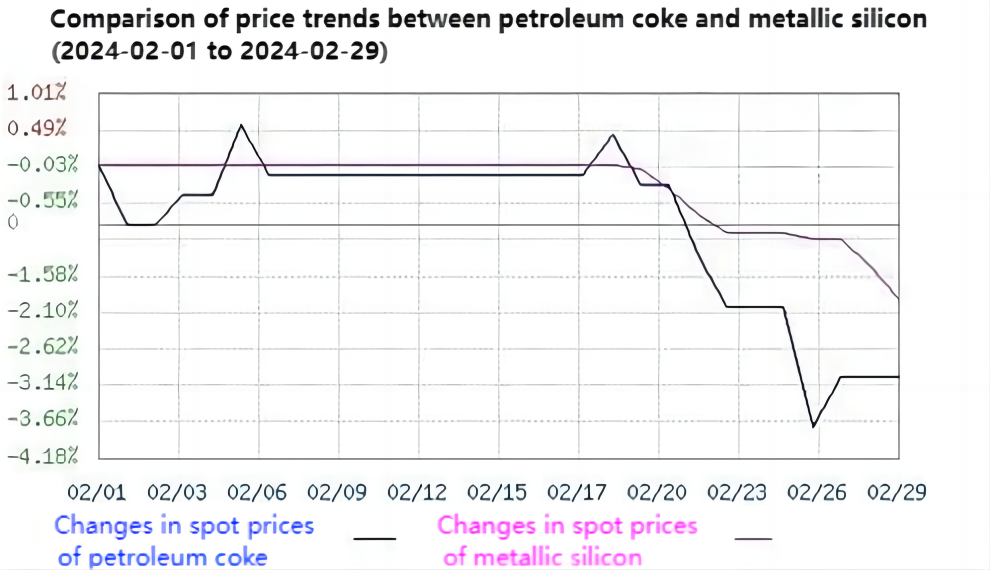

Demand Side: As of February 22nd, there were 308 silicon metal smelting furnaces in operation in China, with an overall operating rate of 41.1%, representing an increase of 1 furnace from the previous week. The operation of silicon metal furnaces stabilized this week, and the market is still in the post-holiday recovery period. Enterprises are gradually increasing the number of furnaces in operation, indicating an anticipated increase in supply this week. Currently, the demand for petroleum coke from the silicon metal industry remains considerable, thereby supporting the petroleum coke market.

This week, medium-sulfur calcined petroleum coke (CPC) remained stable primarily, with average transactions. However, downstream demand release was relatively slow, leading to cautious market operations.

Aluminum prices saw a slight increase this week, with the traditional peak consumption season approaching. Consequently, downstream demand may gradually recover, and the capacity utilization rate of leading downstream aluminum industry enterprises in China is expected to increase. Downstream carbon enterprises for aluminum still exhibit demand for petroleum coke, mostly maintaining just-in-time procurement.

Market Forecast: As we enter March, refinery coking units will enter the peak maintenance season, potentially resulting in a reduction in the supply of refinery petroleum coke. However, with limited downstream demand currently, the market will predominantly maintain just-in-time procurement. Furthermore, with imported petroleum coke continuously arriving at ports, the inventory of port petroleum coke may increase. Overall, it is anticipated that the price of refinery petroleum coke may experience a slight increase in the near term. Contact us for more information on petroleum coke production and sales.

No related results found

0 Replies